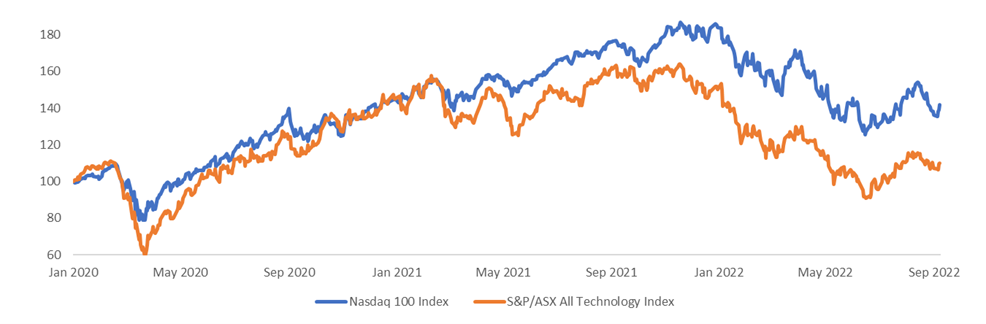

Technology companies enjoyed incredible returns up until their November 2021 highs, with the NASDAQ Composite index increasing 547% over the preceding decade. This was driven by strong economic returns and a significant expansion in the valuations investors placed on these companies (price-to-earnings multiple expansion) which in turn was due to a decade of loose monetary and fiscal policy.

We have since seen a significant correction in highly valued areas of equity markets, with the NASDAQ declining by approximately 30% since its November 2021 highs, erasing approximately US$5.4 trillion in value. Over the same period, the S&P/ASX All Tech Index is down 35% which has left the tech sector vulnerable to opportunistic buyers. 13 ASX-listed tech companies have been approached by potential suitors in the last 12 months, predominantly by private equity groups.

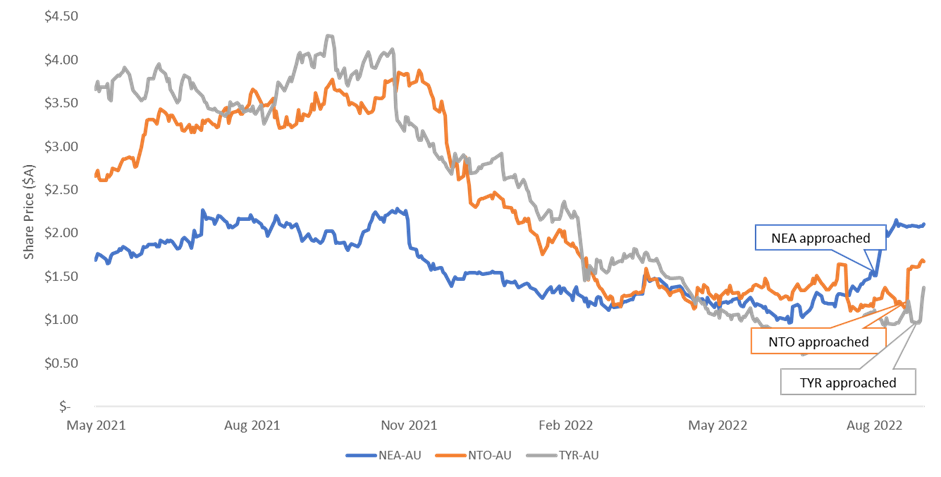

Tyro Payments Limited, Australia’s largest EFTPOS provider outside the big four banks, received a proposal from private equity group Potentia Cap. The takeover offer reflected a roughly 30% premium to Tyro’s previous closing price, however it is 70% below its 12-month highs. Potentia Cap has been very busy. A week prior they made a takeover offer for Nitro Software, a company that provides PDF editing, cloud-based e-signing and document workflow solutions. The proposal represented a 40% premium to its previous closing price, but again was a significant 60% discount to its recent highs. Both deals were rejected based on the Board’s concluding it significantly undervalued their company.

Nearmap, an aerial imagery technology and location data company was approached for takeover by a private equity software investment firm, Thoma Bravo. Thoma Bravo has US$114bn under management so the demand is not just from domestic private equity firms, but from some of the global heavyweights. The deal reflected an 83% premium to the previous closing price, which the Board determined was sufficient and unanimously recommends Nearmap shareholders vote in favour of the offer.

Clearly, cash-rich private equity funds are on the hunt for bargains in what appears to be a distressed technology sector. However, of the 13 takeover bids, only one has successfully converted, three deals are ongoing, and nine deals have fallen over. This is predominantly due to the companies believing the offer significantly undervalues the inherent value of their business. The lack of conversion and significant discounts to peak valuations highlights the opportunistic nature of these deals.

There is clearly a disconnect between private markets and listed-markets forward-looking expectations, investment horizons and costs of capital. We’d expect heightened M&A activity to continue should equity markets remain subdued. We would also expect however low conversion rates to continue as Board’s hold on to previous share price levels as a barometer of value, despite the macro environment having changed. We are wary on parts of the technology sector, however we believe pockets of value are emerging and we will continue to deploy opportunistically into mispriced companies.