It’s a good idea to review your KiwiSaver account at least once a year. Now that spring has sprung, here are a few tips to dust off your KiwiSaver investment and ensure you are making the most of all that it has to offer.

- Make certain that the fund you are in aligns with your goals and timeframe

When it comes to KiwiSaver funds we are spoilt for choice. This can often make the decision to choose what fund to invest in difficult. When it comes to fund selection there are a variety of factors to take into consideration. The three most important ones are your goal, investment timeframe and risk tolerance.

We can help walk you through this with our Digital Advice tool. For Milford clients you’ll find this in the Tools and Calculators menu on your Client Portal or mobile App. If you are not yet a client, you can access the tool from our website. We also offer free KiwiSaver advice with our KiwiSaver Financial Advisers. You can reach them at [email protected]

- Double check your contribution rate

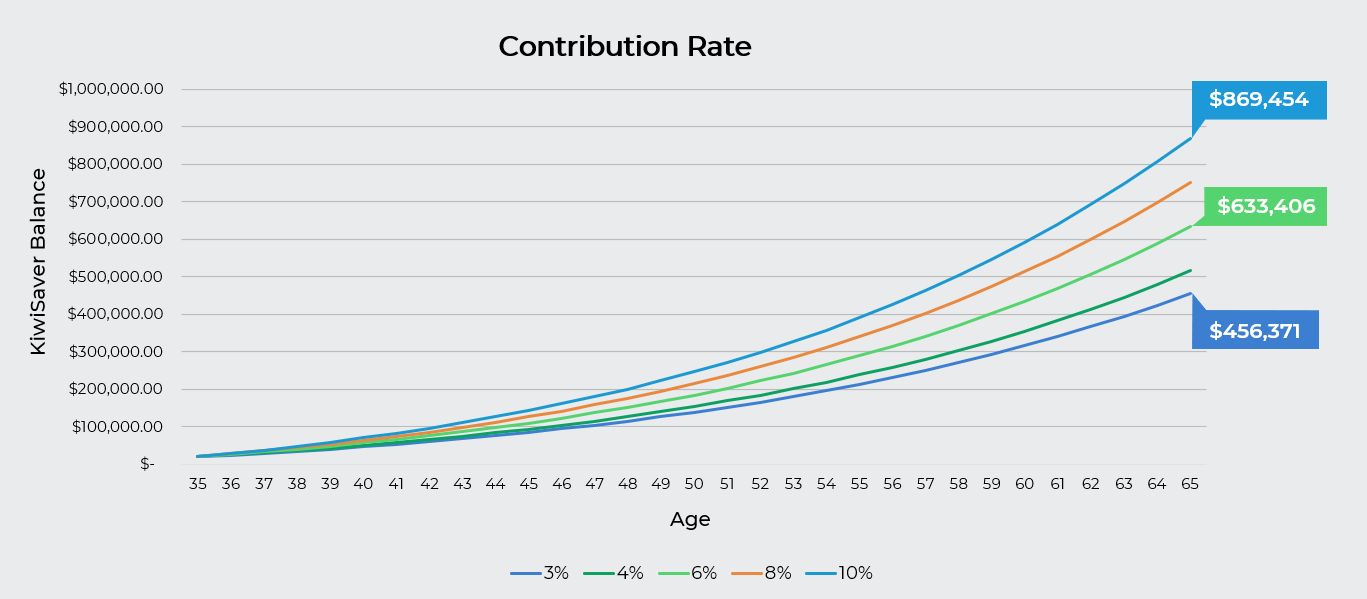

Making minor changes to your contribution rate now can compound to make a significant difference to your retirement lifestyle. Below is a graph that illustrates the power of compounding and the effect it can have on your KiwiSaver balance at retirement. You can contribute 3%, 4%, 6%, 8% or 10% of your pay via your employer.

Contribution Rates – What difference does it make?

Assumptions: This is a hypothetical investment and meant for illustrative purposes only. Past performance is not a guarantee of future performance. Figures do not account for inflation. Assumes 6% p.a. investment returns (after fees & tax), 2.5% p.a. salary growth and no withdrawals for a 35 year old investor with a starting gross annual salary of $55,000, starting KiwiSaver balance of $20,000. Final lump sum is not adjusted for inflation.

- Government contribution. Do not forget about it

For every dollar that you contribute to your KiwiSaver account you will receive an extra 50 cents, up to a maximum of $521.43 If eligible1, you will need to contribute $1043 each KiwiSaver year (1st July to 30th June) to receive the full amount. In the 2022 financial year, the Government made contributions of $9162 million towards KiwiSaver members, however, this represented only 63%3 of members making the most of the benefit available, with over $500 million left unclaimed.

- Getting advice helps more than you think

Getting advice on your KiwiSaver will help you set your goal and create the best plan to try and achieve it.

If you are interested in getting advice, you can get in touch at [email protected] and we can organise a time with one of our KiwiSaver Financial Advisers. Alternatively, we have a comprehensive Digital Advice Tool on our website, or available in the Client Portal and mobile App for existing Milford clients.

Spring clean your KiwiSaver now, using these quick tips, to help you keep your KiwiSaver on track.

For more information about getting advice at Milford, see milfordasset.com/getting-advice. Financial Adviser Disclosure statements are available upon request free of charge.

1 To be eligible you must be 18 years or older, not yet entitled to make a retirement withdrawal and have mainly lived in New Zealand over the 12 months ending 30 June. If you are only eligible for part of the year, or joined KiwiSaver part way through the year, you will receive a proportional amount of the Government Contribution, based on the number of days you have been eligible.

2 https://www.ird.govt.nz/about-us/tax-statistics/kiwisaver/contributions/scheme-providers-payments

3 https://www.ird.govt.nz/about-us/tax-statistics/kiwisaver/datasets