Updated: April 2022

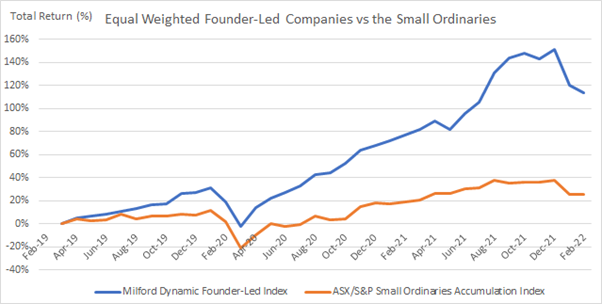

As Portfolio Manager of the Milford Dynamic Fund my focus is on smaller companies, and one of the consistent themes I’ve witnessed over the years is that founder-led, family-linked or employee-owned businesses often have an exceptional track record of outperformance. In August last year we analysed the performance of these businesses against the broader market index. The results were stunning. The founder-led portfolio returned 41% p.a. over 3 years against the S&P/ASX Small Ordinaries index return of 9.2%, an outperformance of 31.7%! Eight months on with a more volatile market landscape, it’s a good opportunity to revisit the results.

The Dynamic fund currently has around 27% of the portfolio invested in founder-led or family-linked businesses, 2% higher than when we last reviewed. Some of these companies include the likes of Simon Henry’s DGL Group (DGL.ASX), Jamie Pherous’ Corporate Travel Management (CTD.ASX) & Ryan Stokes’ Seven Group (SVW.ASX).

The data again confirmed why we love founder-led companies. The 3 year performance of the founder-led portfolio to March 2022 (18 companies) was 30.5% p.a. against the ASX/S&P Small Ordinaries index return of 9.6%, an outperformance of 20.8% p.a.!

Why is this so?

Companies with a founder who owns a material stake and who is still actively engaged in the business can often think and act differently to companies run by professional managers. So why do founder-led, family-linked or employee-owned companies deliver performance over the long term? We have identified 3 key differentiators:

i) Long term mindset

Founders are looking at establishing the business in a multi-generational timescale. According to a 2018 report by PWC strategy consulting arm Strategy&, the average tenure of a CEO in Australia is only five years. This is not a very long time to grow and develop a company. Incentives are also typically associated with earnings performance over shorter time periods (1-3yrs), which can encourage management to focus on short term outcomes over positive long term shareholder returns.

ii) Skin in the game

We believe having a founder’s money next to ours is very powerful. This makes for a real alignment of interests. I’m sure you’ve heard the saying, ‘no one works as hard as the owner’. Where professional managers come and go over time, it’s the founder who is there, and leading it toward success. These founders derive meaning from the challenge, identity, ethos of their work and not necessarily form the incentive package the boards remuneration committee has devised for them. It’s this commitment that often leads to remarkable levels of performance.

iii) Soul in the game (emotional investment)

Founders often bring a passion to business. They are building a legacy, which requires long term thinking. The most underestimated attribute we find is the broader love of the business and the intent to continue the success they’ve had into the future. As Warrant Buffet says, “We’ve had terrific luck with the entrepreneurs who basically love their businesses the way I love Berkshire.”

I believe that Milford shares many of the same attributes I have discussed. One of our core values is to align our success to the performance of our clients’ capital. As a company, Milford is majority staff & board owned and staff are only able to invest in Milford or its funds.