April’s Reserve Bank Monetary Policy Review (MPR) saw the Official Cash Rate (OCR) being raised by 0.5 per cent. The last time NZ saw an increase of this magnitude at a single meeting was over twenty years ago, which leads to the question – why now when we are seeing clear signs the economy is slowing?

It is all about inflation and the Reserve Bank of New Zealand (RBNZ) is very concerned with inflation expectations becoming unanchored. High inflation now translates into people expecting high inflation in the future (people looking for higher wages, businesses setting prices higher etc). The RBNZ are using their main tool (i.e. adjusting OCR) to try to fight this red hot inflation and stop inflation expectations from running away.

New Zealand is not alone in this fight, offshore economies are facing the same issue but do the central banks have the right tools in their kit to do this? A large part of the inflation we are experiencing is due to shocks out of the RBNZ’s control (e.g. low levels of unemployment as a result of closed borders, increasing commodity prices and constrained supply chains) but also from elevated global and domestic demand.

Raising interest rates may reduce demand. In NZ, the transmission from a rising OCR into reducing consumption via increased mortgage rates should be reasonably swift given NZ mortgages have shorter fixing terms versus some countries (e.g., in the US the vast majority of homeowners choose a 30-year fixed mortgage). This should act to reduce demand and therefore inflation, but it will take a bit of time to play out. The big question is will we see any patience from the RBNZ in coming periods in the face of current red-hot inflation? Only time will tell.

There is no disputing the tough task the RBNZ has. On the one hand we are seeing clear early signs that the economy is slowing (notably the housing market) but on the other if we look at the RBNZ’s dual mandate (maximum sustainable employment and maintaining price stability) they are massively overshooting on both accounts. It is hard to argue that the levels of monetary policy in NZ have been and remain too expansionary.

What does this mean for households?

The RBNZ was very clear that it is raising rates by more earlier to reduce the risk of having to increase them even higher in the long term. Nevertheless, in the latest Monetary Policy Review, the RBNZ also outlined no adjustment to its base case for the future path of the OCR, with the bank still expecting a peak for this cycle at around 3.4%.

This contrasts to market interest rates which have been increasing at a rapid pace over recent months, pricing in more OCR hikes than the RBNZ base forecast. Therefore, while it may seem somewhat counterintuitive, after the announcement of the 0.5 per cent OCR increase this week, market interest rates actually fell. They have now started to unwind some of those elevated expectations for interest rate increases from here driven by the RBNZ leaving their view of the terminal rate unchanged.

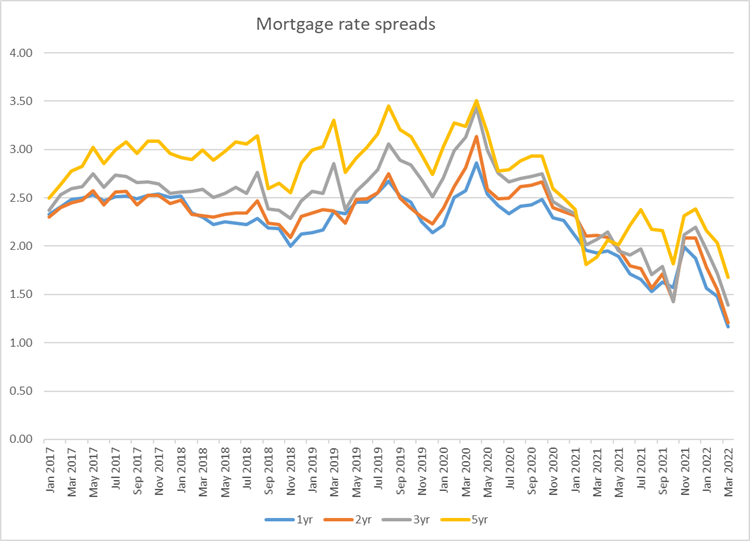

The latest data available from the RBNZ illustrates that the margin banks have been adding to wholesale market interest rates for mortgage loans has been contracting. We believe this means banks are likely to make further adjustments higher in fixed mortgage rates, despite wholesale rates softening.

Source: RBNZ and Bloomberg

Source: RBNZ and Bloomberg

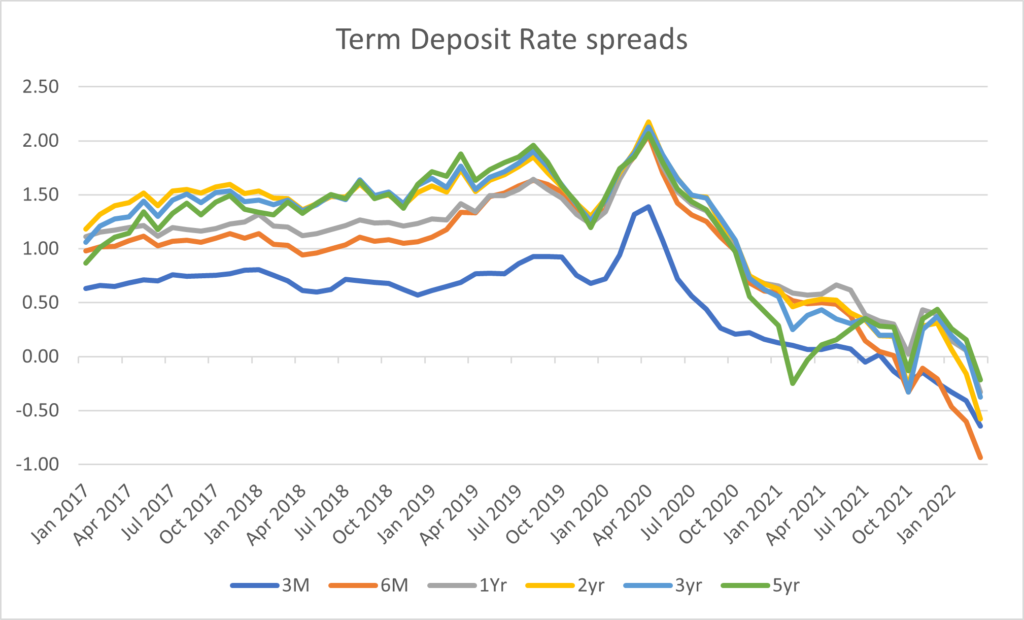

On the flip side, many carded term deposit rates offered by banks have actually fallen below wholesale interest rates for the same term. Again, we expect some movement upwards in term deposit rates in light of the latest OCR increase, albeit likely to a much lesser extent that what was passed through to mortgage rates.

Source: RBNZ and Bloomberg

Source: RBNZ and Bloomberg

Looking forward, the big question is will the RBNZ continue to increase interest rates into a weak economy? For now, inflation remains its focus but the downside economic risks are stacking up. Looking at the latter half of the year it may be tough for the RBNZ to ignore the impacts that higher interest rates are having on the economy. Investors will be focused on getting any clarity at coming meetings on how far the RBNZ are willing to test the economy.