In a previous blog, I looked at the ranking of the world’s biggest companies and how they had changed dramatically over the last decade. As we start the 2020s, let’s take time to reflect on the previous decade and what worked well in the 2010s. Before I do, it’s worth mentioning the 1990s and the 2000s (noughties).

World’s best performing shares in the 1990s?

When I started out my investment career in the 1990s, it was the decade for the internet/technology companies (so called “dotcom bubble”) with US technology giant Microsoft, one of the best performing companies in the world. That was my first taste of “greed” in share markets. Investors wrongly assumed every company with “.com” in their name was going to be worth billions one day. In those days, caution was thrown to the wind and speculation in shares was rife, with little attention given to valuations. Unfortunately, boom turned to bust and to this day, one company epitomises the “bubble” of those times: Pets.com, an online retailer for pet food. Ironically, if they had launched the company 10 years later things may have been different given the pet spending boom (look at Chewy and Pets at Home). However, with a catchy marketing campaign revolving around the dog puppet (see below), Pets.com was a hot share, hitting a high of US$14 before crashing to about US$1 only 5 or 6 months later1. You could argue investors in Pets.com were “barking mad”, but bubbles are nothing new in share markets.

2000s (noughties decade)?

In the 2000s, it was emerging market shares (China, India, Brazil etc.) who were the market darlings, significantly outperforming the developed markets (US, Europe, Japan etc.). China’s admission to the World Trade Organisation in 2001 and the economic boom that followed in China and other emerging markets was the key catalyst for the outperformance. Developed markets underperformed as they were still recovering from the dotcom bust, and later in the decade, the GFC took its toll. For example, emerging markets returned over 164% in US dollars in the 2000s, while the S&P 500 (500 largest companies in the US) returned -9%.

The best performing emerging market shares in the 2000s were dominated by commodity shares, as China’s infrastructure boom relied on vast amounts of commodities. Indian commodity producer Vedanta was the best mainstream share, generating a total return over the decade of 18,239% in US dollars, a return of 182.2 times. To be clear, if you invested US$1,000 in Vedanta at the 31st Dec 1999 and held it for 10 years, your investment would be worth US$182,200.

World’s best performing shares in the 2010s?

The last decade has been dominated by US technology companies, with Netflix, Amazon, Facebook and Alphabet (changed name from Google) some of the best performers. In contrast, emerging market shares had a dreadful decade. One observation from my research is, what worked in the last decade doesn’t tend to be the best performer over the next decade.

But what has been the best performing share in the world over the last 10 years?

In the table below, I show the best performing companies (in NZD) over the last decade in the MSCI World (comprises about 1,655 companies of the 630,000 listed companies globally)2.

Can you believe our very own a2 Milk was the best performing company, up 175.7 times over that period? Hats off to our New Zealand investment team for getting in early, as NZ$1,000 invested in a2 Milk at the 31st Dec 2009 would now be worth NZ$175,705 at the end of the decade. For me, a2 Milk is another example of New Zealand punching above its weight, not just on the sporting field but also in creating world class companies. Think of Xero, Fisher & Paykel Healthcare etc.

And who said there was no money in selling low cost pizzas? Domino’s Pizza was up over 43 times in the last decade.

Source: Bloomberg

For completeness, I have reviewed the best performing companies by country as well.

USA 2010s?

Below, I have listed the best performers of the 500 largest US companies. The best performer, streaming company Netflix, is likely to be known by many of you. Over the last decade, in New Zealand dollars, Netflix shares surged over 43 times. In 2010, Netflix had 12 million subscribers and produced no content but today Netflix has over 158.3 million subscribers and is now producing more original content including recent successes, The Irishman, Marriage Story and The Two Popes. Netflix is forecast to spend over NZ$26 billion on content in 2020 (combination of Netflix originals and buying third party content)1.

Many of the other best performers are not household names but special mention to Align Technology up 16 times over the last decade. Align Technology is the creator of clear aligners (an alternative to braces) for your teeth, a great product in my opinion.

Source: Bloomberg

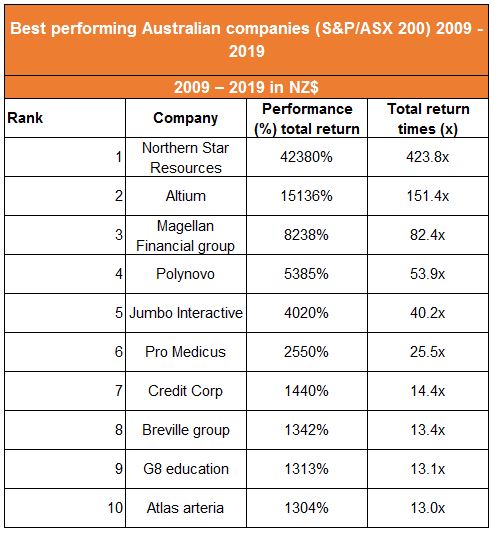

Australia 2010’s?

Closer to home, the best performers in Australia touch on several different industries, including gold mining, asset management, home appliances, and toll roads.

The star of the show was Northern Star Resources, an Australian gold miner. I had to triple check these returns, as Northern Star Resources was up over 423 times in New Zealand dollars in the last decade. Can you believe NZ$1,000 invested in Northern Star Resources at the 31st Dec 2009 would now be worth NZ$423,800 at the end of the decade? That’s what I call a “pot of gold”.

Source: Bloomberg

New Zealand 2010’s?

Finally, to our home market, if you missed out on a2 Milk there is no use “crying over spilled milk” because there were several other companies that generated stellar returns in New Zealand. For example, Restaurant Brands was up almost 15 times over the last decade, and transport company Mainfreight was up over 9 times. The point to make here is that you don’t have to chase high flying sectors like software companies to generate fantastic returns, just keep it simple. Focus on companies that sell everyday products like milk and burgers and you will do just fine.

Source: Bloomberg

What about the 2020s?

Crystal ball gazing time, my hunch is that the best performers over the next decade will be companies that are doing good while making money.

So, companies that provide benefits to our society and the environment, are likely to be the winners. For example, healthcare companies that reduce the cost of cancer treatments and increase the probability of being cured, or companies that in some way address climate change.

Over the Christmas period, I was driving down the West Coast in New Zealand and was horrified to see the sun covered in an orange haze from the devastating bush fires in Australia. I know some prominent politicians are in denial, but explain to me what is causing the Scottish Highlands to reach 18.7 degrees Celsius on the 31st December 2019? It was 13 degrees in Hokitika! We need to urgently start looking after this planet; as Christine Lagarde (European central bank president) said, this is “mission critical”.

Source: 1CNN Money, 2Investopedia, 3BMO Capital Markets.