The seemingly never-ending question of will NZAS (New Zealand Aluminium Smelter) stay or go from Tiwai Point may finally have turned the corner over the past few months.

By way of background, NZAS in early 2021, signed a new electricity agreement to continue operating the Tiwai Point Aluminium smelter until the end of December 2024. NZAS uses approximately 13% of New Zealand’s power, therefore it has big implications for the NZX’s largest sector by market cap, the ‘Gentailers’ (Meridian, Contact, Mercury and Genesis Energy). NZAS is owned by Rio Tinto (79%) and Sumitomo Chemical Company (21%).

Rio Tinto / NZAS has a history of brinkmanship when negotiating deals and it has played hardball historically with the NZ government and Meridian specifically on Tiwai. The normal playbook has been for Rio to wait until the end of its current contract and thrust a tough deal towards Meridian, and by proxy the NZ government. They tend to wait for a period of maximum leverage and put substantial pressure on their counterparties. This type of approach to business has caused Rio a series of public relations issues over the past few years globally. Following a workplace review, Rio has promised a change in culture for how it conducts business. Recent comments from NZAS CEO, Chris Blenkiron are supportive of a change in behaviour and suggest a decent early commitment to stay in New Zealand for the next while:

“With a global strategy focused on decarbonisation and growth, Rio Tinto does see a positive pathway for New Zealand’s Aluminium Smelter to continue operating and contributing to the local and national economies beyond 2024.”

Rio has also stated an ambitious decarbonisation strategy, “The Group (Rio) is unveiling a new target to reduce its Scope 1 & 2 carbon emissions by 50 per cent by 2030, more than tripling its previous target. And a 15 per cent reduction in emissions is now targeted for 2025, five years earlier than previously.” Rio has committed a monster $7.5 billion capex sum to help with these goals. Given 70% of Rio’s carbon emissions come from its aluminium portfolio (aluminium is 20% of Rio’s revenue) this is the place to get wins. Rio seems committed to converting its ‘dirty’ Australian based Aluminium smelters from coal powered to solar power. Given Tiwai Point is powered mainly from the Manapouri Hydro Station in the south of the South Island it is already a fairly low carbon emitting smelter which aligns with these carbon goals.

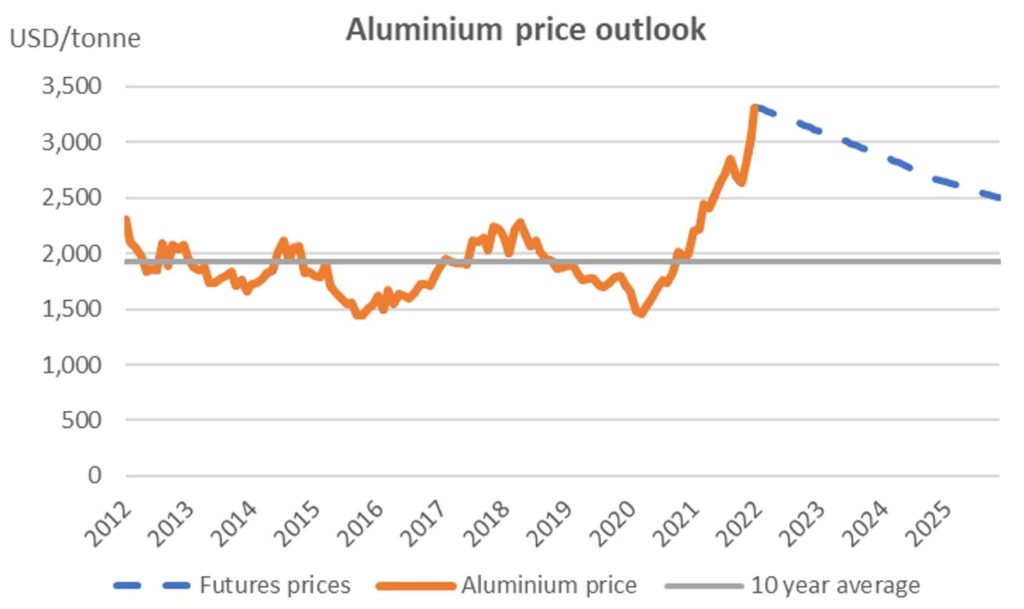

Aluminium prices are also on a tear and are at or near record highs of approximately US$3,000+ per tonne. Thanks to Tiwai’s well negotiated power deal in 2021 and coupled with high Aluminium prices, undoubtably it is making record profits from Tiwai Point currently. Furthermore, increasing carbon costs will make ‘dirty’ smelters (those powered by fossil fuels) uneconomic and there is increasing evidence of green premiums being attached to aluminium made from ‘clean’ (hydro powered) smelters. These both enhance margins for NZAS and is further medium to long term economic support for the smelter at Tiwai Point staying.

Source: Factset, LME

A Tiwai staying scenario is good news for Gentailer investors. Gentailers, with this surety of market demand, are able to invest in growing their renewable supply / generation base and thus their future earnings base. Furthermore, new high electricity users are seemingly being announced in the market daily: data centres, green hydrogen and increasing electric vehicle usage. This is bullish for electricity market demand, and potentially dividend profiles of these Gentailers over the medium term.

The current profitability of the smelter and forward outlook for Aluminium pricing combined with RIO’s incentive to decarbonise support Tiwai Point’s ongoing operation. However, as experienced in the past, negotiation of the smelter’s power supply contract is not a smooth process. Expect some volatility as the news of Tiwai’s recontract filters in.