EBITDA* ≠ Cash

Cash is king, a term popularised by the Volvo CEO after the 1987 crash has become an incredibly popular colloquialism. For investors, the desire for cash is generally driven by equity markets – you can never have enough cash when markets fall, however it’s a bane when the market eventually recovers.

For companies, however, it is always king (or queen!). The Zero Interest Rate Period or ZIRP caused both managers and analysts alike to forget the importance of this, with many chasing growth at any cost. In this new world of higher inflation, higher rates and more volatile economic conditions, companies are having to reorient to this new reality.

Reporting season shined a light on this conundrum and highlighted some interesting accounting behaviour – under the hood, all is not well.

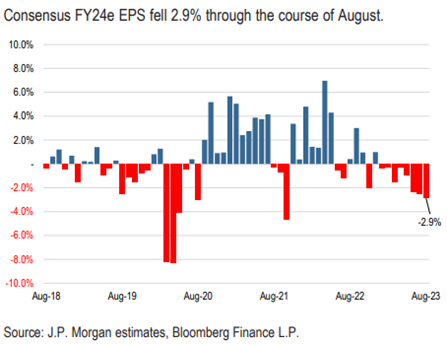

At a high level it was a lower quality reporting period. In Australian small caps, where businesses are generally more exposed to the economic cycle, companies missed market expectations 2x more frequently than they beat them which is much higher than normal. This saw earnings downgrades of 2.9% – the highest level since the 2021 lockdowns.

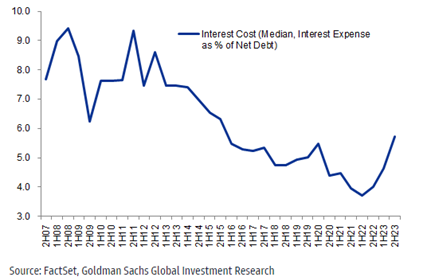

Now the culprit was not sales and it also, surprisingly, wasn’t operating expenses. Interest costs were the key culprit. Interest costs increased 50% for companies in aggregate and were the biggest headwind to earnings. This is far from over – as fixed debt rolls off, it is estimated this in isolation will drag down earnings by 7-14%.

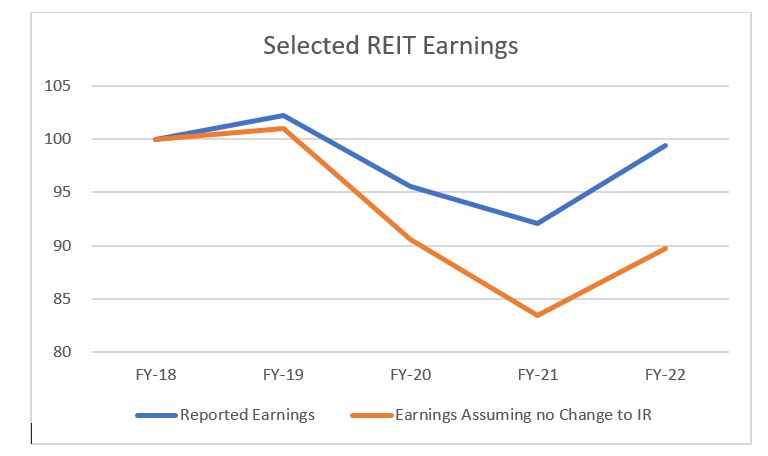

An interesting way to illustrate this is to look at a cross section of the REIT (real estate investment trust) sector. If interest rates had not declined over the years to FY22, earnings would have fallen 10% rather than the small 1% decline experienced. Another way to think about this, is that there would be no earnings growth for this sector if rates didn’t fall.

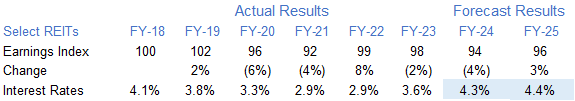

When looking at consensus estimates below, the interest rate assumptions look very optimistic when considering Australian 10-year bond rates are currently at 4.5%! The point here is that higher interest rates are a phenomenon most analysts and management teams haven’t had to deal with, and its wreaking havoc to financial forecasts – this of course provides opportunities for the diligent.

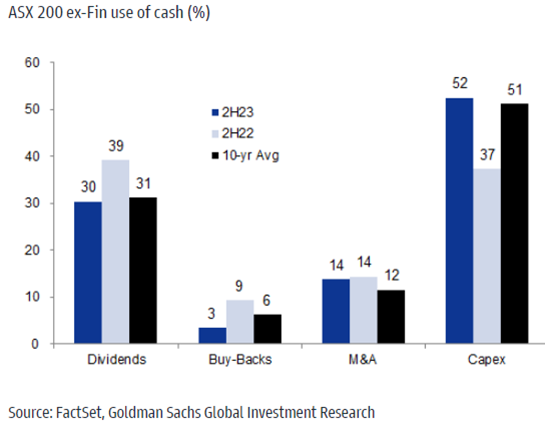

Another feature of reporting season was the significant step up in capital expenditure (capex), which grew 17% in the 6 months to 30-June-2023. There are accounting rules that dictate what can and can’t be capitalised, however there is also often an element of subjectivity by management teams (at times). As can be seen below, capex jumped materially, and forecasts suggest this will only rise further.

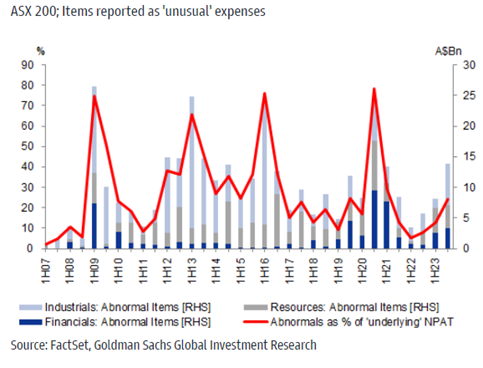

The final red herring was the jump in “abnormal items”. These are items management teams say won’t occur in the next period and therefore should be ignored today. There are genuine abnormalities that should be ignored, but the increase in this, in conjunction with higher capex and interest costs is worrying.

And why is this all important? Well EBITDA is often a key KPI for management teams and they are therefore very incentivised to improve this metric. Critically this measure of profitability excludes interest, capex and abnormal items – increased capitalisation will flow through to depreciation and amortisation and higher rates will impact interest costs, both of which are ignored in EBITDA.

This all culminates in the key conclusion that EBITDA is, in many cases, no longer a good proxy for a company’s cash flow.

This all came to a head this reporting season where dividend upgrades were the lowest on record. A profit and loss statement can be misleading but it’s very hard to consistently manipulate dividends.

We are entering a new phase where investors will have to be much more diligent when analysing the profitability of businesses. The value of any investment is the sum of its discounted cash flows, and these cash flows are, in many cases, decoupling from profit and loss statements. Although, treacherous this provides opportunities for us at Milford as we navigate this complicated economic landscape.

*Earnings before interest, taxes, depreciation and amortisation

Cash is King

EBITDA* ≠ Cash

Cash is king, a term popularised by the Volvo CEO after the 1987 crash has become an incredibly popular colloquialism. For investors, the desire for cash is generally driven by equity markets – you can never have enough cash when markets fall, however it’s a bane when the market eventually recovers.

For companies, however, it is always king (or queen!). The Zero Interest Rate Period or ZIRP caused both managers and analysts alike to forget the importance of this, with many chasing growth at any cost. In this new world of higher inflation, higher rates and more volatile economic conditions, companies are having to reorient to this new reality.

Reporting season shined a light on this conundrum and highlighted some interesting accounting behaviour – under the hood, all is not well.

At a high level it was a lower quality reporting period. In Australian small caps, where businesses are generally more exposed to the economic cycle, companies missed market expectations 2x more frequently than they beat them which is much higher than normal. This saw earnings downgrades of 2.9% – the highest level since the 2021 lockdowns.

Now the culprit was not sales and it also, surprisingly, wasn’t operating expenses. Interest costs were the key culprit. Interest costs increased 50% for companies in aggregate and were the biggest headwind to earnings. This is far from over – as fixed debt rolls off, it is estimated this in isolation will drag down earnings by 7-14%.

An interesting way to illustrate this is to look at a cross section of the REIT (real estate investment trust) sector. If interest rates had not declined over the years to FY22, earnings would have fallen 10% rather than the small 1% decline experienced. Another way to think about this, is that there would be no earnings growth for this sector if rates didn’t fall.

When looking at consensus estimates below, the interest rate assumptions look very optimistic when considering Australian 10-year bond rates are currently at 4.5%! The point here is that higher interest rates are a phenomenon most analysts and management teams haven’t had to deal with, and its wreaking havoc to financial forecasts – this of course provides opportunities for the diligent.

Another feature of reporting season was the significant step up in capital expenditure (capex), which grew 17% in the 6 months to 30-June-2023. There are accounting rules that dictate what can and can’t be capitalised, however there is also often an element of subjectivity by management teams (at times). As can be seen below, capex jumped materially, and forecasts suggest this will only rise further.

The final red herring was the jump in “abnormal items”. These are items management teams say won’t occur in the next period and therefore should be ignored today. There are genuine abnormalities that should be ignored, but the increase in this, in conjunction with higher capex and interest costs is worrying.

And why is this all important? Well EBITDA is often a key KPI for management teams and they are therefore very incentivised to improve this metric. Critically this measure of profitability excludes interest, capex and abnormal items – increased capitalisation will flow through to depreciation and amortisation and higher rates will impact interest costs, both of which are ignored in EBITDA.

This all culminates in the key conclusion that EBITDA is, in many cases, no longer a good proxy for a company’s cash flow.

This all came to a head this reporting season where dividend upgrades were the lowest on record. A profit and loss statement can be misleading but it’s very hard to consistently manipulate dividends.

We are entering a new phase where investors will have to be much more diligent when analysing the profitability of businesses. The value of any investment is the sum of its discounted cash flows, and these cash flows are, in many cases, decoupling from profit and loss statements. Although, treacherous this provides opportunities for us at Milford as we navigate this complicated economic landscape.

*Earnings before interest, taxes, depreciation and amortisation

Milford on The Hits: 7 May 2025

Read MoreMilford on Coast: 7 May 2025

Read MoreStock Story: Haleon

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.