We recently wrote about the implication of interest rate cuts for investors. In recent years income shares including infrastructure companies have been heavily impacted by higher interest rates. Now that we are entering a rate cutting cycle this could reverse, and we have been selectively adding to income stocks which should benefit. One example is Cellnex which is the largest owner of mobile tower infrastructure in Europe.

What does Cellnex do?

After listing on the Spanish stock exchange in 2015 Cellnex grew quickly through acquisitions. This created a lot of value, but also resulted in Cellnex becoming highly leveraged. As a result, when interest rates rose rapidly, Cellnex shares fell from a high of more than $60 in 2021 to below $30 in 2023. This was driven by investor concerns around Cellnex’s debt levels and higher interest rates reducing the value of infrastructure companies like Cellnex. Since then, Cellnex has changed strategy under a new management team, to adapt the company to a higher interest rate environment. This has included reducing debt to more sustainable levels and prioritising organic growth over acquisitions.

Looking ahead we think Cellnex is nearing an inflection point in its strategy, as investment related to prior acquisitions tails off resulting in a large improvement in free cashflow. This will allow Cellnex to start paying a dividend to shareholders from 2026. Rate cuts could also see interest rates shift from a headwind to a tailwind.

Why do we like Cellnex?

Cellnex owns mobile towers which are critical infrastructure assets. Cellnex rents space on its towers to telecom companies in exchange for long term rental contracts, providing Cellnex with defensive and predictable cash flows. There are also high barriers of entry to competition due to the high upfront construction costs and consenting required to build towers.

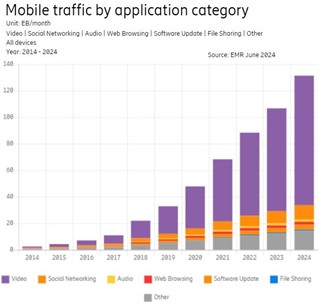

Mobile towers offer long term growth potential from increasing demand for data, which will require continued investment in mobile networks. In recent years we have seen tremendous growth in mobile data traffic from video usage, which we expect to continue with the adoption of 5G. Data traffic is also likely to benefit from new technology like wireless broadband and AI.

In our view, investors are also underappreciating Cellnex’s long term earnings potential, with Cellnex trading at a discount compared to similar companies. We think this valuation gap could close as management delivers on its strategy, or through the sale of some of their towers at higher valuations.

Outlook from here

In summary, we are attracted to the defensive nature of Cellnex’s mobile towers, with upside from growing data demand and lower interest rates. Key risks to Cellnex include lower investment in mobile networks from telecom company consolidation, or new technologies, as well as higher interest rates.