The outbreak of a new strain of coronavirus in Wuhan, China, has raised concerns among both the general public and financial markets. The situation is very tragic and fast-moving. While we can offer no view on how the virus may develop, we can offer a few thoughts on the implications for the New Zealand share market.

Coronaviruses are a large family of viruses that include the common cold, and viruses such as SARS[i]. The first case of this new coronavirus was reported to the World Health Organization (WHO) on December 31, 2019 and at the time of writing, there have been 6065 confirmed cases in China, with 68 cases outside of China across 15 countries.

NZ Impact

The outbreak will result in a sharp decline in arrivals from China and neighbouring countries as a result of flight restrictions. Chinese tourists made up 11.5% of international visitors in 2019, up from 3.7% in 2002. Many travellers from unaffected countries may also choose to cancel or defer their holidays until the situation improves. This reduction in arrivals will impact airlines and airports such as Air New Zealand and Auckland Airport, as well as tourism exposed companies like Tourism Holdings and Sky City Entertainment. If the outbreak is more prolonged there could also be an impact on our export industries.

SARS case study

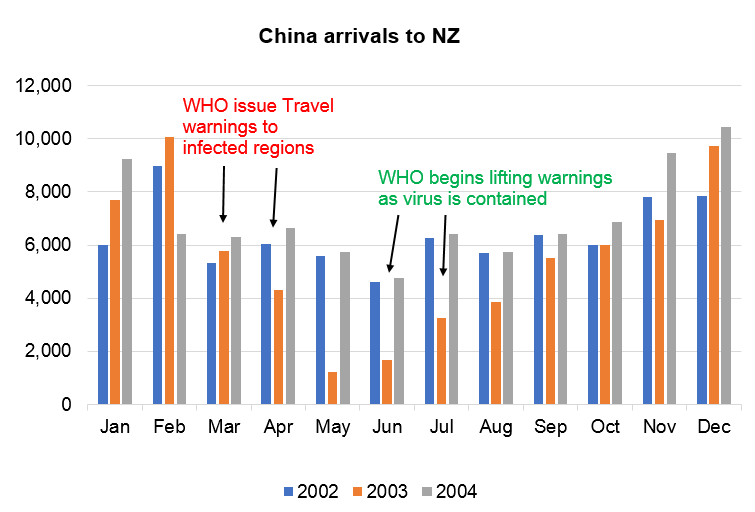

The SARS outbreak in 2003 saw infections grow rapidly before being effectively contained after 3-4 months. The virus resulted in more than 8,000[ii] infections, 800 deaths and infected 26 countries. During the outbreak NZ arrivals from China fell sharply as travel restrictions were implemented, before bouncing back once the virus had been contained. Due to the short duration of the outbreak, there was a limited impact on company earnings.

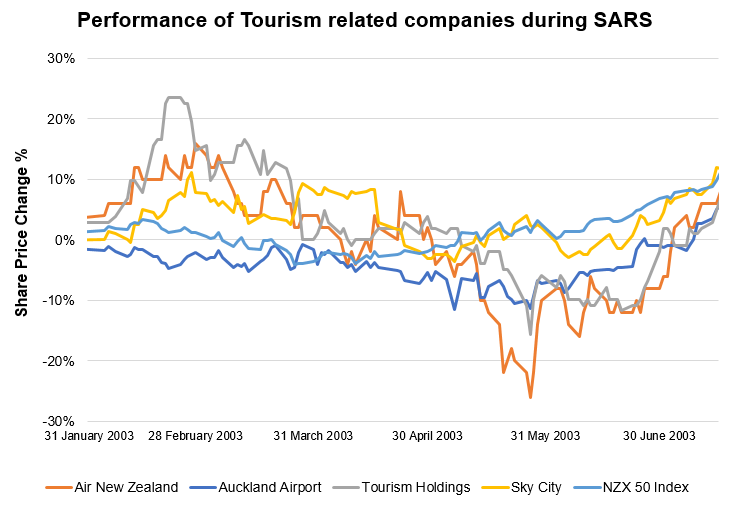

Tourism companies reacted negatively to news of the virus with Air New Zealand falling up to -27%, and Auckland Airport -12% before recovering once SARS was contained and the number of new cases fell.

Figure 1 Source: Stats NZ, World Health Organisation.

Figure 2 Source: Bloomberg, World Health Organisation.

How have stocks reacted so far?

So far tourism stocks have reacted like the SARS outbreak with Air NZ falling -7.2%, and Auckland Airport falling -5.5% since the first publication by WHO on the 21st of January. At current rates the new coronavirus is on track to exceed SARS and could have a greater impact on tourism.

It will be difficult to call a bottom on tourism related stocks, but we would expect sentiment to remain negative until there are signs of containment. The actual impact on earnings will be dependent on the severity and duration of the new coronavirus. We continue to monitor the situation closely.