2022 has seen equity markets give back much of the gain investors enjoyed in 2021. The MSCI World Index (in US$) is down 18% year-to-date to a level last seen in late 2020. Meanwhile, over 5 years the index has gained 6% p.a. which is close to the CAGR achieved in the past 50 years. Equities is a volatile asset class, and the list of reasons to worry is often lengthy. Much has been written about the causes of this downturn with inflation and rising interest rates a catalyst for a reassessment of the egregious valuations placed on many high-flying “growth” stocks as well as a swathe of established, high-quality companies expected to compound high returns on capital for many years. A great company is not always a great investment, and investment opportunity can be found in a company with perceived weaknesses.

Reporting of 2Q22 earnings is now underway internationally, and investors are pouring over corporate commentary, eager for insights to inform portfolio construction decisions. Will inflation combine with falling sales to pressure (record) corporate profit margins lower? Is inflation peaking? Are supply chain constraints easing? How much has consumption slowed? Is this negatively impacting corporate investment intentions? Is the employment market softening? It is too soon to answer these questions with certainty, but these topics have implications for company cash flows, and any assessment of current market valuations.

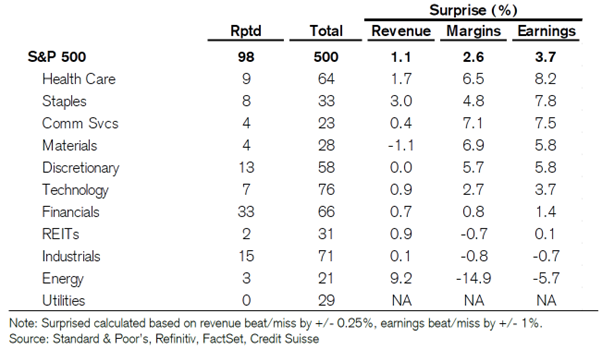

In the first 3 weeks of July about 25% of the US S&P500 companies have reported 2Q22 results, with many more to come this week. Results to date are better than feared; approximately two-thirds of reporting companies beat expectations by an average of 3.7%. The Healthcare, Communication Services and Consumer Staples sectors have surprised most positively, reporting earnings approximately 8% ahead of expectations.

2Q22 S&P500 earnings are surprising to the upside

Inflationary reads are mixed with several industrial companies suggesting year on year pricing gains for their products could accelerate further in the second half of 2022 despite 1) some commodity inputs declining, 2) supply chain constraints easing gradually, and 3) signs of improvement in the hiring market (e.g. Industrial distributor Fastenal reported job applicants per opening now 10% below 2019 levels versus 36% below 2019 levels seen during 2021). Labour demand is also slowing with large technology companies like Microsoft, Alphabet (Google parent company), Meta Platforms (Facebook parent company) and Apple all reducing hiring intentions.

Slower hiring is a clear sign of reduced corporate confidence which is also suggested by weak advertising trends highlighted by SnapChat at its 2Q22 results last week. SnapChat’s 3Q22 sales are tracking about flat year on year, well below the low-teens percentage increase expected by analysts. This contrasts again with early reports from European Capital Goods companies that have, for the most part, cited solid order trends and maintained outlook statements. We’ll learn a lot more over the coming fortnight when most companies report, but if the news to date is anything to go by, we might need to wait until 3Q22 results in October/November for clear evidence of a widely expected slowdown.

Perversely, opportunity is often found in areas where fears around demand or profitability are greatest. Investment outcomes are not always aligned to economic outcomes or earnings results, but instead lean to how those results and outcomes compare to the investor expectations reflected in a stock’s current market valuation.

US Hospitals may be one such industry. Sales are driven by patient admissions and the acuity of treatment. The patient and acuity mix has been highly variable as the pandemic has progressed, creating challenges for hospital operators to match costs and service levels to the care to be provided. Labour costs are material, and typically account for 45-50% of sales. The availability of staff (especially nurses) has led to hospitals’ greater reliance on high-cost temporary labour, which, together with wage inflation for permanent staff, has added complexity and pressured profit margins. This might sound like a difficult environment for investing in these companies, and it has been. In the first 6 months of 2022 bellwether hospital stocks such as Tenet Healthcare and HCA Healthcare declined 35%. The two companies have since reported 2Q22 EBITDA down about 5% year on year versus 2Q21, which sounds poor but was ahead of expectations. Things aren’t as bad as feared and the stocks have responded positively, up around 20% in July.

Earnings outcomes can appear weak at face value, but if they’re ahead of investor expectations then investment outcomes can be quite the opposite. This creates opportunities for active management when a contrarian investment view can be constructed.