Mobile network operators (MNOs) such as Spark & Vodafone often own valuable infrastructure assets but are not rewarded for owning these assets in their valuations. This has prompted a global trend of MNOs separating their passive mobile infrastructure assets (generally the physical mobile tower and land below the tower) into a tower company (TowerCo) and selling the TowerCo for valuation multiples much higher than those applying to the MNO themselves.

Both Spark and Vodafone have taken advantage of strong demand for these assets with Spark announcing the sale of 70% of their TowerCo for a $1.2 billion valuation1 to a Canadian investment fund, and Vodafone the sale of 100%2 of their TowerCo to a group of infrastructure funds. Both transactions are pending overseas investment office approval.

This article will look at why MNOs have been selling their passive mobile towers and the implications for investors.

Firstly, what is a TowerCo?

Traditionally MNOs saw mobile towers as a key part of their business and were reluctant to sell them. However, ownership is no longer seen as a competitive advantage with an MNO able to install their equipment on a mobile tower through a rental agreement instead. The MNO stills owns the active mobile infrastructure which includes spectrum and mobile equipment which are more critical to the MNOs network coverage and quality.

Tower companies first emerged in the US back in the 1990s and following their success the model has spread internationally.

Network Sharing

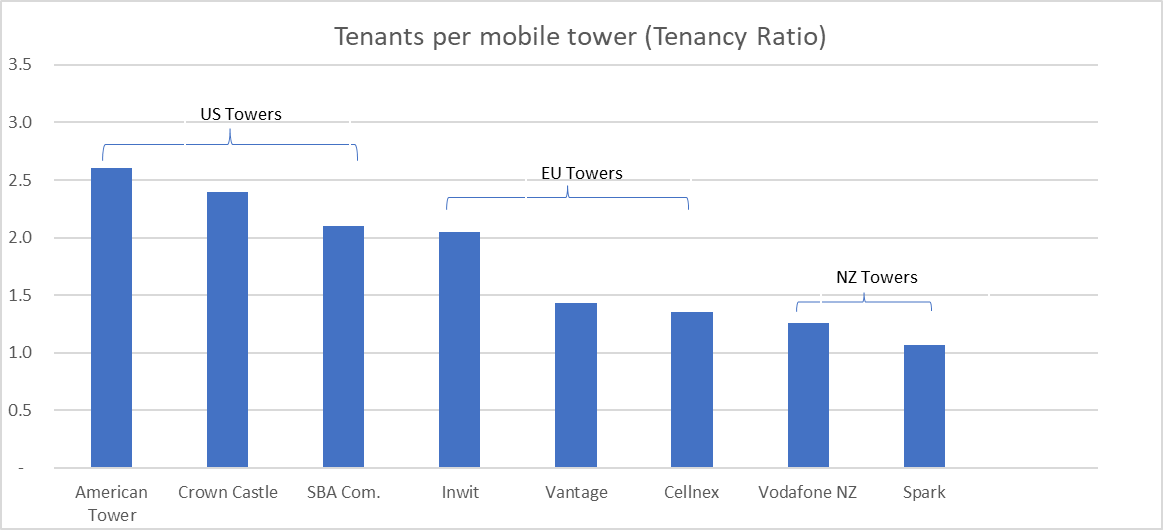

Tower companies are often created to capture the significant benefits that come from sharing towers between operators. Adding a new operator to a tower (a tenant) requires minimal incremental operating expenses resulting in large economies of scale from higher utilisation when hosting multiple tenants. Mobile towers in New Zealand have lower utilisation than markets with more established TowerCos and increasing this will be an opportunity for the new TowerCos.

A separate TowerCo may also be better suited to pursue further cost efficiencies and more efficient rollouts. This is front of mind at the moment with growing data consumption and the rollout of 5G requiring a significant expansion of existing mobile tower networks. As a part of the transaction, Spark’s TowerCo which has 1,263 towers will build a further 650 towers over the next 10 years while Vodafone’s TowerCo which has 1,484 towers will build at least 390.

Figure 2 Source: Company data, Factset

Financial implications

TowerCos are created by a sale and leaseback transaction where the MNO signs a long-term anchor contract (15+ years) to have their equipment on the towers. These contracts will include annual increases (either fixed, linked to inflation, or a combination of both) and a tower build programme. This provides TowerCos with long-term, growing cashflows which are highly attractive to infrastructure investors. The valuation of a TowerCo is dependent on the anchor contract terms and the growth opportunity from increasing utilisation.

These transactions result in large cash proceeds for the MNO offset by the creation of a lease liability due to the annual rent payments to the tower. These proceeds can be used to repay debt (in part to offset the lease liability) with any remaining proceeds able to be reinvested or returned to shareholders.

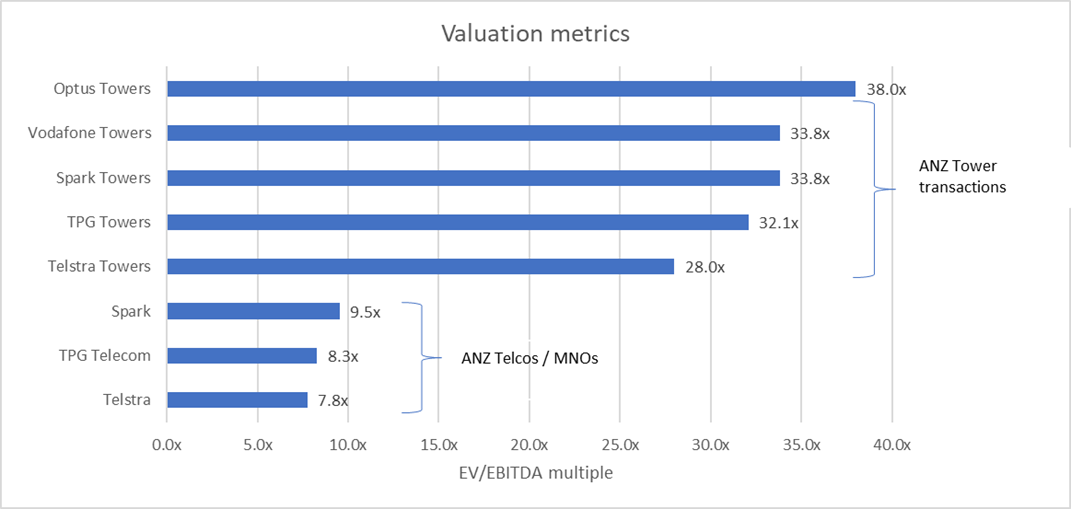

Figure 3 FY22 EV/EBITDA multiple for listed MNOs and EV/EBITDA multiple disclosed in tower transactions. Source: Company data, Factset as of 29 July.

Implications for investors

The value of infrastructure assets owned by MNOs such as mobile towers is often not fully recognised by investors, so selling these assets can unlock more value than if the MNOs were to maintain ownership.

The valuation multiples Spark and Vodafone sold their towers for compares favourably to other tower transactions although the overall attractiveness of the transactions will depend on the terms in their tower contracts (which have not been fully disclosed). Both operators are likely to look at other assets they own (such as fibre) and whether similar transactions could be done.

Following completion, the next big question for investors is how the proceeds from these transactions will be used and whether they can be reinvested in higher returning growth opportunities, or otherwise returned to shareholders.

Sources:

1Spark tower transaction announcement

2Vodafone sold 100%, while Infratil who own 49.9% of Vodafone retained a 20% holding in the TowerCo

3Infratil Vodafone tower transaction announcement