To see our Financial Advice Provider Disclosure Statement, please see Getting Advice

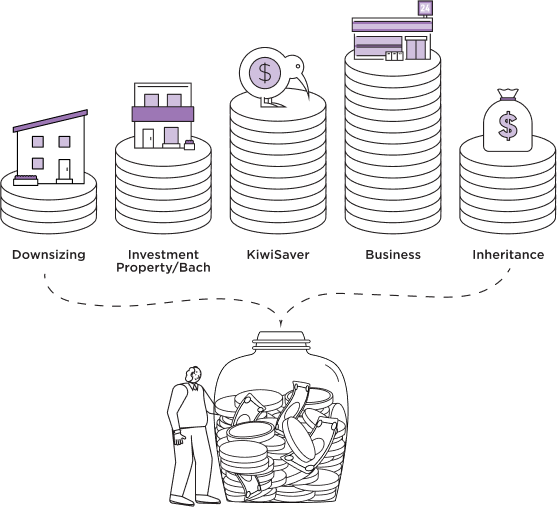

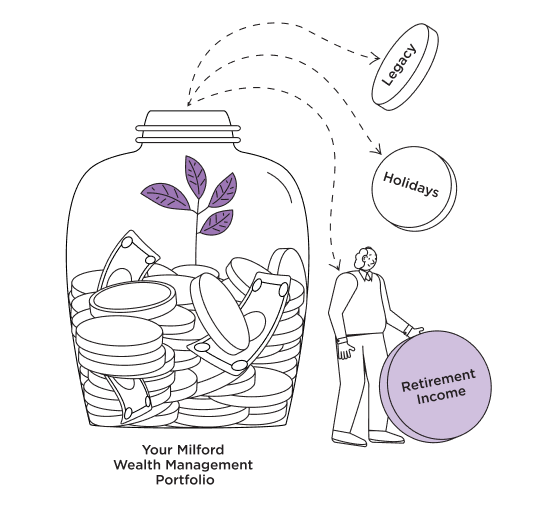

Whether you are planning for your retirement, building a legacy of wealth, or would like to use your assets to generate an income, our expert advisers are here to help you build a comprehensive investment strategy tailored to your goals.

If you have $500,000 or more available to invest, your personal Milford Financial Adviser can partner with you to ensure you have the answers you need to these fundamental questions and retire well.

Consumer People’s Choice – Milford KiwiSaver Plan

(8 years running)

Fund Manager of Year: KiwiSaver