With reporting season behind us we can review the impacts COVID-19 is having on various sectors. Property companies which for the large part rely on collecting rents from tenants have been particularly interesting given the lockdown essentially forcing the closure of stores and the emptying of a range of these assets.

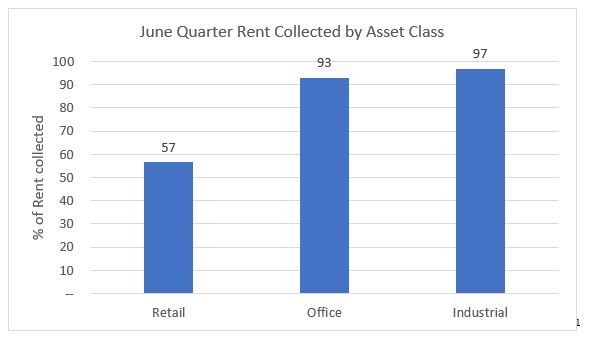

Rent collections have been the key focus this reporting season, and when analysing the results of 20 different REITs we can get a pretty clear picture of how each asset class is performing.

As can be seen above the fortunes of retail landlords has differed drastically from those of their industrial and office counterparts. This makes sense when you consider:

- Certain parts of the industrial sector are beneficiaries of this environment. If you’re exposed to warehousing, logistics, ecommerce, data consumption or consumer staples you can’t get enough space!

- Office is also in a unique position where their tenants for the most part can still offer their goods and services remotely and hence, can still pay rent. There are structural questions surrounding office however – more on that later.

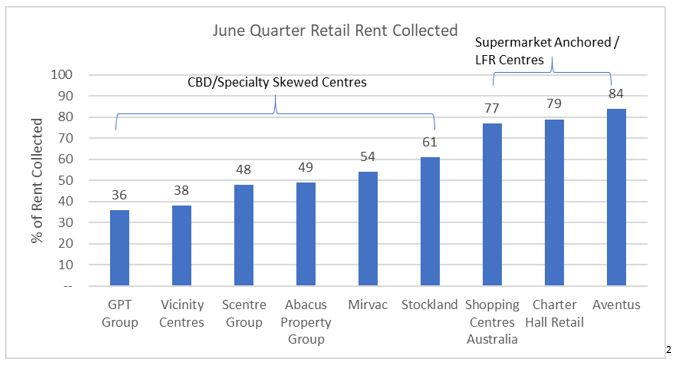

- Retailers and retail landlords saw their foot traffic collapse through forced shutdowns and general avoidance of crowded areas. As can be seen below however some landlords fared better than others – assets that are anchored by supermarkets and located in metro/regional areas have performed materially better than the CBD, specialty skewed assets.

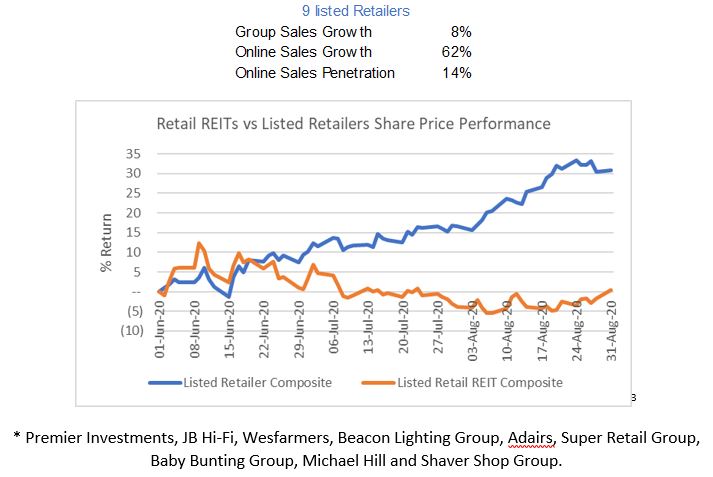

Given the difficult landscape retail landlords have faced it would be logical to assume their tenants would also be under material pressure. This clearly has not been the case. The boredom of a forced lockdown coupled with record stimulus saw online sales growth surge during COVID, with offline growth rebounding strongly once people were allowed back to malls. A composite average of nine retailers reported 62% growth in online sales as part of 8% total sales growth reported.

Despite this relatively resilient retail performance, some groups are using this event as a catalyst to mass renegotiate their rents downward. For the above cohort, although sales growth has been strong, 86% of sales are still offline. This aggressive stance is therefore a relatively dangerous approach and Mosaic (MOZ.ASX) is the first listed retailer to fall victim to a landlord pushing back. Scentre Group has closed 129 or 9% of Mosaic’s stores for refusing to pay rent. This will be an interesting development to monitor.

We also wrote an article in the middle of June around the future of office – although only two months have passed there have been a few data points that are worthy of note.

- Office rent collections have held up very well with office buildings outside of the CBD performing better than those located in the CBD

- For GPT – a large diversified REIT – physical occupancy fell below 10% during the pandemic. It is an experience likely shared by the other landlords.

- In the June quarter, vacancy rates in Melbourne almost doubled to 8% and in Sydney they expanded by 270ppts to 7.5%. This is a very sharp move in only 3 months. This doesn’t bode well for effective rents that historically in Sydney have fallen by 5.6% for every 1% move in vacancy. For Victoria this is less severe at 4.6% for every 1% move in vacancy.

- A Savills Office Survey conducted in June and July found that 89% of respondents believe that the office will remain a necessity. It also found that people considered the office to be a much better place to achieve personal growth (3:1) and they have a much higher sense of belonging / pride in the company when working from the office – aka culture.

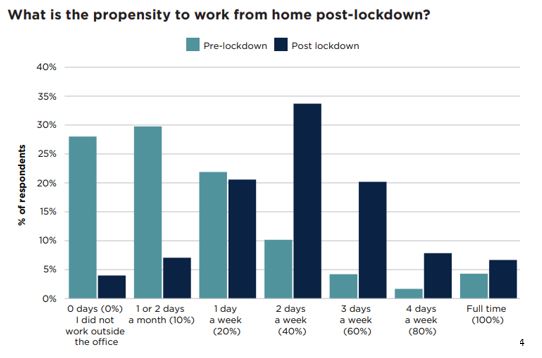

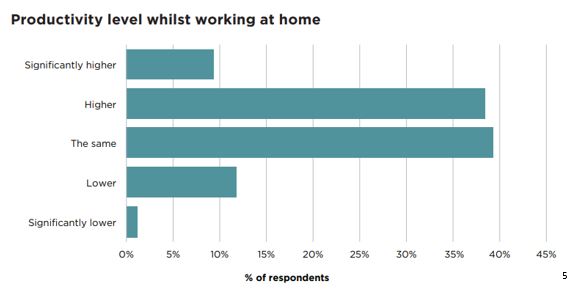

These Savills’ statistics appeared in two of the largest landlord’s full year results presentations. However, there were a few other stats in the same survey that (unsurprisingly) didn’t make the pack. One of two key charts omitted highlighted the clear preference to work at least two days from home, and the other showed productivity remaining elevated since working from home began.

Based on this survey and a range of others (namely a Cushman & Wakefield study[6]) it appears the key headwinds of WFH are more qualitative in nature such as personal development, collaboration, and culture. These are less obvious than productivity, hours worked, and time saved from transport however are critical to a company’s long-term success. We are still of the view WFH will have an impact on demand however believe cyclical elements will be the key driver of office returns particularly over the next 12 months.

[1] ASX Company Releases

[2] ASX Company Releases

[3] Iress Data

[4] https://pdf.savills.com/documents/Savills-Office-FiT-Survey-Results_.pdf

[5] https://pdf.savills.com/documents/Savills-Office-FiT-Survey-Results_.pdf

[6] https://www.cushmanwakefield.com/en/insights/covid-19/the-future-of-workplace