Have you ever wondered how your KiwiSaver fund stacks up against the others? The latest report from independent investment research company Morningstar sheds light on who’s delivering the best returns to their members.

We’re pleased to report our members are achieving outstanding results. Milford’s KiwiSaver Active Growth Fund is the best-performing KiwiSaver Growth Fund in the country over the past 10 years. Plus, our KiwiSaver Balanced Fund is the best-performing Balanced Fund over the past 10 years and our KiwiSaver Conservative Fund is the best-performing Conservative Fund over the past 5 years.

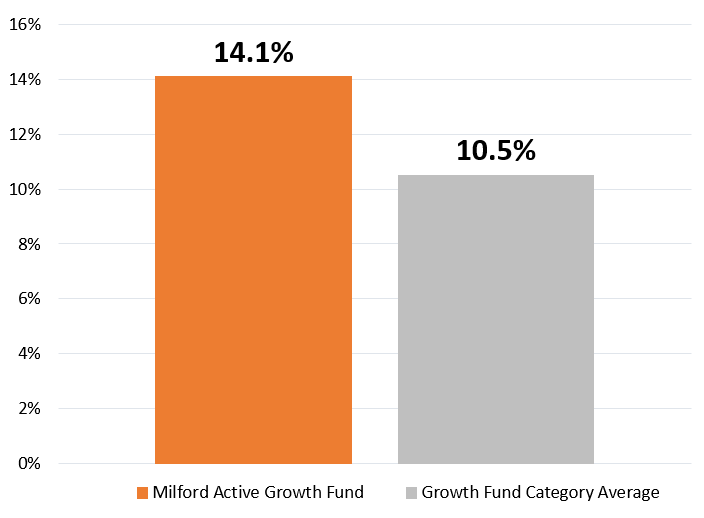

10-Year KiwiSaver Growth Fund Annual Returns

Data sourced from Morningstar KiwiSaver Survey June 2021. Returns are after fees and before tax. Please note past performance is not a reliable indicator of future performance.

By focusing on long-term investment returns achieved after fees have been deducted, Morningstar’s research reveals the true value KiwiSaver providers are adding to their member’s savings.

Is your KiwiSaver account working as hard as it should?

Even a small increase in your annual investment returns can make a big difference to the amount you could have at retirement. In many cases, this could mean thousands of dollars extra for your future. That’s why it’s worth checking your KiwiSaver provider’s long-term performance. Although it’s not a guarantee of the future, it does give you a sense of how skilled they are at growing your savings over time.

At Milford, we’ve produced excellent returns for our KiwiSaver members by combining our world-class investment expertise with an insatiable drive that keeps us constantly asking how we can do better.

And while investment returns are important, like you we have other things that are important to us. So, when you invest with Milford you can take comfort in knowing you’re also supporting the local community, you’re investing sustainably and you’re getting peace of mind because all Milford employees invest their own retirement savings in Milford’s Funds – right next to yours.

If that sounds like the kind of company you’d like looking after your savings, why not join our award-winning KiwiSaver Plan right now?