The Milford Trans-Tasman Equity Fund returned 30.51% after fees for the 12 months to the end of December. Most of the prospective clients we are currently talking to are realistic enough to know a 30.51% return is unlikely in 2020 – but we are talking to plenty who expect a return of 15%.

Is 15% a year realistic? Probably not and almost certainly not as a long run average annual return going forward. Should clients be chasing the returns offered by a portfolio made up of one fund which is all shares and 100% invested in Australasia? How many of us have the courage and strength to “stay on the bull” when it bucks?

Milford Private Wealth Advisers put a lot of time in to assessing and verifying the risk profile of each client in our Advice & Management Service: “has anything materially changed in your circumstances since we last met?”, “are you still planning to retire in five years”, “are you comfortable with the level of income you are drawing from the portfolio”. We are not being nosey, we just want to determine whether your risk profile has changed and we need to change the portfolio accordingly.

So, what do we consider when gauging an investor’s risk profile?

The first component is Risk Tolerance – how do you think and feel about financial risk? In car racing terms, can you handle the occasional slide in the corner or are you going to run for the pit lane as soon as the track gets wet. Risk Tolerance can change over time as investors get used to the highs and lows of market movements (and the hyperbole of media reporting), but it is not something clients or Advisers can change in the short term.

The second component is Risk Capacity – how much financial risk do your financial situation, investment goals and objectives allow. Even the bravest amongst us is going to take it quietly driving with a new baby in the backseat. Conversely, a client who does not need an income from his or her portfolio, has a long investment time horizon and is continuing to save has a high capacity for risk and can look to benefit from the 30% return years knowing he or she can survive periods of lesser or negative returns. This is the travesty of default KiwiSaver schemes allocating young investors to very conservative portfolios without consideration of their circumstances. Whereas Risk Tolerance tends to change slowly, Risk Capacity can change quickly – a decision to retire, an inheritance, a planned housing purchase can all mean a change to the level of risk in your portfolio is sensible.

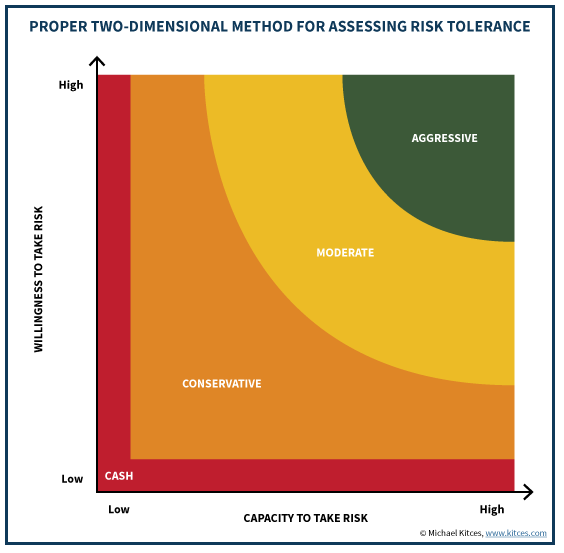

The graph below shows the compromise between Risk Tolerance and Risk Capacity we use to arrive at an investor’s Risk Profile.

If you are in the top left or bottom right corners, either high Risk Tolerance with low Risk Capacity (have you been burned in the past?) or low Risk Tolerance with high Risk Capacity (do you have too much “lazy money” sitting in the bank?), you are especially likely to benefit from financial advice. If you don’t know where you sit on the graph, park somewhere safe until you do!

If you are not sure of your risk profile, the Advisers at Milford Private Wealth can take you through the process of agreeing a risk profile and an appropriate portfolio of Investment Funds as part of our Advice & Management Service, available to investors with $500,000 or more to invest. Contact us on 0800 662 347 or [email protected]