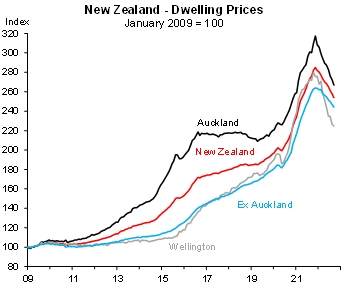

From the peak (Nov 21), the New Zealand house price index (HPI) has fallen 12% overall for NZ, with large centres Auckland down 16% and Wellington down 20%. Most other NZ regions have averaged 8-10% falls.

Source: Macrobond, REINZ, Macquarie Macro Strategy

Despite the sharp falls in house pricing over the past year, there are still several variables leaning negative in the residential housing market:

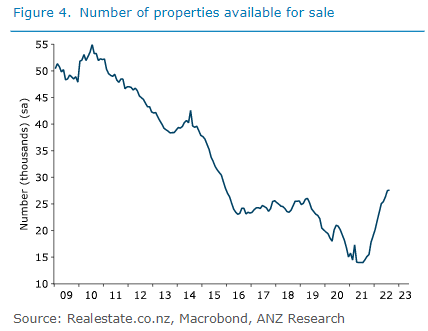

- The number of properties available for sale is at a 6-year high; this is before the more seasonally active spring and summer period for housing sales.

- From the August REINZ data, days to sell a property have increased to 49 days, the highest level since 2008 (ex-Covid lockdowns).

- Auckland realtor Barfoot & Thompson’s auction clearance rates are at multi year lows, hovering around 20% – 30% clearance monthly (down from almost 80% clearance during the peaks).

- With increasingly hawkish central bank commentary and outlooks, the main retail residential lenders have further increased their mortgages rates over the past few weeks. Rates across NZ mortgage maturities are well over 5% on average and in places over 6%.

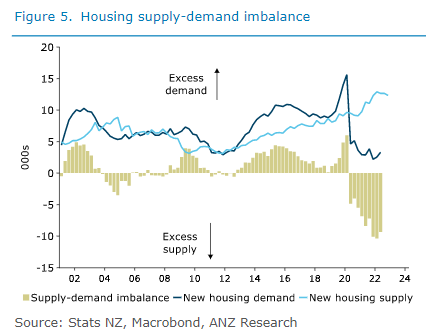

- Migration is unlikely to positively contribute to the same level of potential growth as the pre-Covid period under current immigration policy settings.

- New housing continues to catch up and arguably now outpaces demand, meaning the ‘housing deficit’ could be eroding. This increased new supply could provide an anchor on future house price rises.

The above said, due to the strong labour market and build-up of savings during the Covid period there is no panic evident among homeowners and limited evidence of distressed selling. This is creating a more orderly fall in house prices.

Impact on Retirement Village (RV) operators

The financial performance of listed retirement village operators in New Zealand has traditionally had linkage to national house prices. In short, a more buoyant housing market increases the selling price of village units. This creates increased profits for village operators through higher new unit development margins and higher current unit re-sale margins.

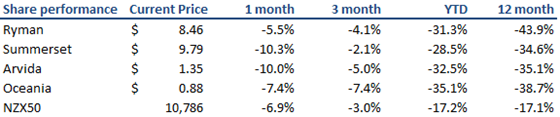

As can be seen from the table below, listed RV operators have had a tough last year with both the reduced market multiple and negative housing outlook weighing on share prices.

Source: Factset

The RV industry is in a structural growth position with the ageing NZ population and the increasing appeal of villages to retirees. Clearly, short-term housing prices are affecting RV share prices; however, from our conversations with RV management teams, and from recent financial results, unit sales, pricing, margins and demand are all still performing strongly. There are also arguments that Covid has further accelerated village adoption and increased demand from potential new residents.

RV share prices have fallen further than the residential property market; perhaps the NZ stock market is already assuming the worst in its outlook for NZ housing.