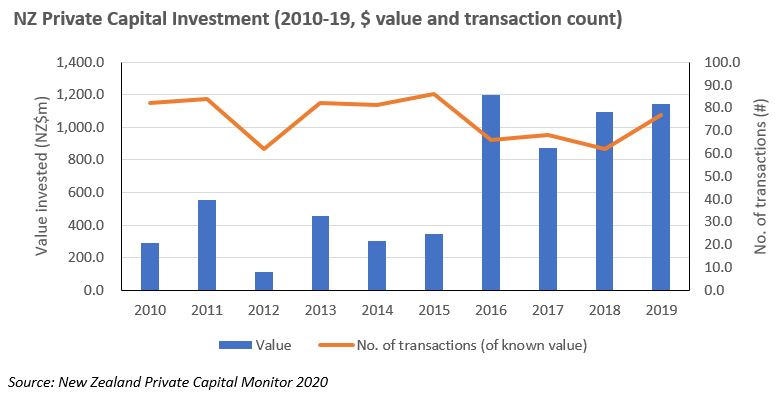

The New Zealand Private Capital Monitor report was recently published. It showed 2019 was a record year of activity for private capital markets, with $1.1bn of investments across private equity and venture capital transactions. This brings the total invested capital into growing New Zealand companies to $6.4bn in a decade of growth emerging from the Global Financial Crisis. Over the same period, $4.6bn of capital has been returned to investors; to be redeployed into new investment opportunities or into the wider New Zealand economy.

The chart below shows the total investment made in New Zealand by the private capital market, by total dollar value and number of transactions (of known value). It shows that the private capital market has been an important source of capital for New Zealand businesses throughout the economic cycle, with a relatively consistent number of transactions occurring each year. The total investment value, however, was weighted to the latter stage of the cycle.

As local COVID-19 restrictions ease, a new business cycle is likely beginning in New Zealand.

From a public health perspective, New Zealand has managed COVID-19 exceptionally well. The government had a clear plan and communicated it effectively; the public co-operated; and we controlled our borders effectively. On 8 May, we announced our first day of zero active cases – a remarkable achievement that puts us in an enviable position globally.

The focus now shifts to restarting the economy, here, the consequences of the relatively strict lockdown measures are still unclear, and the next six months will be telling for businesses as government support dries up and confidence remains shaky.

Many businesses will look to raise capital to shore up balance sheets or capitalise on new opportunities. However, of the 1,700 largest companies in New Zealand, fewer than 200 have immediate access to public market capital or support from a multinational. And with uncertainty around short-term earnings volatility, debt financing will be hard to come by and often prohibitively expensive.

Private capital will, therefore, play an important role again in New Zealand’s economic recovery. Private capital investors can take a longer-term view of businesses, looking through the current volatility to assess the medium-term outlook. They can also forgo dividends for an extended period, relieving the cashflow burden on investee companies.

The current environment presents good opportunities for private capital investors. Scarcity of funding can lead to lower entry valuations and crises, historically, have spawned innovation and accelerated change. The response to SARS in 2003 drove e-commerce in Asia and helped Alibaba break into the consumer space. The GFC gave rise to the gig economy and now-household names like Uber and Airbnb.

We have already seen shifts in consumer preferences in the wake of COVID-19. Platforms that offer services online are thriving, whilst demand for corporate travel and commercial office space appears to have softened.

The source of COVID-19 was linked to a wet market in China, putting even greater emphasis on food security and supply chain transparency. New Zealand Inc’s brand and reputation – and our current COVID-free status – should allow our products to command an even greater premium in export markets. Foods with added health benefits, like kiwifruit, rich in vitamin C, or Manuka honey, with its immunity boosting qualities, have all seen a spike in demand and we would expect this to continue as consumers reprioritise what is important to them and purchase accordingly.

Strong investment returns will be made by investors who have the risk tolerance to look through short-term volatility and pick winners that will benefit from shifting consumer or industry trends.