Updated 23 June 2025

In KiwiSaver you can elect to contribute 3%, 4%, 6%, 8% or 10% of your gross salary directly into your KiwiSaver account, as well as additional voluntary contributions.

Statistics from the IRD show that the majority of people who make contributions to their KiwiSaver only contribute the minimum 3%.

3% of your salary is not a lot. Of course, not everyone’s primary retirement savings are via KiwiSaver, but if yours are: will contributing only 3% of your salary be enough to fund the retirement you’ve dreamed of?

Contributing just 1% more to your KiwiSaver account is a very simple change that can make a significant difference to your retirement and ultimately your lifestyle. There are other benefits as well, such as:

It’s automated

The beauty of KiwiSaver is that it turns saving into a simple automated process. KiwiSaver requires almost no discipline and that’s great! Because for most of us, making plans to save is a lot easier than actually executing that plan. To increase your KiwiSaver contributions, you simply ask your employer to adjust it.

It increases your future income

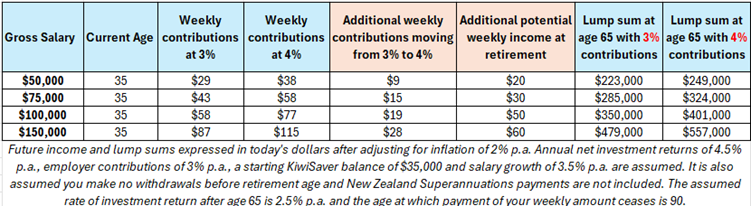

Before you can save more, you need to determine if you can afford it. The table below shows that the difference between contributing 3% and 4% today may not be as large as you think, but the pay-off in terms of additional income at retirement is substantial.

Putting away a little more today, should create much more income in the future*:

Compounding returns

In the above example, the investor’s net annualised return on investment was just 4.5% each year. But after years of compounding, that original $1 of income forgone today should turn into at least $2 of additional retirement income at age 65, and that’s after accounting for inflation, tax and fees, or in other words a real return on investment of at least 100%!

Buy shares at lower prices during market downturns

It’s always nice to buy when things are on sale. Trying to time the market is very difficult, and many are too scared to invest when markets are going backwards. KiwiSaver takes out the guess work because you’re contributing regularly. Therefore, when markets fall you will be buying units at lower prices, or in other words, your regular contribution buys you more units. When markets rise again you benefit from the gain in value of those units.

Your employer may match you

Employers must contribute a minimum of 3% of your gross salary to KiwiSaver. However, check with your employer, because some choose to match your contributions up to a certain level. If you increase your contribution to 4% and they’ll match you up to 4% for instance, you’d be giving yourself a pay rise.

Our free KiwiSaver Retirement Calculator can help show the effect increasing your contributions can have on your own KiwiSaver account by age 65. If you’re an existing client, click here to get a more personalised approach with our KiwiSaver Digital Advice tools available within your Client Portal/ Mobile App.

Before making any decisions, you should always assess your own financial position carefully and if you’re unsure, seek financial advice.

But one thing is very clear, simply increasing your own KiwiSaver contributions and asking your employer to match you, even by just 1%, can help create a much more comfortable retirement.