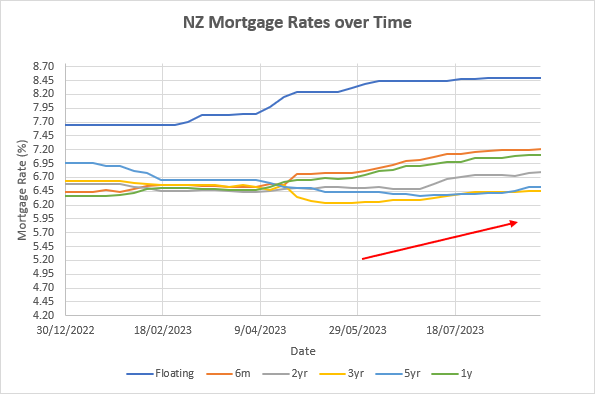

Although the RBNZ’s Official Cash Rate (OCR) has been unchanged at 5.50% since the May 2023 Monetary Policy Review (MPR), with the RBNZ in “watch, worry, and wait” phase, we have seen local mortgage rates increase by over 0.40% in the six month to one year period, over 0.25% at the two-year point, and 0.15% at the three-year point. This can be seen in Figure 1 below.

Figure 1 – NZ Mortgage Rates Over Time

Source: interest.co.nz

With the exception of a stronger housing market, the economic data in NZ has generally been softening, consistent with forecasts from the RBNZ. Given this backdrop, why is it that local mortgage rates have been increasing since May 2023?

Although the RBNZ sets the OCR, there are other drivers that can impact mortgage rates in ways that may not seem obvious at first glance.

Mortgage rates closely follow wholesale interest rates, that are impacted by the both the RBNZ and the market’s outlook for the OCR. At the August Monetary Policy Review, the RBNZ OCR track (the RBNZ-projected expectation of the path they consider the OCR will take over time) was revised up modestly, and then assumed to decline at a slower pace. Specifically, the result was a 0.09% increase for Q1 2023 and a 0.20% increase to Q4 2024, with the later driven by the RBNZ increasing its estimates of the nominal neutral interest rate, or the level of interest rates that is neither stimulative nor restrictive for the economy, from 2% to 2.25%. All else equal, the upward revision to the neutral OCR will add further upwards pressure to mortgages over time.

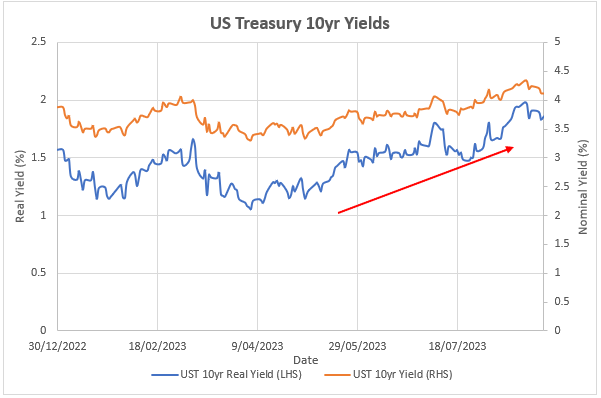

Wholesale interest rates in NZ, particularly longer-term interest rates, are also driven by offshore markets. We consider the developments in offshore interest rate markets have been a larger contributor to higher wholesale interest rates and mortgage rates in NZ. As shown in Figure 2 below, the US 10-year Government Bond has risen approximately 0.5% over the past three months. An important observation is that the recent move to higher US bond yields has been real-yield led, or yields adjusted for the outlook for the rate of inflation.

Figure 2 – US Nominal and Real Interest Rates

Source: Bloomberg

Several contributing factors to move higher are briefly listed below.

- Larger budget deficit forecasts in the US, and higher supply of US Government Bonds. A larger supply typically requires higher yield to bring in additional buyers.

- Fitch ratings agency downgraded US sovereign credit by one notch from AAA to AA+ , although concerns of forced selling of treasuries seem to have been relieved.

- Bank of Japan (BoJ) tweaked to raise the cap to allow for higher 10-year Japan Government Bond Yields. As large holders of foreign debt, concerns remain that higher Japan bond yields would lead to Japanese investors’ repatriation of funds by selling of foreign debt.

- Foreign exchange-driven selling of US Treasuries by central banks, notably in Japan and China.

- Pathway for extended Quantitative Tightening (QT) in the US increasing the supply of US Government Bonds to be taken by private investors.

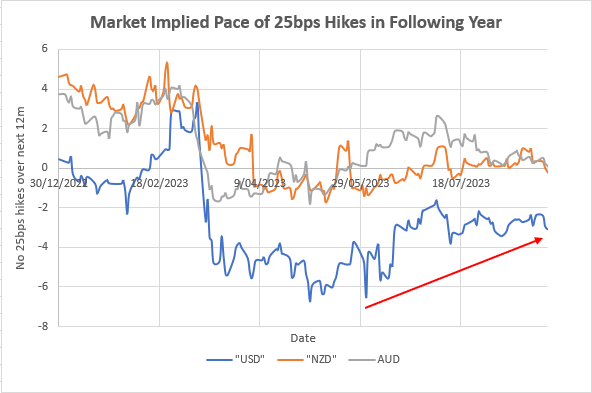

- Stronger growth expectations and the need for higher interest rates for longer (leading to an unwinding of interest rate cuts priced into 2024 by the Federal Reserve – Figure 3 below).

Figure 3 – Number of 25bps hikes priced over the next 12 months

Source: Morgan Stanley/Bloomberg

To conclude, changes in mortgage rates can vary from not only the change in the OCR, or expected forecast of the OCR, but also by events in offshore interest rate markets. We consider the moves in offshore interest rates markets have had a larger impact on our mortgage rates than local factors. However, as most recent moves would suggest, the drag higher in offshore rates, and impact on local mortgage rates, may have done its dash for now. Therefore, unless there is further resurgence higher in global rates, or isolated shocks to the New Zealand economy, we consider that mortgage rates in NZ may have reached their peak.

Recent move higher in NZ mortgage rates

Although the RBNZ’s Official Cash Rate (OCR) has been unchanged at 5.50% since the May 2023 Monetary Policy Review (MPR), with the RBNZ in “watch, worry, and wait” phase, we have seen local mortgage rates increase by over 0.40% in the six month to one year period, over 0.25% at the two-year point, and 0.15% at the three-year point. This can be seen in Figure 1 below.

Figure 1 – NZ Mortgage Rates Over Time

Source: interest.co.nz

With the exception of a stronger housing market, the economic data in NZ has generally been softening, consistent with forecasts from the RBNZ. Given this backdrop, why is it that local mortgage rates have been increasing since May 2023?

Although the RBNZ sets the OCR, there are other drivers that can impact mortgage rates in ways that may not seem obvious at first glance.

Mortgage rates closely follow wholesale interest rates, that are impacted by the both the RBNZ and the market’s outlook for the OCR. At the August Monetary Policy Review, the RBNZ OCR track (the RBNZ-projected expectation of the path they consider the OCR will take over time) was revised up modestly, and then assumed to decline at a slower pace. Specifically, the result was a 0.09% increase for Q1 2023 and a 0.20% increase to Q4 2024, with the later driven by the RBNZ increasing its estimates of the nominal neutral interest rate, or the level of interest rates that is neither stimulative nor restrictive for the economy, from 2% to 2.25%. All else equal, the upward revision to the neutral OCR will add further upwards pressure to mortgages over time.

Wholesale interest rates in NZ, particularly longer-term interest rates, are also driven by offshore markets. We consider the developments in offshore interest rate markets have been a larger contributor to higher wholesale interest rates and mortgage rates in NZ. As shown in Figure 2 below, the US 10-year Government Bond has risen approximately 0.5% over the past three months. An important observation is that the recent move to higher US bond yields has been real-yield led, or yields adjusted for the outlook for the rate of inflation.

Figure 2 – US Nominal and Real Interest Rates

Source: Bloomberg

Several contributing factors to move higher are briefly listed below.

Figure 3 – Number of 25bps hikes priced over the next 12 months

Source: Morgan Stanley/Bloomberg

To conclude, changes in mortgage rates can vary from not only the change in the OCR, or expected forecast of the OCR, but also by events in offshore interest rate markets. We consider the moves in offshore interest rates markets have had a larger impact on our mortgage rates than local factors. However, as most recent moves would suggest, the drag higher in offshore rates, and impact on local mortgage rates, may have done its dash for now. Therefore, unless there is further resurgence higher in global rates, or isolated shocks to the New Zealand economy, we consider that mortgage rates in NZ may have reached their peak.

Milford on Newstalk ZB: 2 July 2025

Read MoreEP39: Time for a mid-winter financial check-up!

Read MoreMilford on Newstalk ZB: 25 June 2025

Read MoreDisclaimer: Milford is an active manager with views and portfolio positions subject to change. This blog is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to a Financial Adviser. Past performance is not a guarantee of future performance.