Punch is gone, time for the hangover?

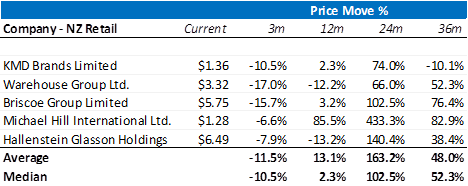

New Zealand retail companies listed on the NZX have performed reasonably well over the past three years, particularly given the impacts of Covid-19. The sector has been under pressure more recently however with headwinds starting to emerge. Below we will take a look at the environment for NZ based retailers for the rest of 2022.

Source: Factset

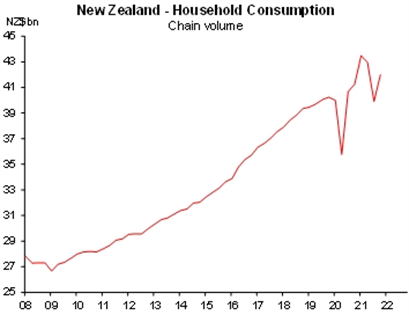

Despite the blips during the Covid lockdowns, New Zealand household consumption and retail sales have been very strong. Considering the likely post lockdown spending rebounds from these data set finishing points, the spending trend is likely well above pre Covid levels. There is plenty of evidence of this overseas as well with record levels of consumer spending as people have been spending up on goods.

Source: ANZ-Roy Morgan, Macrobond, StatsNZ, Macquarie Macro Strategy

The wealth effect has also been large and pronounced since Covid, with large increases in house prices and good stock market returns. Unemployment is also very low and job seeker numbers fell in the past year (albeit these are still ~30% above pre Covid levels). With good job prospects, no doubt some of these savings and wealth increases have filtered down into retail spending (amongst many other things!). Many retailers we talk to have also been able to lift their margins due to no discounting and high demand.

Source: StatsNZ

Now for the hangover?

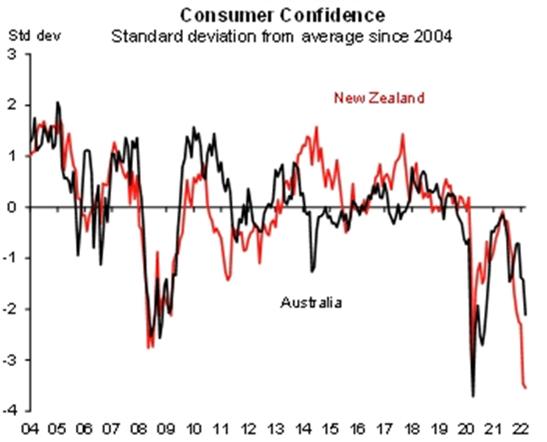

Inflation has arrived, it is broad based and no longer ‘transitory’. Consumer confidence in New Zealand crashed in February, and failed to bounce back in March even as the shock value of Omicron dissipated. Key indicators including whether it is perceived to be a good time to buy a major household item fell to recessionary levels.

Source: ANZ-Roy Morgan, Macrobond, StatsNZ, Macquarie Macro Strategy

With households across the board tightening their belts, what does this mean for retailer share performance and earnings? Recent Retailer share price performance in 2022 has been soft and a greater fall than the NZX market.

We think things will definitely be tougher in 2022, retailers face a number of headwinds already with rising staff costs and crunched supply chains, perhaps they will have to add softer demand to that list too.