Moving towards clean energy

The need to decarbonise will involve dramatic changes to the way we generate and use energy. To achieve this goal, clean energy metals like lithium and nickel are crucial. These metals are needed for batteries used in electric vehicles (EV) and a variety of consumer electronics like your phone.

One company that saw this trend emerge, and decided in 2018 that it needed to change strategy, was Western Australia-based miner IGO Limited. At the time, it was like most of its peers – mining with a heavy focus on gold and less in metals like nickel and copper.

Game Changer

Soon after the strategy change, IGO’s gold mine was put up for sale but before this was completed, a rare opportunity arose to buy a stake in undoubtedly the world’s best lithium mine. One of the owners of the Greenbushes mine in Western Australia needed cash and sold a stake to IGO which had a healthy balance sheet and was able to take advantage of the then soft lithium price. The attraction of not only buying into a high-quality asset at the bottom of the cycle, was the planned expansion of production to meet the expected doubling of global lithium demand every few years as battery growth explodes. Milford significantly increased its exposure to IGO at this time.

The ore mined at Greenbushes contains about 2% lithium, and after some processing becomes an intermediate product of around 6% lithium. Most miners will say their job is done once this is put on a ship for export but IGO are now further processing an increasing amount into “battery grade” lithium of +99% lithium. They do this at their Kwinana hydroxide refinery (also in Western Australia) which continues to ramp up production towards a steady state. The advantage of participating along the production chain is to extract profits along each stage. This usually reduces the volatility of a company’s earnings and history tends to reward such companies.

IGO also mine nickel in Western Australia and are looking at building a facility also in Kwinana that will further process the nickel mined into a higher valued product.

Up and down

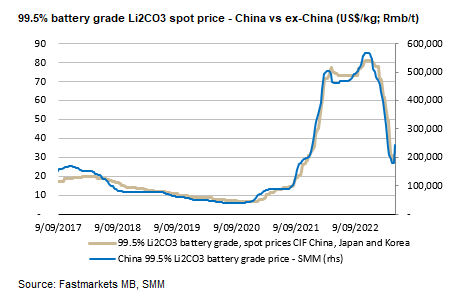

The lithium market is smaller and less mature than oil and gold markets and is therefore more volatile. In the second half of 2022, many battery makers and EV producers were worried about a lack of lithium and, as the chart below shows, saw the price rise very rapidly. This helped to rally IGO’s share price to levels near our valuation, so we took some profits.

So, what goes up often goes down and participants in the market decided to slow down their lithium buying, not helped by a mixed return by the Chinese consumer post the end of their Covid-zero policies. IGO’s price fell in early 2023 and so we added to our holdings. That has proven a success with the price recovering to a level with less upside than in April. Despite having a positive view on the long-term thematic, which is continuing to strengthen, we need to be nimble in our holding of IGO.