Darling Ingredients driving change

As the world transitions towards a low-carbon future, companies like America’s Darling Ingredients Inc. are playing a crucial role in driving change.

Established in 1882, Darling Ingredients is a global leader in converting food waste and animal by-products into valuable specialty ingredients and solutions.

Darling’s unique business model helps facilitate a circular economy by transforming what would normally be considered waste into animal feed, biofuels, renewable energy, and pharmaceutical products. As consumers and governments continue to prioritise low carbon fuels and waste reduction, we see the demand for Darling’s products continuing to accelerate and likely to benefit from regulatory momentum.

Darling’s operations have the advantage of exposure to producing the feedstocks required for biofuels, and producing renewable diesel itself through its joint venture with another US company, Valero Energy. The company’s core feed segment processes around 17% of the world’s animal waste and commands a dominant 50% market share of used cooking oil in North America – key feedstocks used in renewable diesel production. With an established and complex supply chain already in place, coupled with large-scale operations, Darling enjoys a competitive edge over new market entrants and should deliver superior margins.

The investment thesis for Darling hinges on the acceleration of biofuel usage and the increasing demand for low-carbon feedstocks (fats and used cooking oil).

The investment thesis for Darling hinges on the acceleration of biofuel usage and the increasing demand for low-carbon feedstocks (fats and used cooking oil).

As countries try to decarbonise and achieve ambitious emission reduction targets, reducing reliance on traditional fossil fuels will be crucial. According to the IEA, the transport sector has the greatest reliance on fossil fuels of any sector and accounted for 37% of CO2 emissions from end-use sectors in 2021. This illustrates how important it is to decarbonise transport over the coming years.

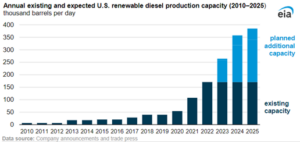

Biofuels, such as renewable diesel and Sustainable Aviation Fuel (SAF), are well positioned to drive decarbonisation as they are readily available today and are compatible with existing infrastructure. Additionally, the future optionality to produce SAF helps build a long-term strategy, as the aviation industry is one with very few alternatives to decarbonise. We see continued momentum in government regulation to support the adoption and production of biofuels, with Darling benefitting directly. With a ramp up of renewable diesel capacity expected to come online in 2023, demand for Darling’s feedstocks is expected to soar.

However, no investment case is perfect, and Darling’s share price has been volatile given its exposure to commodity prices and reliance on subsidies to bridge the gap between the cost of renewable diesel and traditional fossil fuels. This means it is a higher risk investment that needs careful monitoring and a smaller position size as we judge the risk/reward on offer.

However, no investment case is perfect, and Darling’s share price has been volatile given its exposure to commodity prices and reliance on subsidies to bridge the gap between the cost of renewable diesel and traditional fossil fuels. This means it is a higher risk investment that needs careful monitoring and a smaller position size as we judge the risk/reward on offer.

Yet in the long-term, Milford sees Darling Ingredients as a compelling investment opportunity – not only because it supports a circular economy and decarbonisation, but also because of the company’s potential for growth. As a leader in its specialised industry, Darling is well-placed to help drive the global transition towards a low-carbon future.