Within many garden and tool sheds across New Zealand and Australia, you’ll find the eye-catching green of Ryobi. Or within professional tradespersons’ yards and trucks, the bright red of Milwaukee will stand out. Hong Kong-listed Techtronic Industries (TTI) is the owner, designer and manufacturer of these powerhouse brands, both leading the DIY and professional tool market globally.

TTI was founded in Hong Kong in 1985 by Horst Pudwill and Roy Chi Ping Ching, starting life as a tool and vacuum Original Equipment Manufacturer (OEM) out of Asia for several western brands. TTI quickly pivoted to become a vertically-integrated brand owner of battery powered tools, responsible for manufacturing, selling and marketing power tools and light construction equipment to both retail and commercial customers.

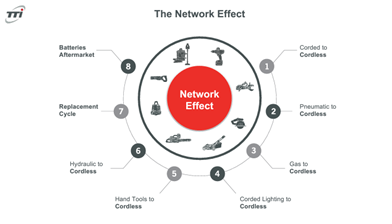

TTI is unrivalled in its commitment to driving a generational shift from corded tools (being gas, pneumatic and electric corded) to battery powered. Battery powered tools provide a number of benefits versus corded, including manoeuvrability (efficiency gains on site), increased safety, lower maintenance costs, and reduced noise and emissions for the user.

Source: Techtronic Industries

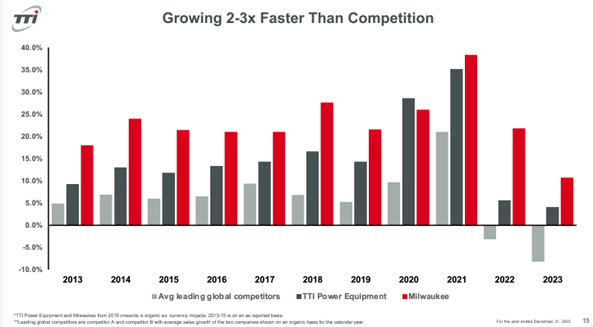

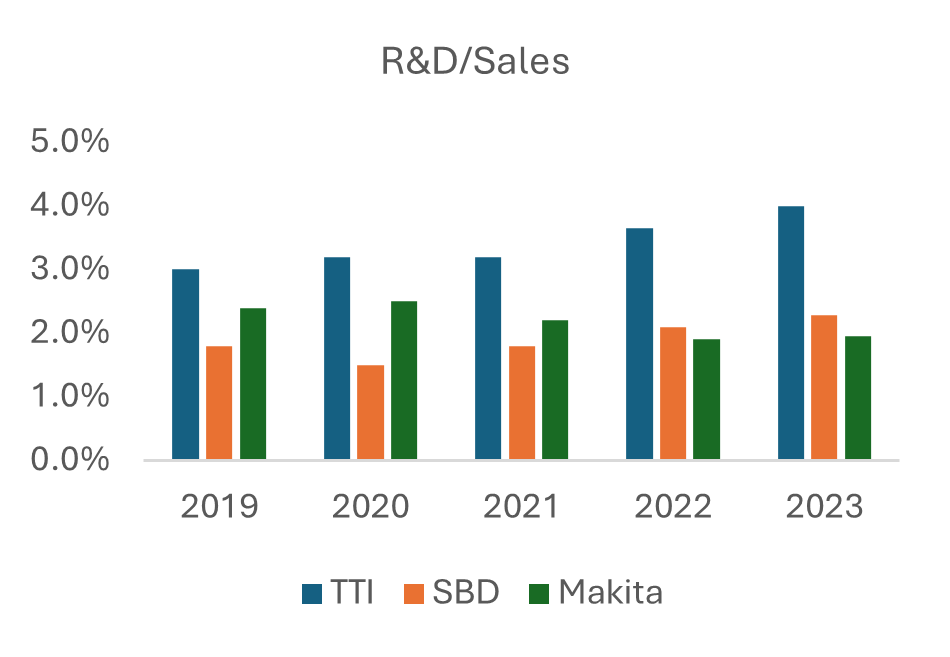

TTI has a long history in battery technology, entrenched in corded products, versus its competitors. In addition, TTI’s founders still own approximately 24% of the company, which has driven focus and investment into its long-term strategy. TTI’s commitment to investing in research and development (R&D) over the long-term has opened up new frontiers in battery-powered innovation, which has both increased its total addressable market by switching an increasingly wide range of tools to cordless, and opened up a significant technology gap on competition that continues to widen. With more than one third of sales each year coming from new products, we believe the product development cadence will continue as TTI pushes the barriers of what can be powered by battery.

Source: Milford, company reports

TTI’s focus on battery powered tools has built a captive and loyal customer base. Take the Milwaukee 18-vault battery platform, for example. A total of 284 different Milwaukee tools can be powered by that one battery platform – that’s every product built in the past decade. Not only does that create a sticky user once they are added to the ”platform” but has opened a recurring higher margin revenue steam via the battery after-market (batteries can cost up to one third of the tool cost). We believe this ”network effect” is a unique source of competitive advantage more commonly associated with a tech company.

Source: Techtronic Industries

Milford invests in TTI for its long-term growth potential. Techtronic possesses many of the attributes we look for in high-quality companies that have the ability to compound earnings growth over a multi-year period, including a leadership position in a growing market, relentless focus on R&D to expand its TAM (total addressable market), and a culture aligned to its competitive advantage.