The term ‘diversification’, in a financial context, is commonly understood as the generations-old adage our grandparents used to tell us: “don’t put all your eggs in one basket”. Periods of share market volatility like we are experiencing currently due to the reaction to COVID-19 remind us of the wisdom of that advice.

Modern Portfolio Theory is also nothing new – Nobel Prize winning economist Harry Markowitz first published his often-cited paper “Portfolio Selection” in the Journal of Finance in 1952. The theory is based on getting the appropriate tradeoff between risk and reward, and reducing risk through diversification, by selecting assets with a low correlation (where one affects or depends on the other) to each other in terms of their risk attributes. It is important to remember that “risk” to these academics means volatility, or changes in the price of an asset.

History shows that a well-diversified portfolio spread across many different asset classes and geographic regions (eggs spread across many baskets), will generally experience lower volatility, or fluctuations in value, because the different asset classes tend to behave differently during different stages of the economic and market cycle. This smooths out the peaks and troughs of investment returns over time.

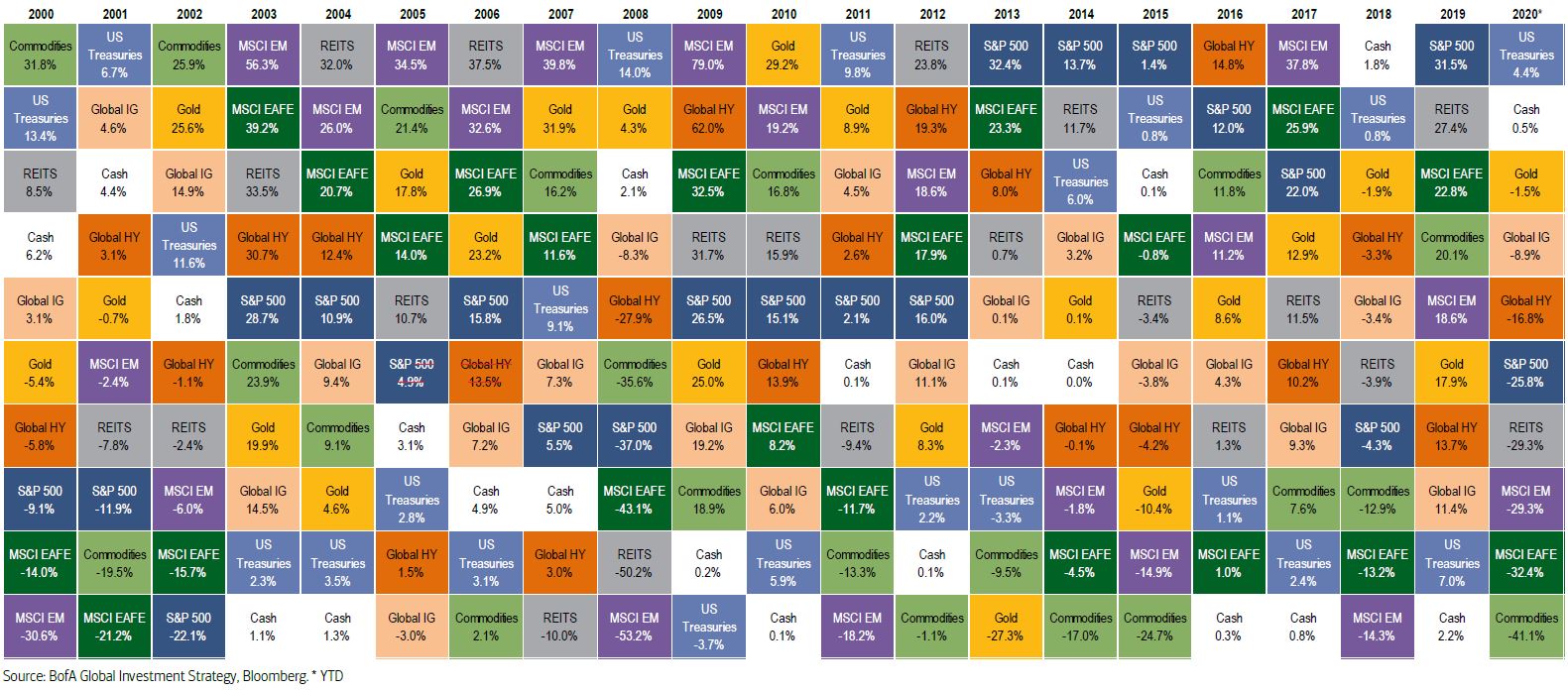

The below table shows the total returns, ranked from best to worst, of several major asset classes across the risk/return spectrum – from the perceived safe haven assets like US Treasury Bonds and Gold, through to the more speculative Commodities and Emerging Markets equities. It covers the period from January 2000 to the 12th of March 2020 – about three weeks into the Coronavirus-driven market sell-off.

What this table shows us is that the best-performing asset classes one year, could be the worst performing the following year– and vice-versa. Having investments concentrated in one or a few of these asset classes, particularly the more speculative ones, would undoubtedly give investors a sense of euphoria when markets favour those assets. But also sleepless nights in times when those assets are falling, tempting the uninitiated investor to drop the basket and break grandma’s eggs by selling during the downturn and realise a loss.

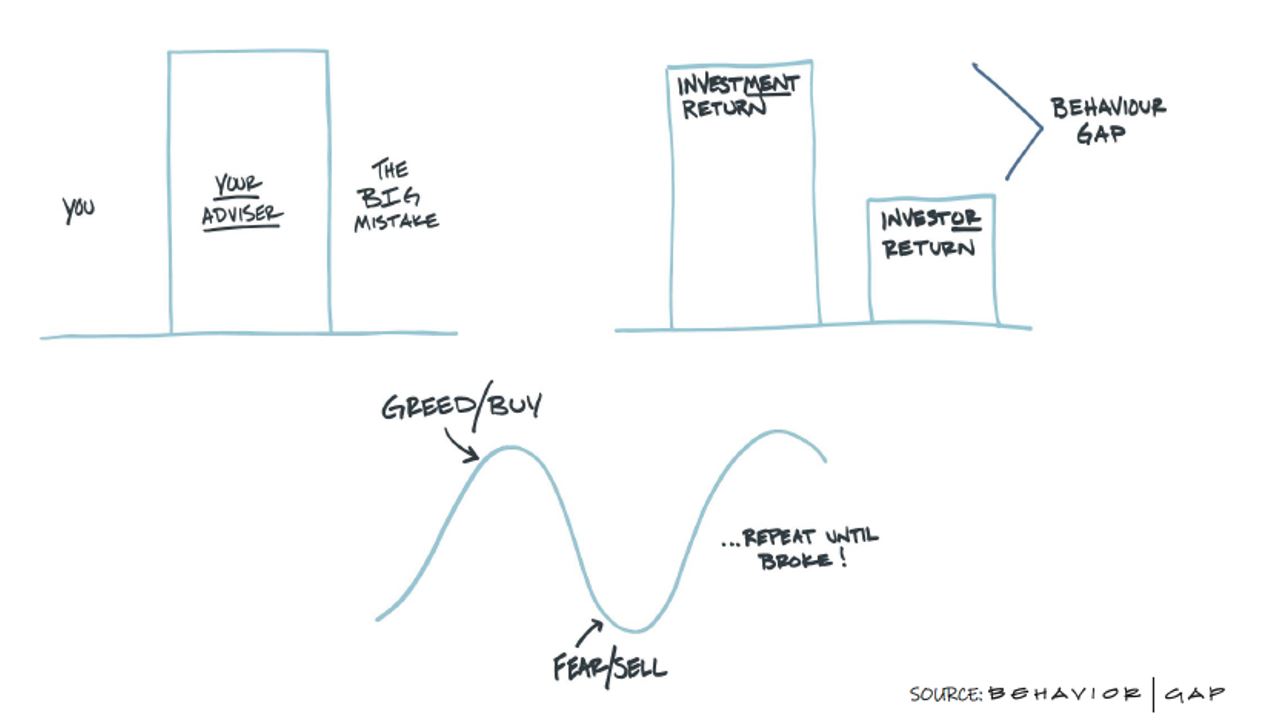

This point also highlights the importance of obtaining financial advice from a qualified adviser, part of whose role it is to stand in between the client and a financial mistake based on human nature and the emotions of fear and greed. A common mistake is for investors to be driven by greed, and to invest in assets that have had a strong recent return. But they often join the rally too late, and when the cycle turns and that index falls, they are driven by fear to sell at a low point, and realise the loss. In other words, they buy high, and sell low – which is the exact opposite of how investing is supposed to work. This is illustrated in the diagrams below.

Warren Buffett, arguably the world’s greatest investor, famously said it is wise for an investor to “be fearful when others are greedy and greedy when others are fearful”, but all too often individual investors succumb to the emotions of fear and greed and make unwise investment decisions. A financial adviser can help keep those emotions in check, but also take a lot of the fear out of investing by constructing a well-diversified portfolio which holds up better in tough markets than a concentrated investment in growth shares or aggressive funds might do.

All of Milford’s funds, both Investment Funds and KiwiSaver, are actively managed, and many are ‘diversified funds’, spread across several asset classes. Some of our funds behave differently in the same market conditions, and some will be more closely correlated to the market than others. Investors need to be mindful of that when investing in funds, as well as the minimum recommended investment periods for the funds you’re investing in.

Milford Private Wealth’s Advised & Managed service* offers both personalised financial advice to ascertain the goals, financial circumstances, preferences and appropriate level of risk for an individual, but also access to one of five managed portfolios, ranging from Conservative to Growth. Each are made up of 12 or more different funds investing in multiple asset classes and geographic regions – thus the investor’s eggs are spread across many baskets, in the right proportions for their individual goals and attitude to risk.

Clients in diversified funds and this latter service have experienced a smoother investment return, proportionate to their individual investment horizon and risk profile, relative to markets generally and have endured recent downturns in markets such as late 2018 and so far in early 2020 relatively well. Such funds and managed portfolios have a long track record of capturing a good deal of the upside of markets, but not capturing all of the downside – relative to their respective exposures to shares – reducing the downside risk for investors, helped by selective diversification.

Quality advice and effective risk-reduction through diversification often go hand in hand. Turns out Grandma was right, all along.

* Minimum investment for Milford Private Wealth $500,000 – portfolio management fee applies for Advised & Managed service