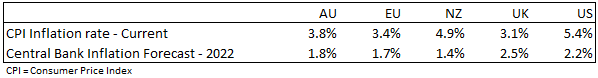

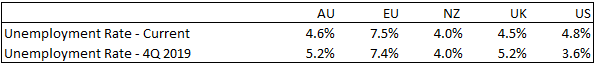

Central banks across the world face a dilemma. The economic recovery remains uneven. Inflation is running at levels associated with a red-hot economy while levels of employment in many countries remain well below pre-pandemic levels. For central banks, many of whom have dual mandates which target both inflation and employment, this is a conundrum. Until recently, central banks have chosen to look through inflationary pressures on the assumption that it is being driven by global supply chain bottlenecks that will prove to be transitory.

Inflation pressures broadening

However, the transitory thesis is becoming increasingly challenged. Disruptions in global supply chains are persisting. Coupled with rising commodity prices and falling unemployment which may put upward pressure on wages, there is a risk that inflationary pressures continue to broaden and become entrenched. Companies are increasingly corroborating this. In one of many recent examples, global consumer goods giant Unilever said they raised prices 4% on average in the last quarter alone and described current conditions as “a once-in-two-decades inflationary environment.”

How are central banks reacting?

Most central banks have reacted to higher inflation by reducing or ending their government bond purchase programmes. The most notable turning point came in September when the US Federal Reserve announced that they could start tapering their bond purchases as early as November.

However, the path to hikes in key central bank cash rates is less certain. In many countries, the likelihood of a central bank hiking rates depends on longer-term inflation trends experienced pre-pandemic. In countries that have struggled with low wage growth, central banks may be more inclined to tolerate a period of above target inflation.

In Europe, where high levels of unemployment resulted in below target inflation for many years, rate hikes appear unlikely any time soon. In the US, which struggled with inflation below target to a lesser extent, views on the timing of rate hikes are more balanced. Whilst some members of the Federal Reserve are anxious to get started with rate hikes in 2022, some prefer to wait longer as they worry that the same structural forces that caused low inflation pre-pandemic will reassert themselves once so-called transitory factors fade.

Similarly, in Australia, the central bank thinks that the pre-pandemic trend of persistently low wage growth will continue to weigh on inflation. They forecast that conditions for rate increases, namely inflation sustainably between 2-4%, will not be met until 2024.

Bond markets are less inclined to wait. With bond yields moving materially higher (prices lower) markets are now pricing rate hikes for both the US and Australia in 2022.

Not all central banks are waiting either. In New Zealand and Norway, where labour markets are already tight, the interest rate hiking cycle has already started. In the UK, the central bank has become increasingly concerned at the persistence of inflation well above their 2% target and have indicated a rate hike may come as early as November.

Conclusion

Persistent inflation pressures are likely to push more central banks to remove monetary policy from emergency settings and increase their benchmark cash rates. As a result, the pressure will likely remain on government bond yields to move higher (prices lower). We continue to think active management is needed to cushion investment returns from the potentially negative impacts of rising interest rates and capitalise on investment opportunities that arise during this transitional process.