As the world transitions to a low carbon future, an array of pathways to achieve this goal are taking shape. Existing technologies such as wind and solar power are being rolled out across the globe and new technologies including hydrogen, batteries, and carbon capture & storage (CCS) are being developed at commercial scale. It has now become clear that a variety of technologies will be required in a net zero future, however the question remains: what does the journey look like?

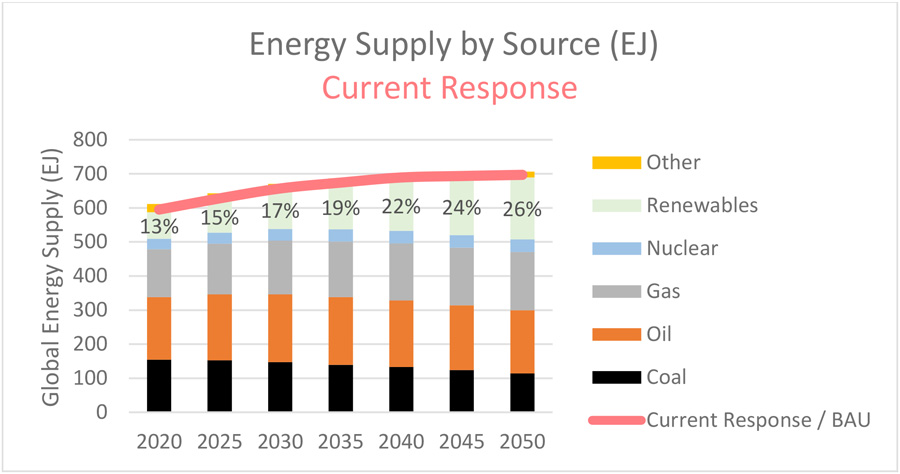

As of 2020, renewable energy accounted for approximately 13-14% of global energy supply, highlighting a significant gap between supply and demand. The limitations of renewable energy filling this gap include long project lead times, land restrictions, large amounts of capital required and the variability of renewable electricity generation.

Most renewable energy sources are not ‘dispatchable’, i.e. they cannot be stored and utilised according to demand. With mass solutions for dispatchable renewable energy not yet commercially feasible, the key challenge remains achieving a predominantly renewable energy network.

Energy supply shortages are a real risk. UK energy prices are a recent example of the possible ramifications of inadequate supply. In the UK. energy prices reached all-time highs in December 2021 and households had to face the cold as power bills doubled. These negative social impacts demonstrate why we need to ensure availability of reliable energy to bridge the gap while transitioning to a low carbon future.

These constraints mean fossil fuels need to continue to play a part in energy transition. But it’s possible to mitigate against some of the worst features of fossil fuels with an initial step being to cut out the highest emitting fuels while investing capital into new technologies. This includes the phasing out of coal and leaning on natural gas as a bridging fuel while innovative technologies are being developed. The inclusion of low carbon natural gas in the EU taxonomy this month, a classification system establishing a list of environmentally sustainable activities, is an acceptance that this type of compromise needs to be made.

Renewable energy constraints impacting the future energy mix

Source: IEA, BNEF, Equinor, IPCC, BP, Milford Research

A trend for listed energy companies is the rush to divest their most polluting assets as a result of pressure from investors to become greener. Unfortunately, many of these high emitting assets end up in the hands of private owners whose transparency and reporting standards are much below that of the listed market and who have no incentive to wind down these assets. To be more effective therefore, listed energy companies must drive change through decommissioning assets, reducing and offsetting emissions and reporting transparently. This will become more difficult if their cost of capital rises via a shrinking pool of investors.

We expect fossil fuel companies to also invest in renewables and new technologies rather than simply growing their fossil fuel production. Some are already delivering. Santos is a recent example having announced a A$220 million investment into their CO2 storage resource in South Australia, furthering their investment into CCS. According to Santos, this project will safely and permanently store 1.7m tonnes of CO2 per year, in contrast to the estimated 40m tonnes of CCS storage capacity currently globally available.

However fossil fuel companies need to do more. These companies have a major role to play in delivering a green future while still supplying energy to those who need it most. We believe investors play a vital role in pushing fossil fuel companies to change, something that cannot be done if these assets are in private hands. At Milford, we undertake detailed analysis of what is required to deliver the most effective transition to a low carbon energy system and are committed to engaging with the companies we invest in to drive these changes.