Gentrack – a great turnaround story

What does Gentrack do?

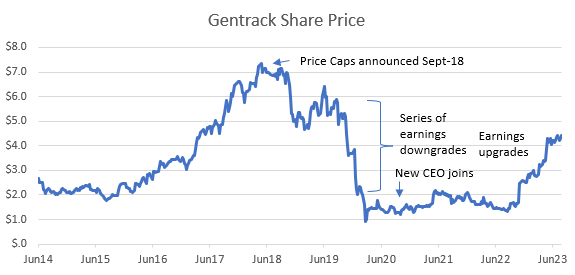

Founded in New Zealand, Gentrack is a leading provider of software and billing solutions to utilities across the UK, Australia, and New Zealand. Gentrack has had a rocky history since listing on the NZX and fell out of favour in 2019 after being heavily impacted by regulatory changes in the UK energy market. However, since then the business has undergone a dramatic transformation, driven by a new management team and improved investment in modernising its technology. This has seen Gentrack’s share price rise over 200% in the past year on the back of several earnings upgrades.

Gentrack has been a core holding in our NZ equity funds after becoming a substantial shareholder in 2021.

What went wrong in 2019?

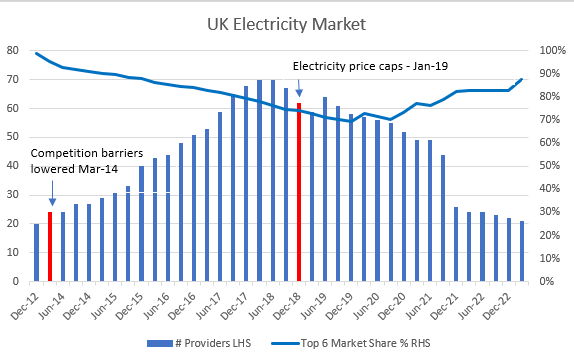

After listing on the NZX in 2014, Gentrack experienced strong growth from the deregulation of retail electricity in the UK. This saw the number of electricity retailers increase from the major six incumbents to more than 60 players (all requiring billing software!) which also put pressure on the incumbents to modernise their systems. This saw Gentrack’s share price rise from the IPO price of $2.40 to a high of over $7 in 2018.

Gentrack’s fortunes then took a turn for the worse when the UK government introduced electricity price caps in January 2019, resulting in many recent entrants (and Gentrack customers) becoming insolvent, and the market effectively returning to six major players. At the same time, in our view, Gentrack’s technology became out of date due to insufficient investment in R&D, which saw existing customers develop their own in-house software. This resulted in a long series of profit downgrades and Gentrack’s share price falling below $1 in early 2020.

Figure 1 Source: Ofgem

What changed?

Subsequently, the business has undergone a significant turnaround under new management led by CEO Gary Miles who joined in 2020. Gentrack has also modernised its technology with the launch of its new product “G2” in late 2022, which integrates with Salesforce’s Utility CRM. This has resulted in several customer wins, and significant growth in its pipeline which saw Gentrack upgrade its medium-term earnings guidance.

Industry headwinds have also turned into tailwinds with utilities undergoing digital transformations to decarbonise and bring new innovative solutions to market. Gentrack’s software allows utilities to offer “time of use tariffs” to incentivise customers to use electricity at non-peak times (reducing the need for non-renewable energy) and support consumers with solar panels, home batteries, and electric vehicles.

Figure 2 Source: Iress

Why did we invest?

Our view at the time was that the share market was too focused on the headwinds in the UK and not giving credit to the turn-around taking place with Gentrack still winning customers in other regions and sectors. We were also impressed with the quality of the new management team and board. As a result, we thought there was limited downside risk (with Gentrack trading on c.1x sales and cashflow positive) and significant upside risk if management delivered on plans and could return Gentrack to growth.

Outlook from here:

Gentrack has been a great turn-around story and today the market is giving management a lot more credit for its growth plans with the expansion into new markets across Europe and Asia. Success from here will depend on management’s ability to continue to win new customers and deliver innovation to help utilities transform.