In May last year we looked at what a Trans-Tasman bubble would mean for New Zealand. The outlook for the NZ travel sector has since improved with the bubble now open and vaccine programs rolling out around the world. However, is this already reflected in travel company valuations?

Trans-Tasman Bubble Hesitations:

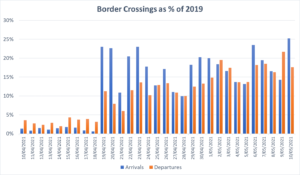

Early data available from Stats NZ shows that international travel has increased significantly since the Trans-Tasman bubble opened on the 19th of April. Arrivals to NZ have recovered to 17% of 2019 levels, while departures have recovered to 14% of 2019 levels. Australia made up 40% of visitor arrivals during 2019 so this would imply that Trans-Tasman travel has recovered to approximately 35% of 2019 levels since the bubble opened.

There is still some hesitance to travel with travellers worried about getting stuck, which we saw when the bubble was temporarily paused with NSW on the 6th of May for 48 hours. Travel across the Tasman is likely to remain suppressed while this uncertainty remains.

Figure 1 Source: Stats NZ

Figure 1 Source: Stats NZ

Outlook for International Travel:

The timing of a recovery in international travel outside of Australia remains uncertain and will depend on whether the government waits until the vaccination rollout completes or follows a risk-based border approach. Under a risk-based approach international travel could restart earlier, with testing and isolation requirements based on a country’s risk profile. If NZ waits until the vaccination rollout completes, then borders could remain closed until 2022, like Australia who have assumed in their budget that international borders remain closed until mid-2022.

Travel Sector Valuations

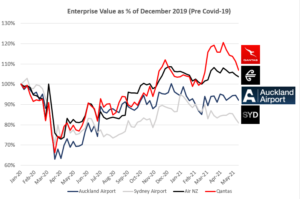

While the share prices of many Australasian travel companies remain below pre-pandemic levels, their valuations have recovered to levels similar to where they traded previously. The pandemic has resulted in higher debt levels and/or dilutive capital raises for many travel companies which isn’t reflected when looking at the company’s historic share price.

A better approach to compare company valuations to pre-pandemic levels is to look at their enterprise value which is the sum of a company’s market capitalization and net debt. With travel sector enterprise valuations back towards pre-pandemic levels, investors are pricing many travel companies as if there has been minimal impact on the sector.

Figure 3 Source: Factset, Milford

Figure 3 Source: Factset, Milford

Overall, the outlook for the NZ travel sector has become a lot brighter with vaccination programs underway and Trans-Tasman travel reopened. While travel across the Tasman is still at low levels, the bubble is an important development for the sector and will greatly reduce the cash burn and balance sheet pressure of travel companies such as Auckland Airport and Air New Zealand. While the outlook for travel has improved, this has been reflected in the valuations of many travel companies which in aggregate have recovered towards pre-pandemic levels. Despite this we still see opportunities in the sector to select quality companies that offer solid return prospects relative to their risks.