Since the start of KiwiSaver in 2007 over 2.9 million New Zealanders have joined and grown their savings to over $50 billion. With about half of KiwiSaver members aged 18 – 44 it will become one of the largest financial contributors to Kiwis retirements. There’s no doubt KiwiSaver is very popular, but with so many investors in lower risk, lower returning conservative funds, are we short changing our future selves?

The average 25-year-old employee will make $101,104 worth of contributions to their KiwiSaver account over their working life. A further $70,236 will come from employer contributions and assuming the annual Government contribution remains in place $20,857 will be come from the government. There are some big numbers here, yet it is actually the investment returns that will make up the bulk of a KiwiSaver member’s balance at retirement – therefore the type of investment fund a member chooses is critical to their success.

It’s important to remember that in investing, risk and return are closely linked. You can’t get returns, without taking risk.

Unfortunately, many younger KiwiSaver members are in conservative funds. If they stay in these funds for their entire career and do not switch to a growth fund, they will likely short change their retirement by tens, and in some cases, hundreds of thousands of dollars.

For example, for an employee aged 25 today and earning a salary $50,000 p.a. (with 2.5% p.a. increases) there can be a huge difference in the savings available in retirement and this is largely dependent on the type of KiwiSaver investment fund they’ve chosen to invest in over their working life.

When invested in a ‘lower risk, lower returning’ KiwiSaver fund (let’s assume 2% p.a. return after fees + tax) this employee – at age 65 – may have a fund balance of around $277,000^.

Should this same employee be invested in a ‘higher risk, higher returning’ KiwiSaver fund (let’s assume 6% p.a. return after fees + tax) over their working life could have a fund balance of around $656,000, at age 65^.

Risk is the word used when describing the volatility of KiwiSaver funds. The mere mention of the word can strike fear into investors. When we talk about risk, we are referring to the risk that your capital (i.e. your original investment value) will be lower over a short period of time. For instance, there is a low risk that $10,000 invested in a 6-month term deposit will be less upon maturity, however, $10,000 invested in the sharemarket may very well be worth less in 6 months’ time, therefore there is a higher risk of your original investment capital reducing.

I certainly don’t feel like a risk taker, you say, so what type of fund is right for me?

KiwiSaver funds are generally categorised as the ‘lower risk’ conservative funds (including default funds), ‘moderate risk’ balanced funds and ‘higher risk’ growth funds.

Conservative funds mainly invest in cash deposits and fixed interest securities with a small portion, usually between 5% and 20%, in equities (i.e. company shares), therefore presenting a lower risk of your capital reducing over the short time frame as the bulk is invested in cash deposits and fixed interest securities. A balanced fund, as the name suggests, takes a balanced approach to the investment and allocates about half to cash and fixed interest securities and half in equities. A growth fund will invest the majority into equities, in an attempt, to provide higher returns and grow your savings. History has shown that indeed growth funds do tend to provide higher returns over the long term, but they also experience larger short-term fluctuations in value. So, growth funds present a ‘higher risk’ that your capital may be lower over a short time frame than other fund types. Some growth fund investors can get spooked by this short-term volatility and move into conservative funds. This is generally not a good idea.

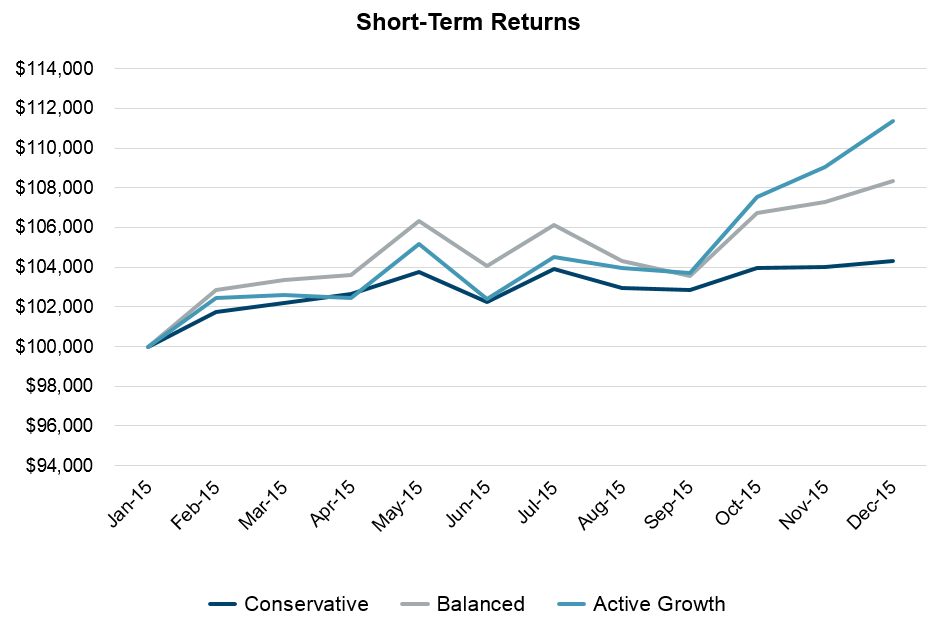

As the chart below illustrates – at any point during a 12-month period either fund type may be the best performer as the lower risk conservative fund provides a low and steady return while the other funds can have larger short-term fluctuations.

Milford KiwiSaver fund unit prices from Jan 2015 to Dec 2015 and its effect on investment capital of $100,000. This does not include any additional contributions an investor may have made.

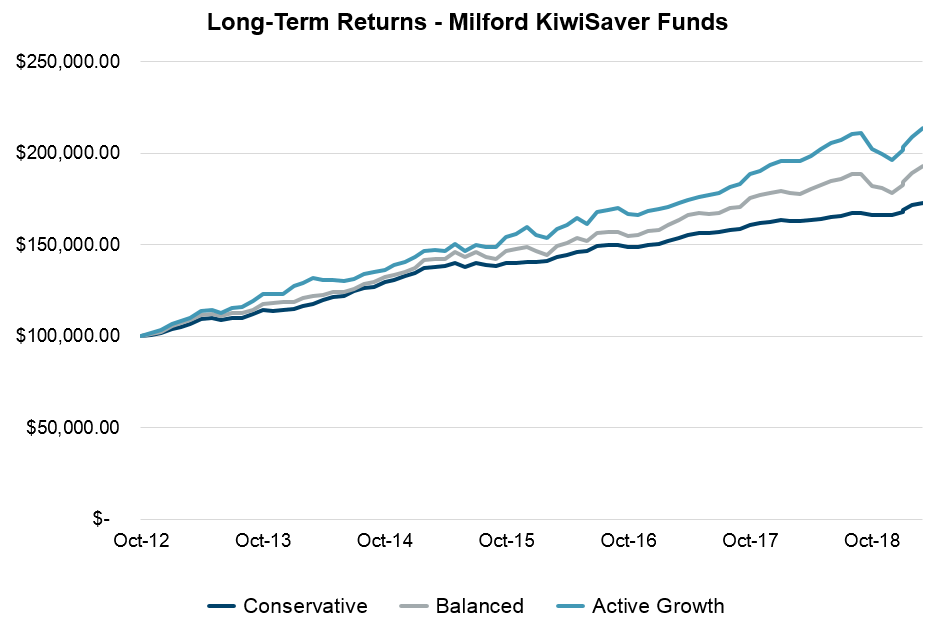

As the investment timeframe becomes longer the short-term fluctuations have less impact, the true performance of the investment funds is evident, as illustrated below.

Milford KiwiSaver fund unit prices from Oct 2012 to Apr 2019 and its effect on investment capital of $100,000. This does not include any additional contributions an investor may have made.

It‘s important that all KiwiSaver members choose to invest in the most suitable fund for their stage of life and their appetite for risk. 80% of KiwiSaver members are at least 11 years away from normal retirement age (65) yet only 37% of total KiwiSaver money is invested in growth and aggressive funds*. This indicates a lot of savers may not be in the most suitable fund and are likely short changing their future self.

Here at Milford we have tools available to help with this decision along with our Investor Services team that can discuss our funds in more detail.