In a geeky spin on “Sex, Drugs & Rock’n’roll,” the title arguably captures the counterculture movement of today.

Digital tokens tied to computer programmes taking advantage of cryptographic techniques have reached two trillion dollars in market value. For comparison, the largest listed company Apple has a market capitalization of $2.3tn; cryptos are in the same ballpark, but most of their appreciation came in the last year – it’s been accelerating. This fact is both concerning and exciting. On the one hand, Apple makes iPhones, but how does crypto add value? On the other hand, some of these tokens look increasingly like securities, and cryptos are only a fraction of the size of the markets for shares and bonds.

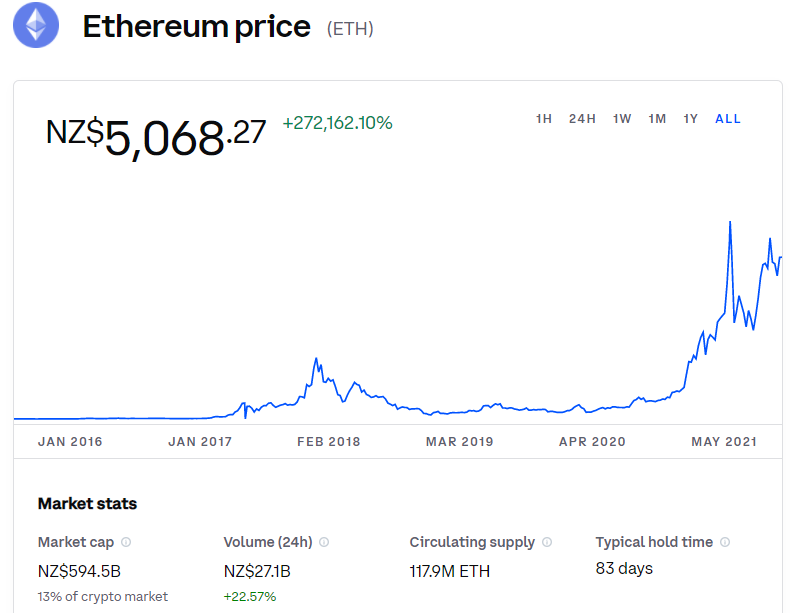

Bitcoin, the first and most recognized crypto, has had no fewer than seven bubble-bursting, soul-searching, 50% plus value crashes since its creation more than a decade agoi . Prominent financial practitioners have condemned itii , China has banned it, and the first government to introduce it as legal tender botched itiii . Still, cryptos, by and large, are holding their heads high. Charts of Ether and Bitcoin show prices zigzagging towards the top right, albeit with wild swings. This year, Wall Street firms have published research primers on crypto and digital asset in droves, inviting mainstream investors.

Source: Coinbase

Source: Coinbase

Furthermore, finance professionals are joining the developers of cryptos in the evolution from simply collecting tokens to decentralized finance (DeFi). DeFi promises investors open access financial applications running on decentralized computing networks (no gatekeepers, no KYC/anti-money laundering checks, no discrimination, available 24/7). It started with automated market making, using rules and programmes (smart contracts) rather than brokers to facilitate transactions from one crypto to another. Like conventional finance, a small commission is earned every time an asset is bought or sold. Unlike conventional finance, the bids and offers are not centralized. Trading commissions are not solely the privilege of organizations with capital and infrastructure, such as exchanges and banks. Here, any token holder can be a market maker and has the opportunity to earn the spread. This DIY market-making has helped provide additional liquidity beyond the relatively well-known, centralized crypto exchanges, such as Coinbase.

Next came lending. A holder of an asset should earn an income. Like placing a term deposit with a bank, the saver effectively lends cash and receives the cash rate. In DeFi, the mechanics are similar to traditional savings except for a notable feature in the interest earned. The crypto saver gets a bonus in the form of the lending platform’s native token, another crypto that confers governance rights and potential economic interests in the lending programme. To further the analogy, the saver earns cash interest from the bank and gets shares in the bank. The lending platform token aligns interests while potentially turbocharging the returns since both cryptos are tradeable, lendable, and could appreciate. DeFi makes it more compelling for capital to flow into and stay in the system by offering things to do with the crypto assets. DeFi increases engagement.

As is often the case with progress, multiple ingredients need to converge. When wind and solar power meet cheaper batteries, more of the power grid can be switched to renewables. When camera pixel count improvement meets more affordable mobile phones, social media takes off.

Enter video games that project large 3D virtual environments. The likes of Fortnite, Minecraft, Roblox, and even Facebookiv have elements of the sci-fi holy grail that is the Metaverse or, simply, the virtual world. Many proto-metaverse games have a social component; they encourage you to invest in your virtual identity or avatar and enable live interactions with friends or strangers. The often-cited example is the virtual concert. Super-sized avatars of real artists (such as Travis Scott, Lil Nas X) have performed in virtual environments to audiences of 20-30 million players.

These games have in-game currencies and items but are not freely or easily exchangeable back into real-world dollars. The customed avatars are not portable to other games and have no value outside the game. In effect, the in-game assets lack liquidity. The other issue is growing the player base. Marketing can attract new players relatively easily. But retaining active players requires continual engagement and stimulation through new content releases.

So, where have we seen recent innovations on liquidity and engagement?

You got it! Let’s combine virtual worlds with DeFi.

Games with openly exchangeable native tokens give players an added incentive. Games that are fun give crypto speculators/investors another reason to buy-in. A mixing of work and pleasure if you like.

In this respect, the rise of crypto-based games (aka. NFT games) looks interesting. Axie Infinity, a Pokémon-like game, promotes the Play-to-Earn concept and has been credited with providing an income to those who lost jobs during the pandemic, particularly in the Phillippines. Early success has spurred on local regulators to call revenues from playing Axie taxablev.

So, to the very first question posed in this blog, ‘how does crypto add value?’

It appears to be multifaceted but vague. There is still a lot to figure out. A helpful framing is to see the internet as an open network that enables the exchange of information. In contrast, crypto/DeFi enables the exchange of value in the broadest sense – including purchasing power, computing power, trust, certainty, anonymity, freedom, etc. A tangible example is to use waste gas and heat to power cryptos. This recovers energy that otherwise would have dissipated into the atmosphere, turning it into value without needing transmission infrastructure or to be near demand centres, just an internet connection.

There will be failures and glitches, and the sceptics may be proven right – that there is no intrinsic value behind all this, and we told you so; it is the Wild West. Regulators will have their say. But an objective observer may reasonably conclude that cryptos have shown resiliency through the trials and tribulations and are evolving. Thousands of software developers often work on crypto projects instead of taking high-salary jobs at established tech firms. And some non-technical members of society, such as participants in Axie Infinity and artists publishing digital artworks, are taking economics from the ecosystem.

The future is what we make it. Equity investors are inherent backers of the ingenuity of our brightest to push the frontier and create value. In any case, even sceptics have to acknowledge that what some would call a Ponzi scheme is increasingly too big to ignore.

p.s.

Some funds managed by Milford have small, indirect exposure to concepts and themes discussed in this blog through holdings such as PayPal, Square/Afterpay, Silicon Valley Bank, Tencent, Visa, and Mastercard.