Technology Leaders

2023 is shaping up to be the year Artificial Intelligence (AI) went mainstream. Following the public launch of ChatGPT in November 2022, we have witnessed a Cambrian explosion of AI activity, as decades of academic research finally surfaced into the real world.

This progress has no doubt been underpinned by significant advances in semiconductors and computing power. Whilst Nvidia has garnered the bulk of investor interest with its best-in-class AI accelerator chips and a lofty valuation to match, we believe another way to gain exposure to the AI megatrend is through memory. The world has an insatiable demand for memory used in both compute and storage, and AI adoption will only accelerate this, as AI servers are much more memory-intensive than traditional CPU servers.

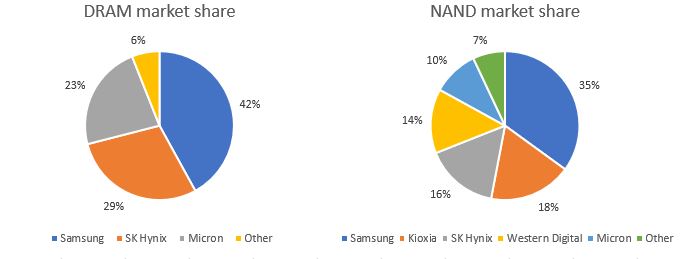

Micron Technologies is a US-listed supplier of memory chips with 23% market share in DRAM (stores data used by the computer processor for calculations) and 10% in NAND (used for long-term data storage), making it the third largest memory supplier globally after Samsung Electronics and SK Hynix of South Korea. Yet despite its smaller size, Micron has achieved technology leadership through an intense focus on R&D and production optimisation, being the first to commercialise 1-alpha DRAM and 176-layer NAND processes, and looks set to lead the transition to 1-beta and 232-layer processes. This translates to higher bit density, faster speeds, and lower price per bit for customers, while lowering the cost per bit for Micron.

Chart: memory market share

Source: Bank of America Global Research

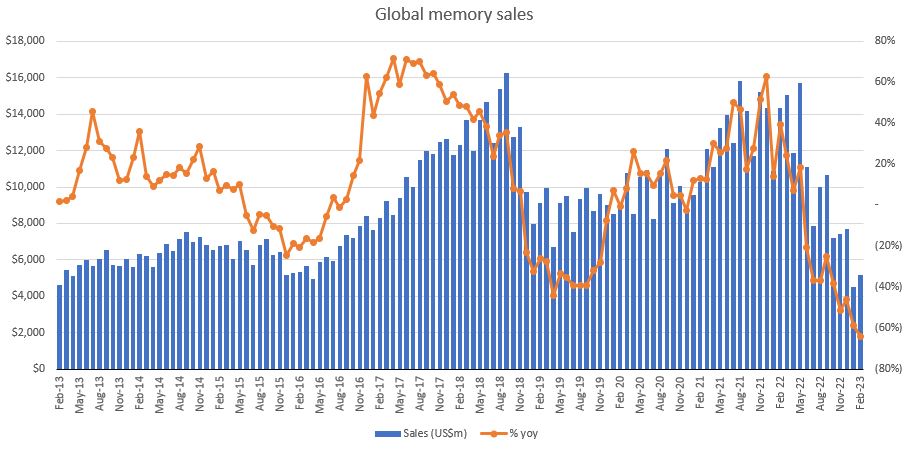

In addition to Micron’s technology leadership, we are also at an attractive point in the memory cycle. The memory industry is currently going through the deepest cyclical downturn of the past two decades, with industry sales down 64% year-on-year in February 2023 to levels last seen in 2016. Unlike prior downturns which are typically driven by oversupply, this record downturn has been driven by cyclical demand weakness coming out of the pandemic.

Due to industry consolidation over the past two decades, the current memory oligopoly has acted rationally to bring industry supply and demand back into balance. Memory semiconductors are substantially commoditised so supply-demand balance matters greatly. Micron, SK Hynix and the Western Digital-Kioxia JV have cut wafer production by up to 30% and wafer fabrication equipment capex by up to 50% this year, while industry leader and last holdout Samsung finally capitulated and announced production cuts in April.

Chart: global monthly memory sales (US$ millions)

Source: Semiconductor Industry Association

The stage appears set for a strong memory market recovery over the coming years. While the downturn is persisting for longer than anticipated, notwithstanding the aggressive production and capex cuts, recent comments from Micron have turned more positive and suggest a bottom in Q2 and recovery from H2 2023. In addition to the incremental memory demand from generative AI, new server architectures from Intel and AMD (which were delayed) and next-generation DDR5 technology for server DRAM should drive an elevated data centre upgrade cycle by the hyperscale cloud service providers. We believe this inflection in memory demand will coincide with two years of weak memory capex and result in a tight supply situation and very favourable pricing environment for the memory suppliers.

Additionally, both Samsung and SK Hynix have substantial production capacity located in China and are caught up in the US-China “chip war”. While the Korean companies have been granted temporary export licences to receive US memory fabrication equipment at their Chinese facilities, indications are that these licences won’t be renewed. Should this occur, a meaningful portion of global memory capacity will be stranded in China, unable to be upgraded to the latest processes. This will further exacerbate what is likely to be an already tight supply situation.

Historically, dramatic recoveries have followed the steepest memory downturns, and Micron has a healthy balance sheet and ample liquidity to weather the current downturn. Semiconductor stocks typically start pricing in a recovery around six months before the trough, and although the path may be bumpy, a cyclical recovery is inevitable given the underlying structural demand drivers. While we don’t expect Micron to repeat the 500%+ and 200%+ trough-to-peak stock returns of the 2016 and 2019 cycles, we do believe Micron is one of the most compelling opportunities within the semiconductor sector.