The below is for information only. Milford are not tax advisers and the below does not constitute tax advice, rather is a call to action to speak to your tax advisers to ensure you are investing in the most tax efficient way given the recent changes. Trustees should take their own tax advice.

For the 2024-2025 and later tax income years, trustee income is subject to tax at the 39% trustee tax rate (unless some very limited special rules apply). This change took effect on 1st April and has renewed trustee interest in holding Investment Fund Portfolio Investment Entities (PIEs) over other forms of investment e.g. direct shares, based on their tax efficiency.

Those experienced with family trusts will know that annual income of a trust is taxed either to the trustees or to the beneficiaries of the trust. The change introduced in April of this year means it’s important for all trustees and beneficiaries to check the implications of this change for them. For example, with trustee income, having an investment approach investing via PIEs just got even more attractive with PIEs attracting the highest rate of tax at 28% versus the now 39% trustee rate. Also, if the beneficiaries are all taxed at 39%, again having an investment approach investing via PIEs just became a lot more attractive.

First things first, no one is saying that you should choose your investment approach solely on tax. However, such a big difference between the upper PIE rate of 28% and the new trustee rate of 39% means you need to review your own position to establish whether the way you invest is tax efficient. With an 11% difference between the top rate of a PIE and the top rate for personal and trustee income, investing in a tax efficient way is attracting considerable attention.

Investing all starts with the right investment approach or strategy. That needs to cover a range of areas but at the end of the day a key measure of success is the return your investment approach is achieving after all fees and tax. Let’s take a simplified example. Let’s take an investment of $250,000 generating 10% income after fees. The tax on a PIE at 28% would be $7,000 but for another non-PIE investment attracting a 39% tax rate it would be $9,750. Do you want to be paying the latter?

PIEs offer a huge range of investment options to fit a wide range of investment approaches or strategies. According to the Sorted website there are 463 different PIE managed funds available for investment in NZ so the likelihood of one, some, or a group of PIEs fitting all sorts of investment approach is very, very high. And information on PIEs is plentiful with lots of transparency to assist with making realistic comparisons, including as to historic after fee returns, to help with the process of selecting the right provider for you.

There are certain features of PIEs which may be important to some, such as the way they themselves are taxed. Generally speaking, gains made by a PIE on the sale of equities will not be taxable whereas gains made on sale of equities directly held by trustees may attract tax where they are trading actively.

PIE Tax Rules

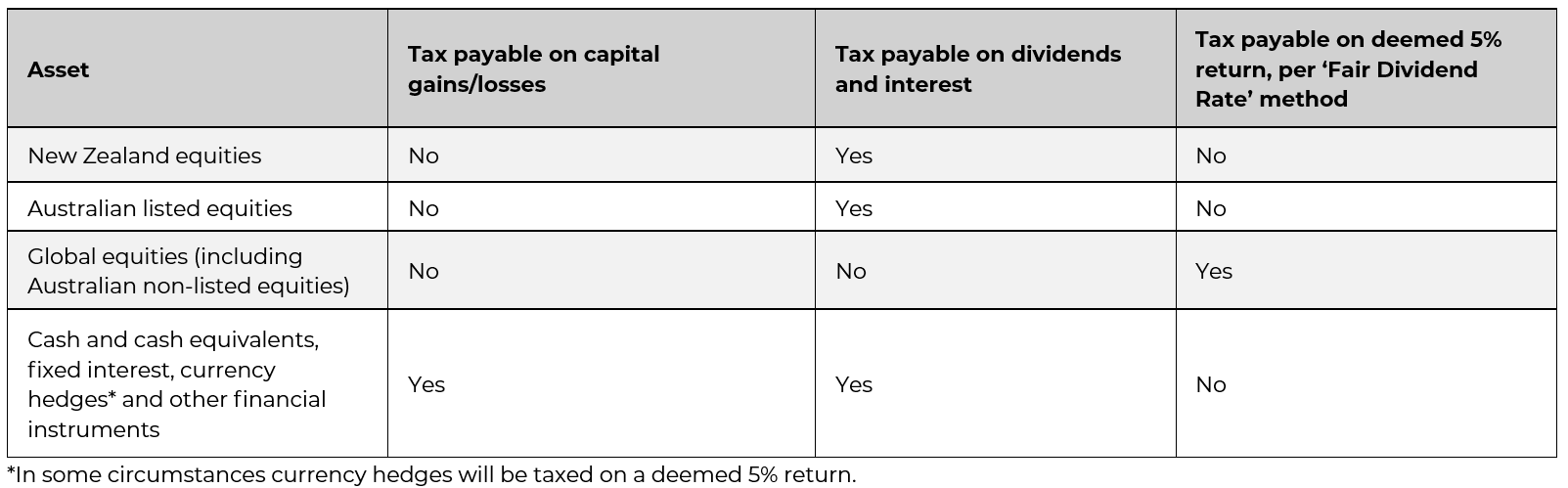

The PIE tax Rules in the Income Tax Act 2007 determine the tax treatment of all income and expenses of PIEs. Generally, assets are taxed as in the table below.

PIEs themselves pay tax on any dividends received from New Zealand and Australian resident listed companies. For foreign shares the Foreign Investment Fund rules apply and there are a few options. It is usual for PIEs to use the Fair Dividend Rate method where tax is payable on 5% of opening market value (with adjustments for certain disposals). This is where it can get complicated for trustees, dependent on other factors but even so, against the change to an 11% difference between the trustee rate of 39% and the top rate for a PIE of 28%, even they will need to reassess that they are being tax efficient in managing their trust’s investments.

Aside from benefits such as expert investment management, reduced complexity and having tax dealt with at source, investing in a PIE can provide material tax advantages for New Zealand resident investors. Those advantages just got bigger. Investing in PIEs is transparent with a wide range of investment options. All trustees would be wise to review their situation to ensure that they are investing in a tax efficient way. Many already are.