To say the US-China relationship has devolved over the past several years is a grand understatement. The two superpowers are in a technological cold war and the most strategic asset is the humble semiconductor chip. In October, the US expanded its export controls to ban the sale into China of leading-edge AI and supercomputing chips, US-made wafer fab equipment (WFE) for manufacturing leading-edge chips, and prohibited US persons from assisting in the design and production of Chinese WFE. But even before this recent escalation, the path to semiconductor independence was already a strategic priority for both the US and China.

It is not hard to understand why the US specifically and the West generally are concerned with the current state of the global semiconductor supply chain. Taiwan controls around 50% of global foundry capacity and TSMC, the world’s largest foundry, controls the substantial majority of leading-edge capacity required to manufacture the most advanced chips. Korea and Japan control around 13% of global capacity, with Samsung the only other leading-edge foundry globally. All three geographies sit within a few hundred kilometres of Mainland China. China itself controls a further 25% of global capacity at the mature nodes.

The US, meanwhile, is the largest consumer of semiconductors globally yet hosts less than 5% of global foundry capacity. While Intel has numerous fabrication facilities across the US, it has fallen behind TSMC and Samsung at the leading-edge nodes, and its internal foundry capacity is only now being opened to external customers.

What policies are being implemented?

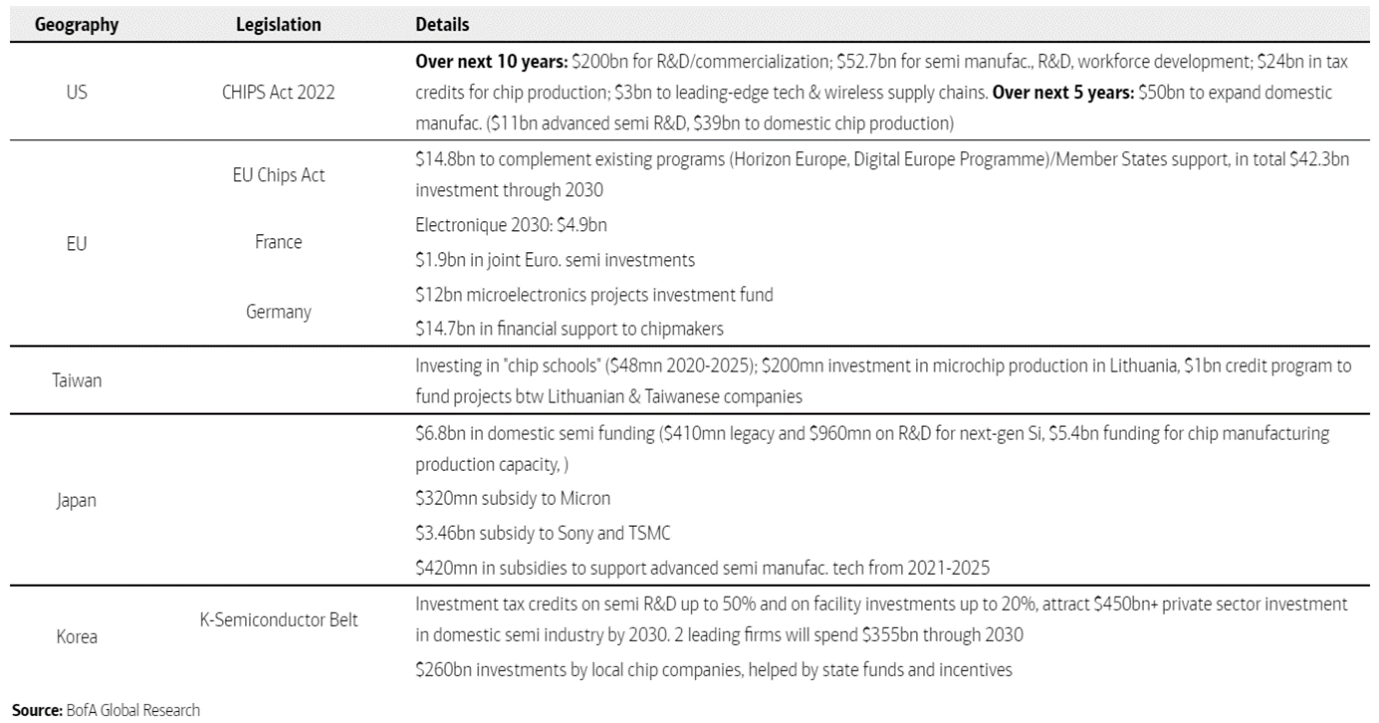

As it becomes clear to Western countries that having all leading-edge foundry capacity concentrated on China’s doorstep is strategically untenable, governments have been announcing policies and funding to secure domestic semiconductor capabilities. Over US$100 billion in government incentives have been announced globally over the past two years to help fund domestic semiconductor manufacturing projects over the next decade.

The US CHIPS Act allocates US$50 billion over five years to add resiliency to the US domestic semiconductor ecosystem, with US$39 billion earmarked for manufacturing incentives and US$11 billion for advanced semiconductor R&D programmes. The EU Chips Act allocates US$15 billion to fund public/private semiconductor investments with a goal of doubling Europe’s foundry market share by 2030. Japan’s public funding similarly has a goal to triple semiconductor revenue by 2030.

How are semiconductor companies responding?

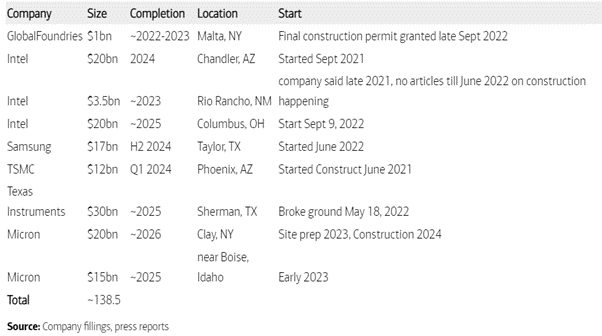

Starting with TSMC in May 2020, semiconductor companies have announced nearly US$140 billion of capacity expansion plans in the US alone, with scope to increase to more than US$300 billion over the long term. The Intel, TSMC and Samsung fabs will have leading-edge process nodes and manufacture chips for AI, high-performance computing, 5G and mobile applications.

European chipmakers are also investing in local capacity expansion, with Infineon’s announcement of a new EUR5 billion fab in Germany the most recent.

Implications for investors

Given the increasing complexities of semiconductor manufacturing, capex intensity is clearly on the rise and especially so with localisation efforts that diversify away from current efficient manufacturing clusters (e.g. Taiwan). This will be a clear tailwind to the WFE vendors such as ASML and Applied Materials, as structural demand for WFE should remain elevated for years to come. The increase in equipment demand from reshoring should also help mitigate demand headwinds from the recent US export restrictions against China.

Other companies that Milford believes will benefit from semiconductor reshoring (and reshoring generally) include building materials and aggregates suppliers that participate in these large construction projects, and niche stocks such as WillScot Mobile Mini, a company that leases modular workspaces and portable storage containers to big projects such as those being targeted by the US Infrastructure Act, the CHIPS Act and the Inflation Reduction Act.

Reshoring of the global semiconductor supply chain

To say the US-China relationship has devolved over the past several years is a grand understatement. The two superpowers are in a technological cold war and the most strategic asset is the humble semiconductor chip. In October, the US expanded its export controls to ban the sale into China of leading-edge AI and supercomputing chips, US-made wafer fab equipment (WFE) for manufacturing leading-edge chips, and prohibited US persons from assisting in the design and production of Chinese WFE. But even before this recent escalation, the path to semiconductor independence was already a strategic priority for both the US and China.

It is not hard to understand why the US specifically and the West generally are concerned with the current state of the global semiconductor supply chain. Taiwan controls around 50% of global foundry capacity and TSMC, the world’s largest foundry, controls the substantial majority of leading-edge capacity required to manufacture the most advanced chips. Korea and Japan control around 13% of global capacity, with Samsung the only other leading-edge foundry globally. All three geographies sit within a few hundred kilometres of Mainland China. China itself controls a further 25% of global capacity at the mature nodes.

The US, meanwhile, is the largest consumer of semiconductors globally yet hosts less than 5% of global foundry capacity. While Intel has numerous fabrication facilities across the US, it has fallen behind TSMC and Samsung at the leading-edge nodes, and its internal foundry capacity is only now being opened to external customers.

What policies are being implemented?

As it becomes clear to Western countries that having all leading-edge foundry capacity concentrated on China’s doorstep is strategically untenable, governments have been announcing policies and funding to secure domestic semiconductor capabilities. Over US$100 billion in government incentives have been announced globally over the past two years to help fund domestic semiconductor manufacturing projects over the next decade.

The US CHIPS Act allocates US$50 billion over five years to add resiliency to the US domestic semiconductor ecosystem, with US$39 billion earmarked for manufacturing incentives and US$11 billion for advanced semiconductor R&D programmes. The EU Chips Act allocates US$15 billion to fund public/private semiconductor investments with a goal of doubling Europe’s foundry market share by 2030. Japan’s public funding similarly has a goal to triple semiconductor revenue by 2030.

How are semiconductor companies responding?

Starting with TSMC in May 2020, semiconductor companies have announced nearly US$140 billion of capacity expansion plans in the US alone, with scope to increase to more than US$300 billion over the long term. The Intel, TSMC and Samsung fabs will have leading-edge process nodes and manufacture chips for AI, high-performance computing, 5G and mobile applications.

European chipmakers are also investing in local capacity expansion, with Infineon’s announcement of a new EUR5 billion fab in Germany the most recent.

Implications for investors

Given the increasing complexities of semiconductor manufacturing, capex intensity is clearly on the rise and especially so with localisation efforts that diversify away from current efficient manufacturing clusters (e.g. Taiwan). This will be a clear tailwind to the WFE vendors such as ASML and Applied Materials, as structural demand for WFE should remain elevated for years to come. The increase in equipment demand from reshoring should also help mitigate demand headwinds from the recent US export restrictions against China.

Other companies that Milford believes will benefit from semiconductor reshoring (and reshoring generally) include building materials and aggregates suppliers that participate in these large construction projects, and niche stocks such as WillScot Mobile Mini, a company that leases modular workspaces and portable storage containers to big projects such as those being targeted by the US Infrastructure Act, the CHIPS Act and the Inflation Reduction Act.

Milford on Newstalk ZB: 27 August 2025

Read MoreMilford on The Hits: 27 Aug 2025

Read MoreEP46: Are Trump’s tariffs hitting consumer pockets yet?

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.