APi Group is a global, market-leading industrial services provider headquartered in the US, and focused on non-discretionary, statutorily-mandated inspection, testing and maintenance work. It is the largest player globally in fire protection systems, a leading player in commercial security, and a recent entrant into the elevator services market.

Milford uncovered APi Group on a research trip to the US and was attracted to the quality of the company, the resilience of earnings, the long-term growth runway, and management’s relentless focus on culture, all available at what appeared to be a reasonable price.

The inspection and testing services APi Group provides are either mandated by regulatory bodies or required by insurance companies to be performed on a recurring basis. These range from monthly to annually depending on local regulation and building type, and creates a highly defensive inspection and testing revenue stream.

On average, every $1 of inspection and testing revenue that APi generates drives an additional $3-4 of high-margin maintenance work, most of which is non-discretionary and cannot be deferred.

The industry benefits from strong growth dynamics, driven by annual contract price escalations of 3-4%, alongside volume tailwinds from a rising number of buildings, stricter regulatory standards for life safety systems, and heightened requirements from insurance companies.

As part of Milford’s due diligence process, we spoke with building managers, former employees and unlisted industry peers across Europe and the US. These conversations helped us build confidence that APi is a high-quality company with pricing power, scale advantage and a unique corporate culture.

• Pricing power – The services APi Group provides represents a small proportion of the overall cost of running a building and can be disproportionately disruptive. This makes building managers’ price inelastic for high-quality service and favours larger players.

• Competitive advantage – APi’s scale allows large building managers to have a single point of contact across all their buildings, regardless of location, size or capability required. APi’s scheduling systems integrate into its customers’ building management systems, and its accounting department receives a single bill. The benefits are magnified in emergency repair situations, where APi can have technicians on-site within hours, and its scale and branch density allows it to hold an inventory of replacement parts and to divert resources where needed.

• Culture – CEO Russ Becker has been with the company for 25 years and has made corporate culture a primary focus. Management emphasises equipping great leaders, empowering employees and putting their people in the field first. Dedicated training facilities provide upskilling and development opportunities for any employee wanting to progress their career. In a customer-facing role, where business is won on service quality, having an engaged workforce that feels valued by the organisation is critical for driving organic growth. This philosophy also helps succession planning at all levels of the organisation.

APi Group also excels at value-accretive mergers and acquisitions (M&A). Despite being the largest player globally, the market remains highly fragmented. In the US, APi’s largest market, the company holds a 10% market share, while an estimated 5,000 smaller operators serve the rest of the market. These are predominantly independent, single-branch, family-owned businesses. APi is highly successful at acquiring these smaller operators, integrating them into its existing sales network, professionalising its service offering, and delivering a stronger value proposition to its customers.

APi accelerates the organic growth of these branches in the years following the acquisitions by adding new capabilities and cross-selling. It also improves profitability through better utilisation of the branch’s resources across the network.

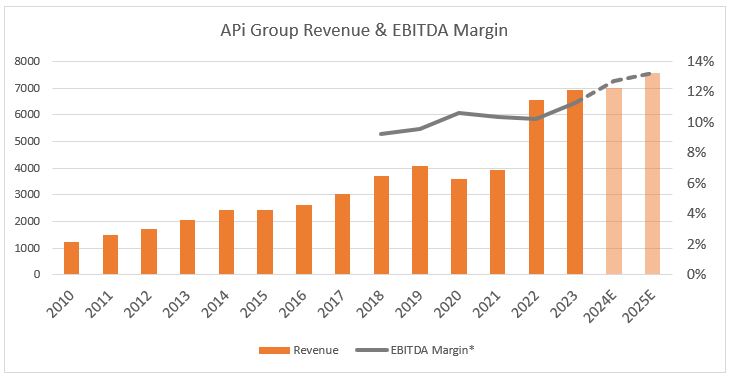

Over the past decade, APi has averaged 10% revenue growth per annum, split evenly between organic and bolt-on acquisitions. This includes the 2016 industrial recession and Covid lockdowns. Since listing in 2019, margins have also expanded 300bp as APi leverages its scale.

We believe an investment in APi has a unique proposition in the current political environment:

1) The business should be insulated from the impacts of potential tariff increases or trade wars. As a domestically-focused service provider, it doesn’t rely on imports or cross-border trade.

2) Its technicians hold specialised skills that require multi-year training programmes, which means the company should be well protected from changes in immigration policy.

3) Its services are required regardless of broader economic conditions.

The earnings growth algorithm for APi Group is quite simple. 3-4% contracted price increases, 1-2% volume growth, and 3-5% growth from bolt-on M&A at accretive purchase price, add up to high-single-digit revenue growth. Applying some margin expansion from its scale benefits and fixed cost leverage, provides mid-teens earnings growth independent of the economic cycle.

We believe APi Group’s current share price offers an attractive investment proposition. At 17x 2025 earnings, APi Group trades at a discount of more than 20% to the S&P 500, despite a higher earnings growth outlook and more resilience to the economic cycle.

*Company listed in 2020, only sales data available pre-2018.

Source: Company reports and Milford estimates