In KiwiSaver you can elect to contribute 3%, 4% or 8% of your gross salary directly into your KiwiSaver account, as well as additional voluntary contributions.

The IRD does not publish stats on KiwiSavers’ contribution rates, but we estimate that the majority of people are only contributing the minimum 3%.

3% of your salary is not a lot. Of course not everyone’s primary retirement savings are via KiwiSaver, but if yours are, will contributing only 3% of your salary be enough to fund the retirement you’ve dreamed of?

Contributing just 1% more to your KiwiSaver is a very simple change that can make a significant difference to your retirement and ultimately your lifestyle. There are other benefits as well, such as:

It’s automated.

The beauty of KiwiSaver is that it turns saving into a simple automated process. KiwiSaver requires almost no discipline and that’s great! Because for most of us, making plans to save is a lot easier than actually executing that plan. To increase your KiwiSaver contributions, you simply tell your employer to adjust it.

Increases your future income.

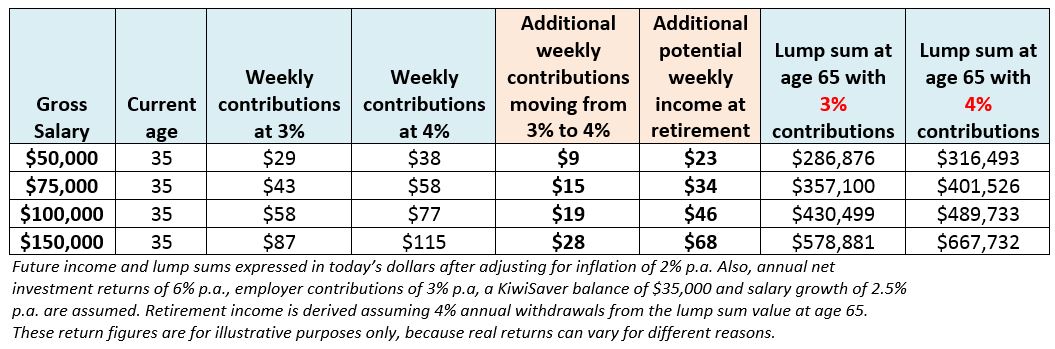

Before you can save more, you need to determine if you can afford it. The table below shows that the difference between contributing 3% and 4% may not be as large as you think and the payoff in terms of additional income at retirement is substantial.

Putting away a little more today, should create much more income in the future:

Compounding returns.

In the above example, the investor’s net annualised return on investment was just 6% p.a. But after years of compounding, that original $1 of income forgone today turned into over $2 of additional retirement income at age 65, and that’s after accounting for inflation, or in other words a real return on investment of over 100%!

Buy shares at lower prices during market downturns.

It’s always nice to buy when things are on sale. Trying to time the market is very difficult, and many are too scared to invest when markets are going backwards. KiwiSaver takes out the guess work because you’re contributing regularly. Therefore, when markets pull back you will be buying units at lower prices.

Your employer may match you.

Employers must contribute a minimum of 3% of your gross salary to KiwiSaver. However, check with your employer, because some choose to match your contributions up to a certain level. If they’ll match you up to 4% for instance, you’d be giving yourself a pay rise.

Our free Retirement Planner can help show the effect increasing your contributions can have on your own KiwiSaver by age 65.

Before making any decisions, you should always assess your own financial position carefully and if you’re unsure, seek financial advice.

But one thing is very clear, simply telling your employer to increase your KiwiSaver contributions, even by just 1%, can help create a more comfortable retirement.

Sean Donovan

KiwiSaver Associate

Disclaimer: This article is intended to provide general information only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to an Authorised Financial Adviser.