If your only retirement savings are in KiwiSaver and you’re contributing the minimum amount, you may not be saving enough. The minimum contribution rates are 3% for an employee and 3% for the employer, minus the tax paid on your employer’s contribution, meaning in total you’re only contributing between 5-6% of your gross salary each year.

Will that be enough to fund the retirement you want?

KiwiSaver is still relatively new, so it’s always interesting to look at how other countries approach retirement savings contributions.

In Australia, your employer contributes 9.5% on top of your annual salary to your Super account and you can make voluntary contributions as well. In Canada, you can choose to contribute up to 18% of your pre-tax annual earned income, up to a maximum of about $25,000 per year. In the US, you can contribute a maximum annual pre-tax contribution of $18,000 to your 401(k) retirement savings plan with employers usually matching a certain amount and in the UK you receive tax relief on contributions up to 100% of your earnings capped at a whopping £40,000 annually. These are all slightly different approaches but two clear benefits of each are:

- Your contributions reduce your annual income tax and

- You choose how much you contribute (in some cases up to a maximum)

In KiwiSaver, your contributions do not reduce your income tax, however you do choose how much to contribute. Unfortunately, not enough people realise that contributing only 3% of your salary may not be enough.

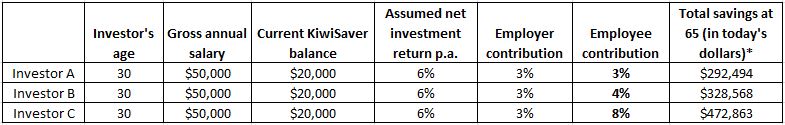

Here’s a look at three different investors, all their personal and investment details are the same except for their contribution rate.

*Assumed 2% inflation and 2% wage growth.

*Assumed 2% inflation and 2% wage growth.

As you can see from the table, your contribution rate will significantly impact the size of your savings. Doing a bit more may be more affordable than you think too. For this investor the difference between contributing 3% and 4% works out to less than $10 per week from their payslip. Every person’s “right” contribution rate will be different, so have a plan and consider the link between your contribution rate and the type of retirement you want to have.

Sean Donovan

KiwiSaver Associate

Disclaimer: This blog is intended to provide general information only. The information presented does not take into account the investment objectives, financial situation and advisory needs of any particular person, nor does the information provided constitute investment or financial advice. Under no circumstances should investments be based solely on the information provided. Should you require financial advice you should always speak to an Authorised Financial Advisor.