French company Legrand is one of the world’s largest suppliers of low-voltage electrical equipment and data centre infrastructure. Its products can be found in almost every building type globally, from light switches and power points in an office, through to complex power distribution and cooling systems used in data centres, and even backup power and connected care systems in hospitals that are critical to human life.

Legrand aims to be the #1 or #2 player in every area it operates, applying a “giant in niche” strategy. With more than a century of experience in electrical devices, it has grown through a blend of internal innovation and disciplined capital allocation. The company has a successful track record of acquiring markets leaders, integrating them into Legrand’s vast distribution network and best-in-class manufacturing, providing greater access to capital for investments, while still enabling the business to operate in an entrepreneurial, independent manner.

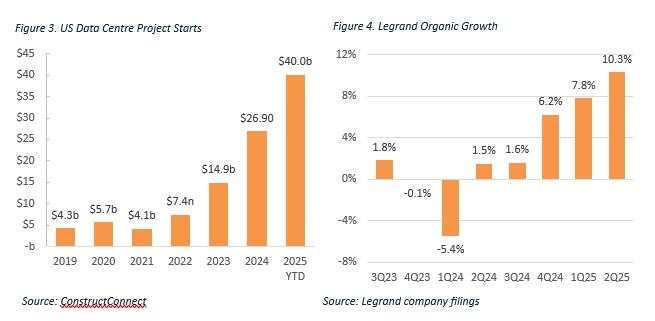

Milford initiated a position in Legrand in late 2024. We believed that the growth rate of Legrand’s data centre business was poised to accelerate and was being underappreciated by the market. While not central to the thesis, Legrand also offers cyclical upside from any improvement in European and US construction markets, with volumes at a trough below 2019 levels.

Data Centre: Underappreciated Growth

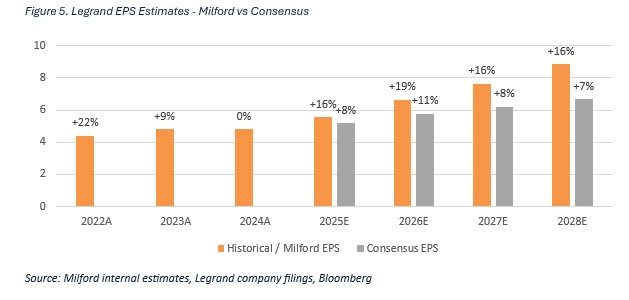

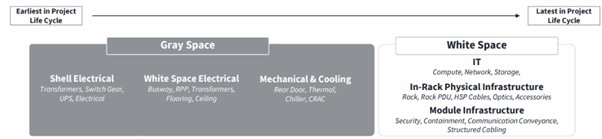

Legrand’s data centre product mix gives us good visibility into future growth. Data centre equipment can be split into two categories: grey space and white space. Grey space encompasses the building’s supporting infrastructure and power systems, such as electrical switchgear, transformers and backup generators. White space refers to the main operational area that houses the IT equipment, including server racks, compute, in-room cooling, and power distribution.

During the construction of a data centre, which takes on average 12-24 months, grey space equipment is installed early in the construction cycle, typically in parallel with the building shell, while white space fit-out is the final stage of construction. As a result, white space growth generally lags grey space growth by up to two years.

Figure 1. Data Centre Construction Project Lifecycle

Source: Wesco investor presentation, May 2024

By the end of 2025, over a quarter of Legrand’s revenue will come from data centres. Over 80% of this data centre exposure is in the white space, and Legrand is the largest player globally in white space equipment. Because of this positioning, Legrand missed the early stages of data centre growth we saw from other electrical equipment suppliers such as Schneider Electric and Eaton, which have a much higher skew to the grey space. It is now Legrand’s turn to catch up.

Figure 2. Legrand Data Centre Portfolio

Source: Legrand capital markets day presentation, September 2024

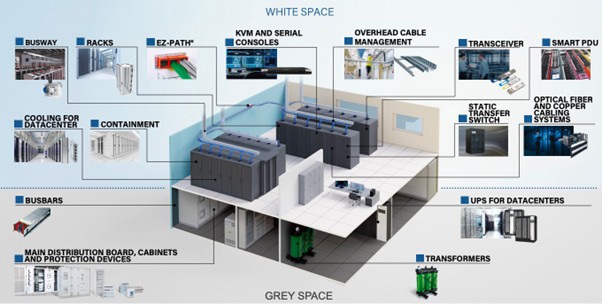

Figure 3 below shows US data centre starts by year, measured as the value of the entire project at the time the construction breaks ground. The acceleration in starts began in 2023, with the earliest of these projects only reaching completion by the beginning of 2024.

We are now more than two years into the data centre build out, and Legrand’s organic growth has begun to accelerate. Organic growth registered over 10% in the most recent quarter, with data centre revenue growing more than 30%. This growth is likely to accelerate further as tech giant spending not only continues to step up, but also shifts more towards server spend, to which white space spend is tightly linked.

White space equipment also has a very attractive characteristic that grey space does not – a frequent replacement cycle. Data centre servers have replacement cycles that typically range 3-6 years, at which point the servers, along with a significant portion of the white space equipment, are replaced. Grey space equipment can have useful lives of 30+ years and depends on new data centre builds to generate sales. This makes white space equipment revenue much more resilient than grey space equipment when new build growth starts to slow.

The Remainder: Unpriced Cyclical Upside

The remainder of Legrand’s business is more aligned to traditional building markets. In these markets, Legrand’s products make up a very small portion of the overall building cost. Purchasing decisions are made by the contractor, not the end customer, and reputation for quality and reliability is the key selling point. The cost to a contractor to go to a job site and replace a faulty electrical product they’ve installed far outweighs the saving of choosing a cheaper alternative. As the product cost is passed through to the end customer, the contractor has no incentive to use a lower tier product. This model has created a competitive advantage for Legrand and gives it pricing power to protect from inflationary shocks, such as the pandemic-induced supply chain challenges, and the current round of US tariffs on imported goods.

Legrand’s three key building markets – US office, European residential, and European commercial – are all at trough levels and have been weighing on growth for over two years. Legrand’s US office volumes are down almost 40% from 2019 levels, while European residential and commercial volumes are down mid-single-digits.

US office renovation has started to gradually improve as return to work picks up and occupancy rates increase. As we enter a rate cutting cycle, we should see further improvement in new builds. Europe has seen a pickup in building permits now it has had a series of rate cuts, which should drive growth for Legrand in 2026.

There are also structural tailwinds in these markets as electrification intensifies. Housing needs stronger electrical systems, more surge protection, and more complex architectures as solar and battery storage become more common. Office buildings need advanced energy management systems and lighting controls to receive premium lease rates and meet sustainability requirements. Hospitals need more back up power systems and connected devices to keep their patients safe and improve outcomes.

The Numbers

Putting all the pieces together, we see a pathway to annualised mid-teens earnings growth through to 2030, driven by the data centre business and a very modest improvement in construction markets. We believe the market is drastically underestimating the growth potential in white space equipment as it catches up to, and overtakes, grey space spending, with already announced projects sufficient to cover this growth through to 2027.

There is also significant upside potential on top of our estimates if we see a construction upcycle, which is not factored into analyst estimates.