One source of ongoing uncertainty about the economic outlook is the behaviour of the consumer. There is no doubt the current stream of news we are seeing is increasingly negative; inflation is surging, mortgage rates are rising, and house prices are falling. But how bad is it going to get for the consumer?

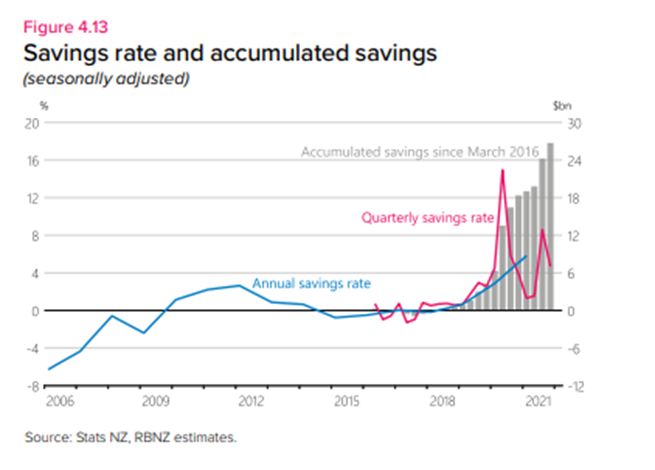

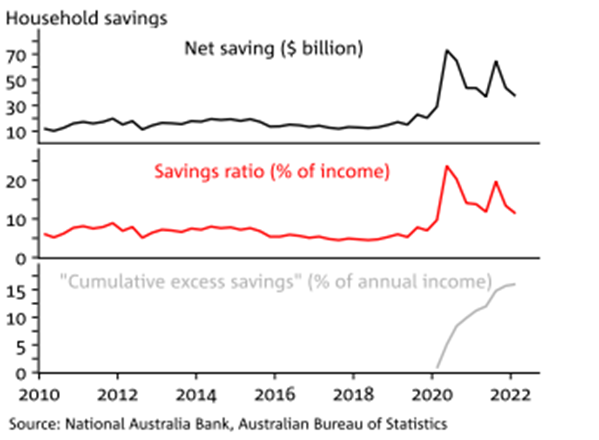

Fortunately, the starting position is reasonably strong. Pre-covid, the savings rate in New Zealand was remarkably low at about 0.7% of disposable income in 2019, however built-up savings during lockdowns saw the consumer balance sheet strengthen, with the savings rate rising to around 4.7% in December 2021 (Chart 1). There is no doubt some of this has been spent after a period of generally rising prices, but for the time being savings are still providing some support to offset the higher costs being faced. In Australia, we are already seeing signs of these savings being spent, with the savings rate for March 2022 falling to 11.4% from 13.4%.

Chart 1: NZ Savings rate and accumulated savings

Source: RBNZ

Chart 2: Australia Household Savings

Source: NAB, ABS

The employment market in New Zealand and Australia is also incredibly strong. The unemployment rate in New Zealand is 3.2%, the lowest recorded since the Household Labour Force Survey (HLFS) series began in 1986, while the unemployment rate in Australia is 3.9%, the lowest since 1974. One implication of such a strong labour market is surging wage inflation, with average hourly earnings increasing 4.8% in New Zealand in the year to March 2022, while wage growth in Australia was a touch softer at 2.4%year on year. Anecdotally, we have been hearing of wage growth much larger than this to attract workers, so this has thus far helped in offsetting inflation impacts on consumer finances.

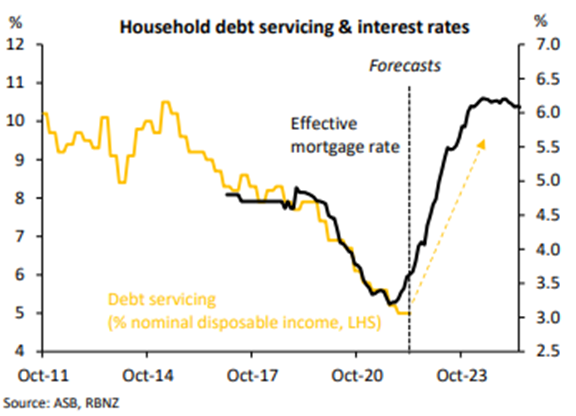

However, despite these factors, there are looming headwinds. Mortgage rates are rising at the fastest pace in 20 years, with the 2-year fixed rate in New Zealand rising from 2.82% in July last year to around 5.92% today. ASB estimate this increase could add $5.6bn to household outgoings by the end of 2023. In addition, inflation impacts are seeing kiwis paying more for everyday items like groceries and petrol, which ASB expects will add a further $10bn to household outgoings. In Australia, a similar negative impact is expected because of higher interest rates and inflation, with NAB forecasting that a 2% rise in interest rates could result in a 2% reduction in household disposable income. This would be in addition to the 2% fall we have seen in Australian household disposable income over the last 2 quarters as a result of high levels of inflation.

Chart 3: NZ Debt servicing and interest rates

This negativity is being reflected in consumer confidence surveys, with the Westpac McDermott Miller Consumer Confidence index falling in June to the lowest level since the series began in 1988. Clearly, consumers are already fearing these impacts. So where to from here?

We think that unemployment will remain low for the rest of the year in both New Zealand and Australia, which will likely support wage growth in the short term and, to an extent, will help offset higher household outgoings. However, the drawdown of excess savings will continue, and the longer inflation remains elevated, the harder it will be for consumers to keep up.

In the coming months, the consumer will likely struggle to maintain spending levels as savings get drawn down, inflation remains elevated and higher mortgage costs are felt. However, early next year there may be some relief as inflation starts to wane and interest rate rises end. We will be watching closely the evolution of inflation and how Central Banks respond in the coming months for any sign that light is forming at the end of the tunnel.