The Australian aged care sector is sometimes described as sleepy and slow-moving, yet it plays a vital role in the nation’s healthcare system. Heavily regulated and reliant on government funding and policy, the sector has faced its fair share of challenges over the years. Despite growing demand due to an aging population, the industry has been historically marked by periods of underinvestment, increasing regulatory burdens and rising operational costs. For almost a decade, the lack of government funding led to an industry-wide capital strike by aged care operators.

Regis Healthcare, the only remaining ASX-listed aged care operator, has more than 30 years of experience in the sector and has built a high-quality portfolio of approximately 7,500 beds. With over 7% of the market share, Regis Healthcare is one of Australia’s largest aged care providers. Aware of the growing demand for aged care services and ongoing discussions about industry-wide reforms, Regis has been focused on portfolio growth and maintaining quality. In August 2024, Milford Asset Management invested in Regis Healthcare, recognising the positive shifts unfolding within the industry.

A sector starved of capital

The unfavourable funding landscape resulted in underinvestment in both existing facilities and new developments. This, coupled with the growing demand for services, created an insufficient supply of beds and the current stock of beds being of mixed quality.

In 2018, Regis Healthcare started divesting underperforming assets as part of a broader restructuring effort to focus on more profitable and higher-quality facilities. The move was a direct response to the sector’s high operating leverage and the challenges facing the industry. The capital strike created a significant imbalance in the supply and demand for aged care beds.

Supply – demand imbalance

By 2022, the aged care sector’s supply and demand imbalance had reached critical levels. Building approvals for new aged care facilities were at a decade-low, and many existing aged care homes were forced to close. The lack of new facilities and beds, coupled with closures, meant the sector was facing a shortage of aged care beds when the need for them was only rising.

Source: AIHW GEN Data

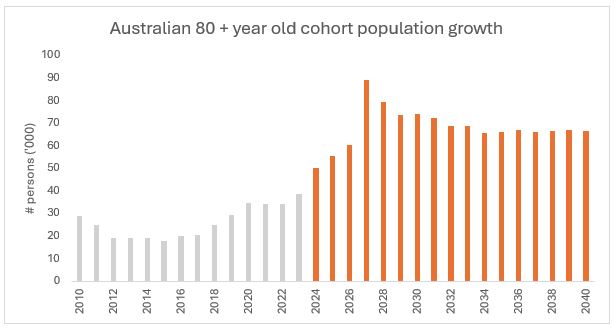

On the demand side, the long-term thematic of an aging population continues. As more Australians live longer, the number of people aged 80 years and over is increasing rapidly. In 2023, 40,000 Australians entered the 80+ age cohort, with that number expected to rise to 90,000 by 2027 and remain at these elevated levels for the next decade. These demographic shifts have placed immense pressure on a system struggling with underinvestment.

Source: Population projects, by age and sex, Australia. Australian Bureau of Statistics.

A breath of fresh air: The funding reform

In response to the growing crisis, regulators and policymakers took action. In late 2024, the Aged Care Act was introduced to the Australian Parliament with bipartisan support, marking a major turning point for the sector. The new legislation provides a much-needed breath of fresh air for the industry by increasing funding and allowing operators to charge more for their services. The reform makes it possible for operators to reinvest in the quality of the infrastructure and build new capacity to meet growing demand.

For the first time in years, there is optimism in the sector, with early signs of recovery showing in the form of green shoots in new supply and a renewed interest in mergers and acquisitions (M&A).

Regis has significant opportunities for both new developments and expansions or improvements to existing facilities benefiting both capital providers and aged care residents.

An industry ripe for consolidation

With the new funding system in place, the aged care sector is also entering a phase of consolidation. The industry remains highly fragmented, with numerous small operators struggling to meet the regulatory and financial demands of the sector. Larger, more established operators have a material profitability advantage over smaller competitors, who may struggle to adapt to increasing regulatory burdens.

Regis’ desire to acquire new assets shows its confidence in the sector’s future. The company is in a net cash position, which gives it the financial flexibility to continue deploying capital into the sector as demand for aged care services continues to outpace supply.

Looking ahead, Regis Healthcare is well-placed to benefit from the strong fundamentals underpinning the aged care sector.