In the last two years we have witnessed a major market event in Covid-19, followed by some of the most extreme monetary policy support (ultra-low interest rates) in history and huge fiscal stimulus (government spending). Events and policy responses can trigger significant moves in equity, fixed income, property, and commodity markets. Many of these market moves mask even bigger moves in individual share prices. Spreading your risk and not putting all your eggs in one basket, can help to limit the impact of events that are beyond your control. Markets are constantly changing, and a combination of diversification and active management can help manage risk and improve returns.

Different asset classes contain different risks and react differently to certain events, performing very differently at any given time. Within share markets, companies also perform very distinctly in different environments – a healthcare company performed very differently to an airline or cruise line company when Covid-19 struck and borders closed.

Why Would I Bother?

We often hear questions such as ‘why wouldn’t I just own NZ property?’ which to be fair has been a decent performing asset class in recent years. However, situations change. What if our Reserve Bank raises interest rates another eight times? What if NZ goes into a recession and we see unemployment rise, followed by defaults on mortgages, followed by mortgagee house sales? In that hypothetical scenario you might wish you also had some of your investments exposed to international markets driven by other factors. Shares in Microsoft don’t care what’s happening in the NZ property market.

2021 Different to 2020, and 2022 Could be Different Again

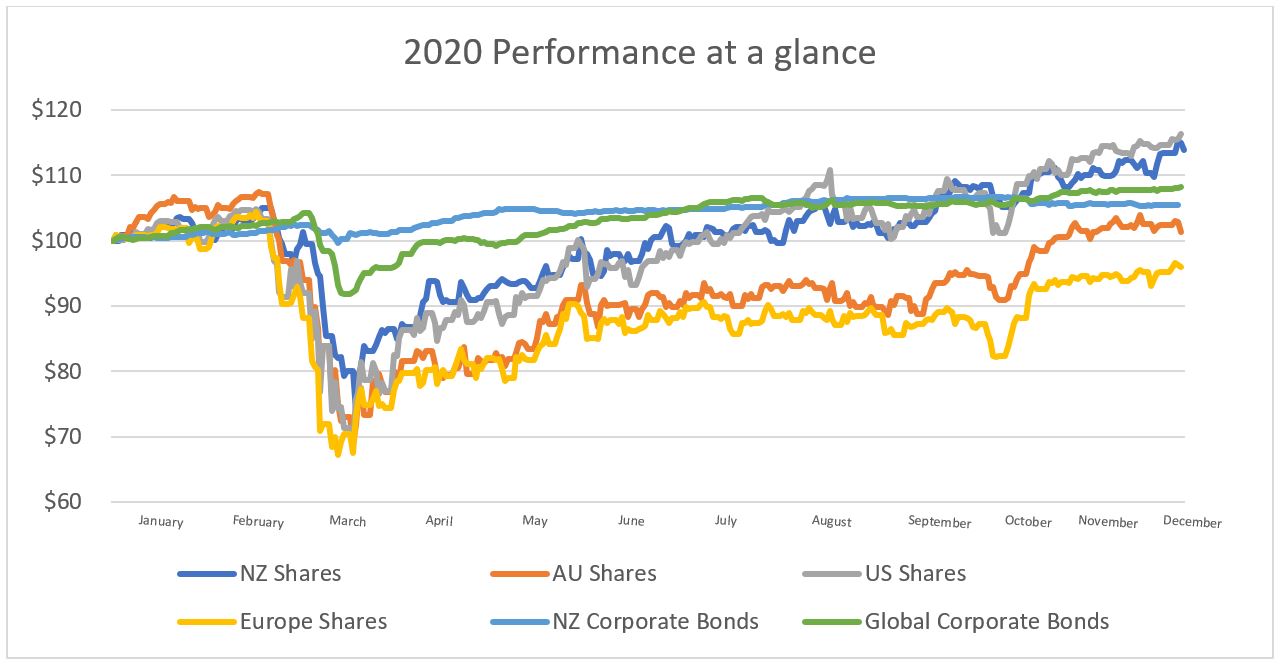

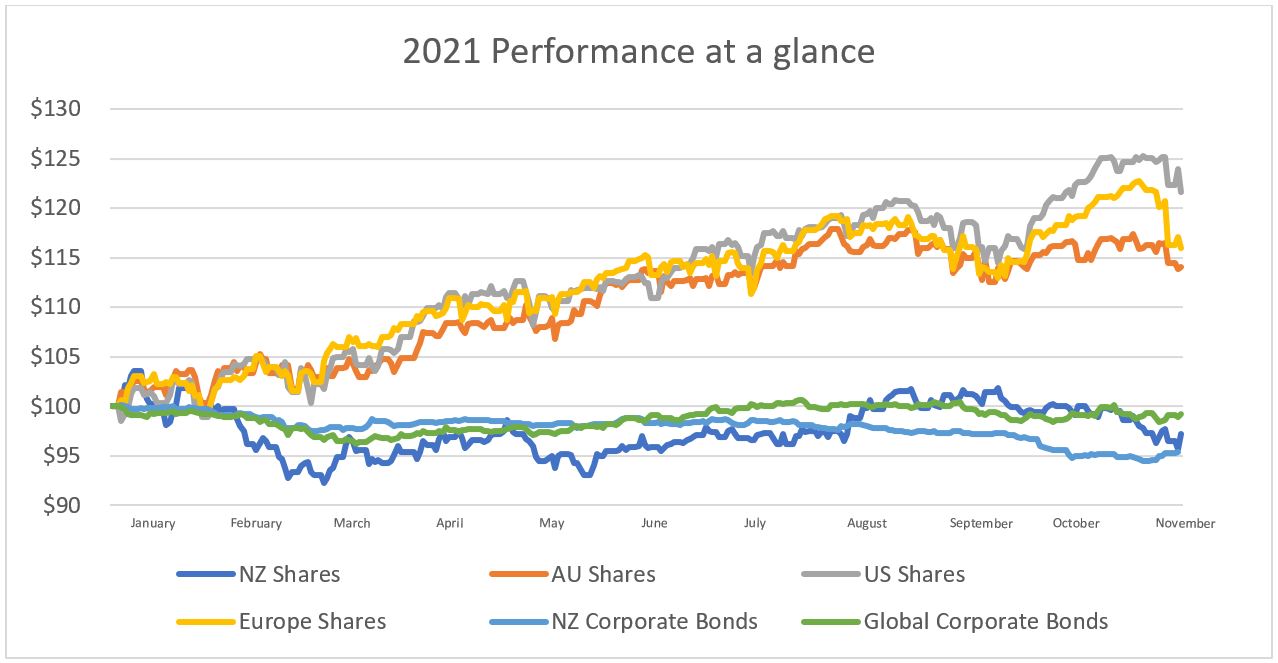

The two charts below show the performances between three different geographies of shares and two different geographies of corporate bonds over 2020 and 2021. What worked in 2020, was not the same as 2021, and 2022 could be different again.

(Source – Bloomberg)

After being a top performer in 2020, NZ shares have underperformed in 2021, due to rising interest rates and some stock specific issues. Europe and Australia have done better in 2021 than they did in 2020 as economic growth recovered. Bonds offered you some protection in March 2020 but have struggled in 2021 as expectations of higher interest rates has weighed.

US shares have done well in both 2020 and 2021 but will they lead us again in 2022 as the economic backdrop changes? Will the assets that benefited during interest rate cuts still perform when rates are being hiked?

Milford Diversification

At Milford we manage a variety of funds with varying degrees of diversification. While some are single asset class funds investing in a specific asset class or region, even these funds are diversified across many different stocks. Our diversified funds are running allocations across multiple asset types and geographies, and are spread across many different stocks and bonds. This not only reduces the potential impact of one company underperforming, or even going out of business, but also limits the impact of you being exposed to one country that is underperforming others.

Peace of Mind

Diversifying can reduce your risk of loss, give you exposure to more opportunities for return and, perhaps most importantly, it can give you peace of mind and help stop you over-reacting or panic selling during periods of adverse market conditions.

Milford employs a large investment team scouring the markets for opportunities in shares and bonds to find those offering an attractive risk/reward. We also have tools and services to help you as an investor. These include simple digital advice to match a single diversified fund to your risk tolerance and goal, and a full advice process* where one of our experienced Private Wealth Advisers will match your personal financial goals and risk considerations to a diversified portfolio of funds and help guide you through those more challenging times.

*for investors with $500,000 or more