The first half of the year has been very tumultuous for investors across the board, there is no other way to say it. Due partly to the conflict in Europe, inflation running hot globally and interest rates beginning to rise, volatility has come back to the financial markets in a big way. Investors around the world are looking to central bank messaging for any indication as to the path ahead for interest rates. Too hard and fast could hurt the economy, however, too slow and prices could rage out of control. Central Banks are in a difficult situation, presently performing a meticulous balancing act.

An unfortunate consequence of the expectation of rising interest rates is that conservative investors, investing primarily in bonds, have experienced high levels of volatility. So much so that their experience has been similar to that of equity investors so far in 2022. There’s a good chance that this will have taken many by surprise.

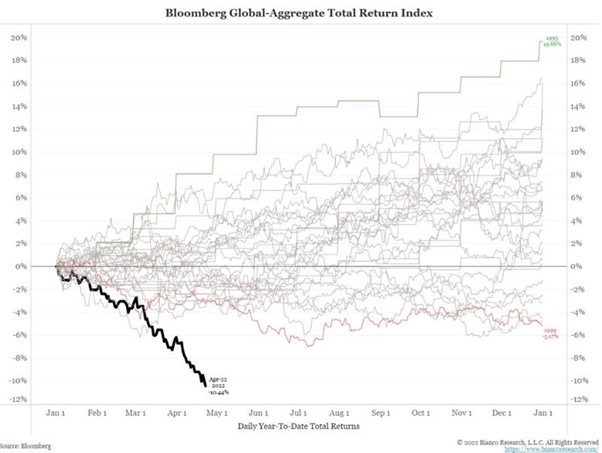

Bonds, which are a great source of portfolio diversification and normally act as a strong hedge against share-price volatility, have had the worst start to the year since record keeping began! The Bloomberg chart below shows just how hard bond prices have been hit since January. Each line on the chart shows the calendar year performance of bond returns over the past 30 years. 2022 (bold line) is clearly the standout as the worst performance.

Why has this happened? Why are Bonds being sold off in such volatile times?

Inflation has hit 30-year highs due to the huge amounts of monetary and fiscal stimulus used to support economies during the COVID-19 era. This, coupled with supply-chain disruptions and rising oil prices has sparked a need for urgent action from central banks to get rising prices under control. New Zealand was quick off the mark to begin raising interest rates to combat inflation and has been closely followed in recent times by the United States, the United Kingdom and Australia. Bond prices have an inverse relationship to interest rates so when interest rates rise, current bond prices fall. Even the expectation of interest rate rises can have a heavy effect on the current price of a bond.

The large sell off in bonds at the start of 2022 was largely due to investors’ future expectations that central banks need to raise interest rates to fight inflation.

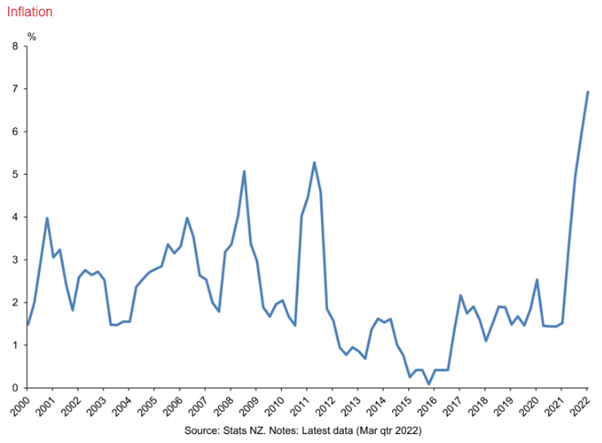

This chart taken from the RBNZ website shows the significant increase in inflation in recent times.

While the chart above looks concerning, it also gives us comfort in knowing that we have seen spikes in inflation before. Central banks will continue to raise interest rates to slow down economies and bring prices under control. History shows that sooner or later, they will be successful in their mission.

Milford has been under-weight fixed income securities such as bonds in our multi-asset funds and portfolios since the beginning of this year. The strategy of holding higher levels of cash and not investing more into bonds has helped mitigate some of the volatility that our conservative investors will have felt.

So where to from here for bonds and conservative investors?

There are still benefits to holding bonds. While the price of bonds can fluctuate in the short term due to sudden changes in interest rate expectations, if you continue to hold a bond until maturity, you will have your original capital returned to you plus you will receive the benefit of regular interest payments during the bond’s term. This helps to provide some longer-term certainty and stability to portfolios. Cognisant that bonds come with the risk that the issuer may become insolvent, Milford, as an active manager, focuses considerable attention on choosing the right companies whose bonds we invest in on behalf of our investors. Companies with strong balance sheets and plenty of earnings to pay back their debts are ideal target investments. Selecting these companies minimises the risk of any defaults in our portfolios.

A further benefit that comes from rising interest rates is that new bond issuances will come with a higher coupon or interest payments attached. As always, we continue to screen the market for the best new opportunities and actively add these into the Funds as we look to optimise those future returns.

We are now beginning to see real value re-emerge in bonds. Bonds are currently being sold with very attractive yields in the current market environment. As such, we are beginning to add a higher allocation of bonds to many of our multi-asset funds, some of which are paying income yields in the realm of 4 or 5%. These income yields are coupled with the fact that if central banks can beat out inflation in the near term, there is a strong possibility of capital appreciation (gains) for many of these new bonds in the medium to long term as interest rates drift lower once the inflation battle has been won.

In conclusion, there are signs that the storm is clearing for the conservative investor. Fundamental data is starting to predict positive returns on the horizon for the more conservatively invested funds and portfolios. While we understand that seeing change within historically stable conservative funds can be worrying, it is important to remember that this is expected (particularly over shorter time periods) and can happen in any investment type. These occurrences can remind all investors to remain focussed on the bigger picture and assess overall investment timeframe as opposed to short-term performance.

Milford has a range of tools available to help assess your risk profile through our website, alternatively, you can call us and speak with one of the team who can help with any queries you may have about your investment.