Since the beginning of the pandemic, fintech, and particularly digital consumer payments, has been the new hotness. While Australian investors may be most familiar with Block’s acquisition of Afterpay, between the record level of IPOs, M&A activity and private mega-rounds, global fintech funding nearly tripled to a record US$132 billion in 2021. But as with any boom, there comes a bust, and while we sift through the digital payments debris for gold nuggets, we continue to hold onto our dependable Levi’s – the global card networks Visa and Mastercard.

Chart 1: Global fintech funding

Source: CBInsights State of Fintech 2021 Report

In a highly competitive market where participants funded to the brim with cheap capital are chasing after the same goal – to reduce the friction of making and accepting payments – we believe taking a page out of Levi Strauss’ playbook and owning the “picks and shovels” is the more prudent path to achieving sustainable returns over the long term. Visa and Mastercard own the payment rails that facilitate the smooth and near-instant movement of money globally and operate as a duopoly in most markets. With the pandemic accelerating the global conversion from cash to card, Visa and Mastercard are direct beneficiaries of the digitisation of consumer payments regardless of their source.

At their simplest, Visa and Mastercard are messaging networks that send bits between issuing and acquiring banks. The technology itself is rudimentary by today’s standards but their moat comes from massive scale. There are tens of thousands of banks connected to the Visa and Mastercard networks, millions of merchants that accept their cards and billions of cardholders globally. Visa and Mastercard handled over 360 billion payment transactions in 2021 at a speed of up to 65,000 transactions per second. The sheer volume of data the networks collect further extend their moat through fraud and authentication capabilities. Ultimately, most digital payment upstarts that set out to disrupt Visa and Mastercard’s incumbency eventually realise they need the card networks’ ubiquitous reach to achieve viable scale themselves.

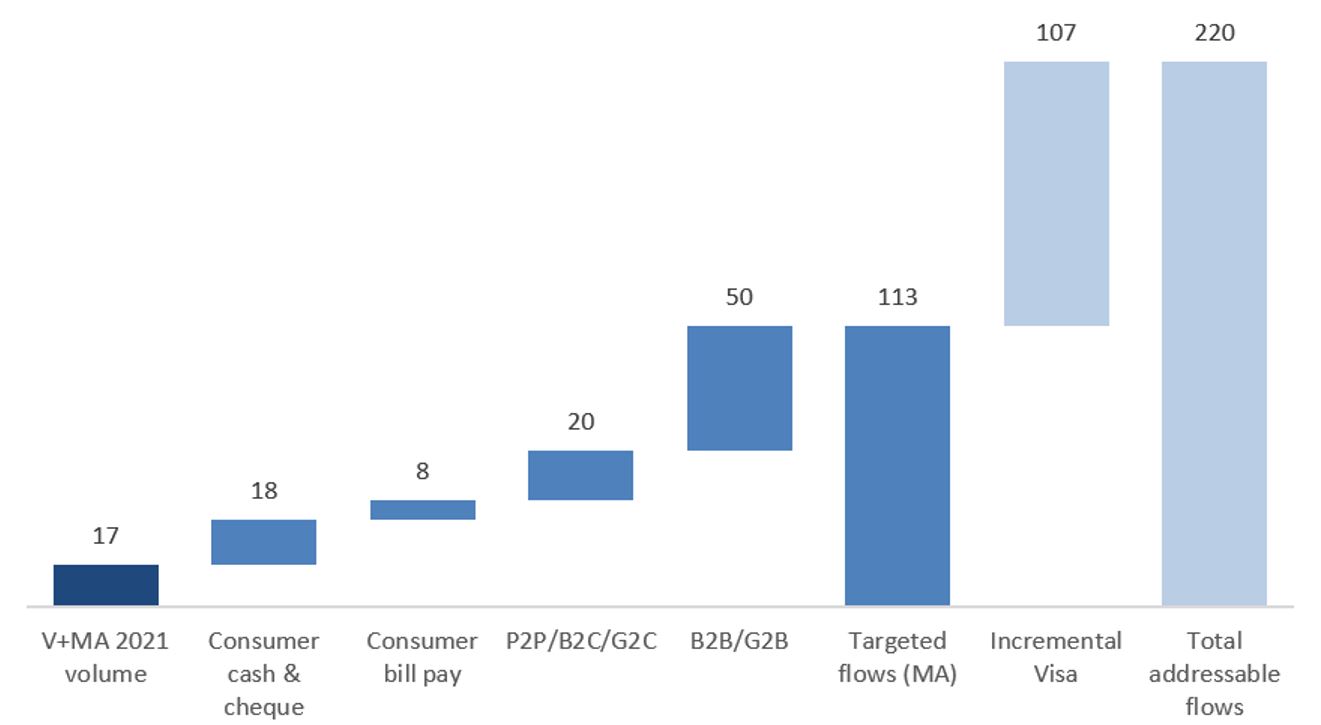

Visa and Mastercard together handled US$17 trillion in global card payment volumes in 2021. While this seems like a large sum, both companies estimate a further US$18 trillion of consumer cash and cheque payments can be converted to card over time. E-commerce and the digitalisation of businesses will continue to drive global cash-to-card conversion, with the pandemic acting as an accelerant. Beyond these consumer-to-business (C2B) payments, Mastercard believes there is a further US$78 trillion of targeted new payment flows across P2P, B2C, B2B and government, while Visa estimates US$185 trillion of new flows of which US$65 trillion low value, high volume payments can be addressed immediately through Visa’s card networks and the remaining US$120 trillion high value, low volume B2B payments are a longer-term opportunity.

Chart 2: Total payment flows opportunity (US$ trillion)

Source: Mastercard 2021 Investor Day, Visa 2020 Investor Day

Over the long term, the key risk that Visa and Mastercard face is the displacement of their card rails by alternative payment networks. These range from real time account-to-account (A2A) payments and Fast ACH systems predicated on cheaper payments (for merchants), to more nebulous systems such as crypto and Central Bank Digital Currencies (CBDC). We believe the main obstacle these alternative payment networks face is the chicken-and-egg problem that all network models face. Card payments are already close to frictionless for consumers in most use cases, so there is limited incentive to switch to higher-friction alternatives just because they are cheaper for the merchant. And while merchants would love cheaper payments, there is no point accepting payment methods that consumers don’t use. Banks also receive material interchange fee income from card payments and are thus disincentivised from pushing A2A payments, especially if they also bear a greater fraud burden. CBDCs could pose a credible threat to the card networks by government mandate, but the more likely outcome is central banks enlist the help of Visa and Mastercard to operate these networks.

Visa and Mastercard shareholders may have felt a strong sense of FOMO during much of 2021, but with strong underlying fundamentals, the imminent recovery of lucrative cross-border travel volumes to 2019 levels and high-flying consumer fintech valuations falling back to earth, we believe the setup is now favourable for the card networks to outperform. Notwithstanding some long-term disruption risks that we continue to monitor, we believe Visa and Mastercard will prove to be the most durable beneficiaries of the accelerated digitisation of consumer payments.