Neuren leads the way in treating Rett syndrome

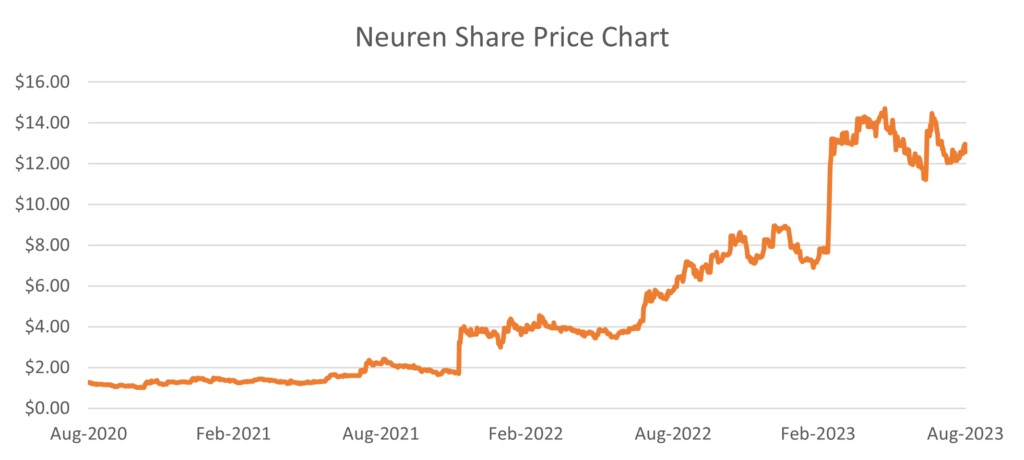

In March, the US Food and Drug Administration (FDA) approved Australian company Neuren Pharmaceuticals’ and its US partner Acadia Pharmaceuticals’ drug for the treatment of Rett syndrome in the US. The drug, Daybue, is the first and only FDA-approved treatment for Rett syndrome, a rare and severe neurodevelopmental disorder that primarily affects young girls. This news came as an immense relief to the patients, families and caregivers affected by Rett syndrome. The significant milestone saw Neuren’s stock price rally 75%.

The launch of Daybue has been strong, achieving approximately US$23m of net sales in the first two months of launch. The economics to Neuren from global partnership with Acadia include up to US$1bn in milestone payments and 10-20% royalties on Daybue sales. As the only available treatment for Rett syndrome, we believe the drug will continue to have a strong uptake. This is supported by the recent update from Acadia Pharmaceuticals noting the increase in prescribing clinicians to 500, up from 400 in early August. Encouragingly, insurance coverage is now at 70%, up from approximately 33% in August.

While early signs are positive, it is not without risk. We continue to actively monitor side effects, breadth and depth of insurance coverage, and potential competition. There is a potential near-term competing drug being developed by Anavex Life Sciences. It has conducted a late-stage trial for its drug for Rett syndrome, and will present its clinical data imminently. If positive, there could be another drug on the market in a few years.

At Milford, we run a very active investment approach to investing which means managing these risks by taking profits along the way.

Source: Factset

Beyond Daybue, Neuren also has four phase II clinical trials for a second drug to treat genetic diseases Phelan-McDermid syndrome, Angelman syndrome, Pitt-Hopkins syndrome and Prader-Willi syndrome. The clinical trials are expected to release data sequentially over 12 months, starting in December 2023. If successful, the potential market size for this drug is estimated to be five times larger than Daybue, but this new drug is in early-stage trials, so the chance of success is low and would require significant investment to reach commercialisation. That said, the success of Daybue is an encouraging sign for the future of this second drug, given it is trying to resolve a similar issue as Daybue (repair communication between neurons) in diseases which present in a similar way to Rett syndrome.

Neuren has come a long way as a business and as it stands today, they have a strong balance sheet, an attractive economic global partnership with Acadia and a catalyst-rich clinical pipeline. Milford retains a core position in the company as the risk/ reward is still attractive, but not as attractive as it once was, which has been reflected in our position sizing.