2022 has brought with it significant volatility in global share markets. This has been driven by a multitude of factors including: rising inflation; rising interest rates; exchange rate volatility; and geo-political uncertainty. Going forward, the economic outlook remains uncertain, and a 2022/23 recession is a real possibility. Given this, investors have been looking for ‘safe-havens’ which can still do well in this environment.

A sector fitting this bill is the biopharmaceutical (biopharma) sector. Unfortunately, disease and illness stop for no-one. This means that the revenue stream generated through these companies selling medicines remains relatively robust irrespective of where we are in the business cycle. One driver of share prices is earnings expectations and if we look back to the Global Financial Crisis in 2008 and subsequent recession, volatility seen in biopharma share prices was lower.1 Moreover, forward looking revenue estimates for biopharma remained comparatively flat over mid-2008 through to the end of 2009, while revenue estimates for S&P500 stocks fell ~18% over the same period.2 Biopharma can provide defensiveness in periods of broad macro volatility, and so far in 2022 it has proven so once again.

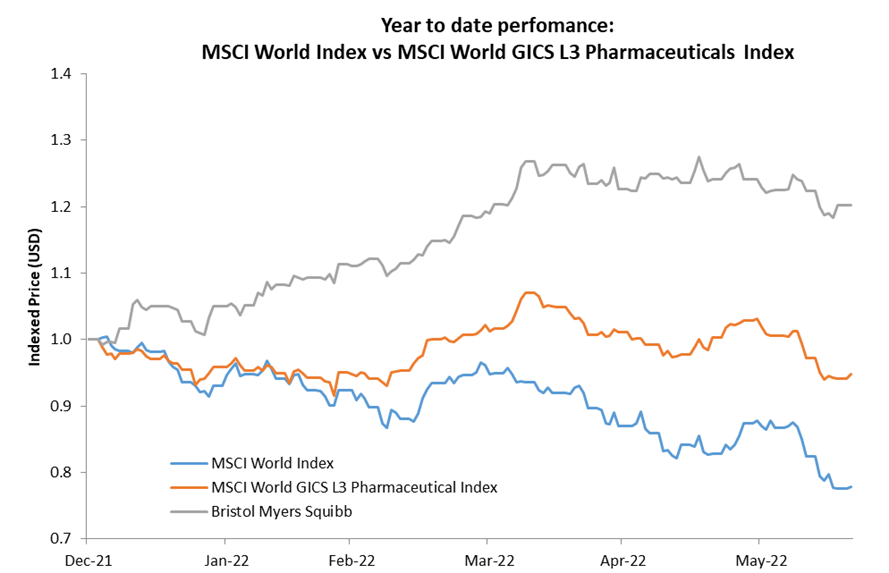

Source: Bloomberg as at 21 June 2022.

Over time, there have also been a number of fundamental changes that make biopharma a more attractive industry to invest in, relative to what it has been in the past:

- Drugs in clinical trials have a higher probability of success. The US Food & Drug Administration (FDA) approval rate of medicines has improved over time – the 3-year average approval rate for new drugs is now ~88% compared to 2018 when it was only 45%.3 This has been driven, in part, by improved FDA funding allowing the FDA to work more closely with companies leading up to approval, allowing tweaks to be made earlier in the process. By the time a drug approval application is submitted, the probability of success is much higher than previously meaning binary event risk is now overall lower for investors.

- Earnings are more diversified. A large focus of investors in biopharma companies is the ‘patent cliff’ or ‘loss of exclusivity’ that inevitably occurs for each drug, which limits the life cycle of most drugs to ~10-15 years. To limit the impact of any one loss of exclusivity event, over the last decade large biopharma companies have significantly improved their diversification, thus reducing the overall impact from any one loss of exclusivity event.

- Increasing sales of biologics create more durable revenue streams. The past decade has seen a rise of biologics which can be thought of as human made proteins or large molecule drugs. These have almost doubled as a proportion of global pharma sales, to ~42% of global sales in 2021.4 Biologics do not face the same cliff-like revenue erosion that we see with small molecule drugs when they come off patent because while branded and generic small molecule drugs are interchangeable, biosimilar versions of biologics are highly similar but not identical.

One company in this space that is of interest to us is Bristol Myers Squibb (BMY US). It is a good example of a large pharma company that has been diversifying by both disease area and drug modality over time, and currently has 8 main products across 4 therapeutic areas (oncology, haematology, cardiovascular & immunology). In the near term, BMY is facing revenue headwinds, with upcoming ‘loss of exclusivity’ events set to impact its pricing power. These have dented investor confidence and created an overhang for the stock and it currently trades on just 9 times 2023 forecast earnings. However, offsetting this, BMY has a full late stage and new product portfolio of medicines coming through the approval process. Successful trial readouts and new product approvals underpin the potential for earnings upgrades and multiple expansion. If you refer back to the chart above, you can see that BMY has significantly outperformed the MSCI World Index this year.

Despite its defensive characteristics, investing in Biopharma is not without risks and in recent weeks talk in the United States of a Reconciliation Bill that includes Drug Pricing Reform has resurfaced. Currently, potential changes include Medicare renegotiation of prices on a select number of drugs each year from 2025; and caps on annual pricing increases for drugs. We believe this will prove manageable for the industry, but it remains a risk that we are monitoring, as we continue to hunt for companies that can perform well in what is a very challenging macroeconomic environment.

References:

1 BOA US Biopharmaceuticals Industry Report, June 2022.

2 Bloomberg. S&P500 forward looking revenue estimates fell -17.7% over 30 June 2008 to 31 December 2009, compared to the DRG Index (NYSE Arca Pharmaceutical Index) falling -2.7%.

3 Redburn Investing in Pharma Report, September 2021.

4 Redburn Investing in Pharma Report, September 2021.