Tuas is a small but fast growing Australian-based telecommunications provider. In 2016 they were awarded a license allowing them to become the fourth official mobile network operator in Singapore. They now have over 1m subscribers and have launched into the home broadband market. From no revenue to almost A$200m today, Tuas is an impressive founder-led business.

When they were awarded the license, Tuas was still part of the broader TPG Group, a large Australian telecommunications company focused on fibre-based services. In July 2020, Tuas was spun out of TPG when TPG merged with Vodafone – forming a much larger diversified telecommunications business. Given we were covering TPG we knew the Tuas business well, although at the time it was an illiquid, essentially unfollowed small cap.

We saw a significant opportunity to disrupt what was a very archaic mobile market in Singapore. Local operators were realising very high margins, and consumers were still not receiving unlimited access to many services we take for granted (like sms messages).

Adding to our thesis was the fact TPG founder, David Teoh, was going to be heavily involved in the operation of this business. We highly rate David as he has a ruthless focus on cost and efficiency, which is particularly important when running a start-up telecommunications business in an established market.

Amazingly, Tuas started with no infrastructure and just a license. They invested in efficient, best-in-class telecommunications equipment to quickly establish a network. Although not necessarily as deep as competitors, impressively in just a few years they managed to be close enough in network quality to launch competing services.

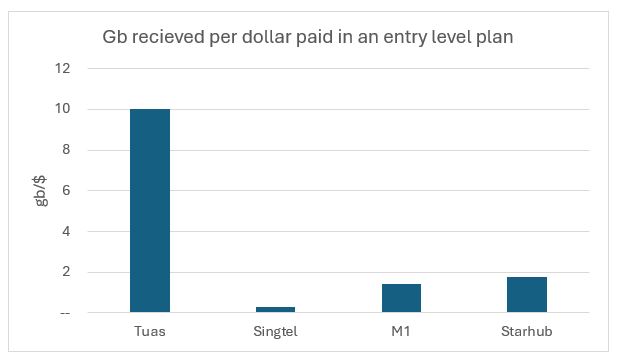

This, coupled with a rigorous focus on their cost base, allowed Tuas to materially undercut their competitors who had legacy networks and bloated expenditure and, hence, were unable to respond. In 2020 Tuas launched with their highly disruptive entry-level plan under the brand Simba. Not only was it 50% cheaper than all the major Singaporean operators but included more gigabits per month than anyone else.

This, coupled with a rigorous focus on their cost base, allowed Tuas to materially undercut their competitors who had legacy networks and bloated expenditure and, hence, were unable to respond. In 2020 Tuas launched with their highly disruptive entry-level plan under the brand Simba. Not only was it 50% cheaper than all the major Singaporean operators but included more gigabits per month than anyone else.

Source: Milford Asset Management

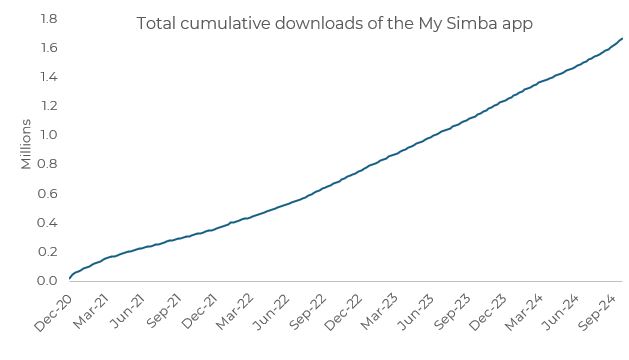

This saw great success, with Tuas growing from 7,000 Simba subscribers in April 2020, to over 1,000,000 in July 2024. This equates to just under 11% market share in approximately four years.

Source: Barenjoey Research

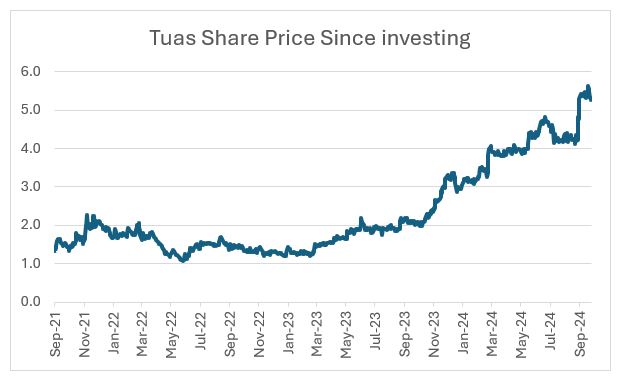

Tuas has appreciated by 318% since we first invested in September 2021. An incredible return, with revenue growing from nothing to S$117m and EBITDA (earnings before interest, taxes, depreciation and amortization) from a negative to ~S$50m (both in their recent financial year).

Source: Bloomberg

Excitingly (although not for their competitors) Tuas is looking to disrupt the Singaporean broadband market. True to their playbook, they’re >50% cheaper than peers, and the market structure is attractive where 80% is controlled by two of the incumbents – again these incumbents have legacy cost bases and hence will struggle to respond.

Beyond this it’s hard to say, but small to medium business offerings and a regional expansion into other South-East Asian markets isn’t out of the question. Given the significant return, we have been managing our position but remain excited of Tuas’ prospects.