Our strong investment performance comes down to our strong team; Our expert active Investment Team is constantly adjusting your investment based on potential risk and potential opportunities. We do our own detailed research and our team invests their own money in the Milford Funds right alongside yours – so you can take comfort knowing your KiwiSaver money will get the care and attention it deserves.

The graph shows three of our Funds outperforming other KiwiSaver providers in the Morningstar Survey over the last decade. To see how our performance compares to others in the latest Morningstar Quarterly KiwiSaver Survey here.

Past performance is not a reliable indicator of future performance. Milford Funds Limited is the issuer of the Milford KiwiSaver Plan. Please read the Milford KiwiSaver Plan Product Disclosure Statement here. Before investing, you may wish to seek financial advice. For more information about our financial advice services, please visit here.

Not feeling ready? Read on or try our Digital Advice Tool

Identifying you goal should be your first step - will you use your KiwiSaver savings for your first home or for retirement? Deciding on your goal will help narrow down your Fund choice.

The next thing worth considering is your tolerance for risk. This is often referred to as your ‘risk profile’. Investments can go up and down in value so, it’s important to consider how much risk you’re comfortable with, taking into account your goal and your timeframe.

Once you know your goal, you can work out your investment timeframe. This is the amount of time you plan to keep your money in KiwiSaver before you withdraw it for a home or for retirement.

Lower-risk Funds are those that are less likely to fluctuate up and down over a period of market volatility. That means less risk of loss, but also lower returns in the long run.

Higher-risk Funds are more likely to have bigger drops in value (than low-risk Funds) during periods of market volatility. But they’re also more likely to produce higher returns over the long run.

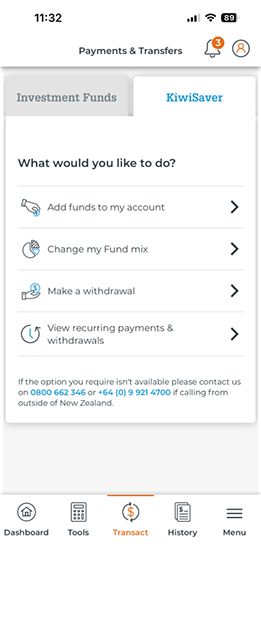

Direct credit via your online banking

Set up regular payments or do a one-off payment via your online banking straight into your account using the following details:

Bank account name: Milford KiwiSaver Plan

Account number: 02 0500 0966274 00

Particulars: Please enter Milford Account Name

Code: Please enter Three Letter Fund Code e.g. KWS

Payer Reference: Please enter your Milford Account Number (starts with ML)

Set up a Direct Debit

Click here to set up automatic regular payments from your bank account straight into your account.

Tell your employer to increase your contribution rate

You can set your contribution rate at either 3%, 4%, 6%, 8% or 10% of your salary or wages. Simply tell your employer in writing the rate you would like.

To change your KiwiSaver provider to Milford is easy and hassle-free. Just complete our online application form on our website with your NZ ID and IRD number, and we’ll handle the rest. It only takes a few minutes to complete the application and you don’t need to contact your current provider. We’ll let them know and manage all the paperwork. The change will be completed within a couple of weeks. If you have any questions, our friendly Client Experience team is here to help. Call us at 0800 662 345 or [email protected]. It’s that simple—no fuss, no dramas!

Milford is committed to sustainable investing. We believe in affecting positive change through active engagement with the companies we invest in, encouraging them to improve their sustainable practices.

We undertake in depth analysis of the Environmental, Social and Governance (ESG) credentials of every company we invest in. We believe we can make the biggest impact by engaging with companies to address sustainability issues and drive positive change and help drive the transition to a more sustainable future.

To learn more, visit the Sustainable Investing section of our website.

Yes, you can transfer your Australian Superannuation (Aussie Super) to your Milford KiwiSaver account, so you can manage all your retirement savings under one roof.

Our team at Milford can assist you with the paperwork. For more information visit the Transferring your Australian Superannuation to KiwiSaver on our website. If you have any questions or need help, call 0800 662 345 or email [email protected]

Yes, you can use your KiwiSaver savings to buy your first home through the First Home Withdrawal scheme. To be eligible, you must have been a KiwiSaver member for at least three years as well as meet other criteria set by the scheme.

Choosing the right KiwiSaver Fund for buying a house depends on your risk profile and your timeframe. If you’re planning to buy a home in the next few years, a Conservative or Defensive Fund might be a good choice as it has lower risk and less chance of significant short-term fluctuations. If you are planning your first home further down the line, you might consider a Balanced or Growth Fund as they come with more risk but could offer higher returns over the long term.

Use our Digital Advice KiwiSaver tool on our website or talk to our KiwiSaver advice team for a personalised recommendation for your situation.

You can use our Digital Advice KiwiSaver tool on our website to get a personalised recommendation based on your goals, risk profile and investment timeframe. If you prefer to talk to someone, our KiwiSaver advice team is here to help too. Just give us a call at 0800 662 345. We’re here to make sure you find the right Fund for your circumstances.

With more than 20 years until retirement, you have a long investment timeframe, which means you can afford to take on more risk for potentially higher returns. A Growth Fund or an Aggressive Fund could suit you, as these Funds have the potential for higher returns over the long term, but they can be more volatile in the short term – so you would need to have a higher tolerance for risk to be in this type of Fund. For tailored advice, use our Digital Advice KiwiSaver tool or speak with our KiwiSaver advice team at 0800 662 345 to find the best Fund for your retirement goals.