Just like that we are almost halfway through the year. As we approach 30 June, which marks the end of the KiwiSaver year (from 1 July – 30 June), it’s important to ensure you are on track to receive the full Government Contribution of $521.43 to your KiwiSaver account.

What is the Government Contribution?

To help encourage Kiwis to save for retirement, the Government contributes to eligible KiwiSaver members. For every $1 you contribute to your KiwiSaver account, the Government will contribute an extra 50c, up to a maximum of $521.43 per annum. This means that you will need to contribute $1042.86 during the KiwiSaver year to receive the full entitlement (this works out to $21 per week).

It is important to note that not all contributions count towards to the Government Contribution. Only your own contributions (ie, employee contributions and voluntary contributions) are counted. Those made by your employer, and transfers from Australian Superannuation, are not.

Are you eligible for the Government Contribution?

To be eligible for the Government Contribution you must be:

- Living mainly in New Zealand over the 12 months ending 30 June 20241;

- Aged 18 years or older;

- Not be eligible for retirement withdrawals2; and

- A member of KiwiSaver

If you are only eligible for part of the year, or joined KiwiSaver part way through the year, you will receive a proportional amount of the Government Contribution, based on the number of days you have been eligible.

Don’t be a statistic!

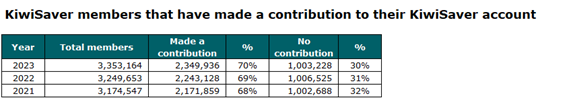

In the 2023 financial year, the Government made contributions of $9713 million towards the retirement savings of KiwiSaver members. Whilst this is a large sum of money, it only represented 70% (see table below) of all KiwiSaver member contributions. This means that 30% of KiwiSaver members did not contribute the full amount to their KiwiSaver, leaving more than $520 million unclaimed.

Source: https://www.ird.govt.nz/about-us/tax-statistics/kiwisaver/datasets

It’s not too late

If you are a Milford client and want to see if you are on track to receive the full Government contribution, simply log into your Milford Client Portal and click the orange button.

For a detailed breakdown you can check the year-to-date summary for your Milford KiwiSaver Plan. This will provide a breakdown of employee contributions, as well as any voluntary contributions that have been made.

Please note, these numbers are provided as a guide only and you should confirm your eligible contributions by logging into your MyIR account at www.ird.govt.nz/kiwisaver. Go to “View transactions” and filter on transaction type “Deductions from salary/wages” and the date range from 01/07/2023 to the current date, to see whether you’re on track to reach $1,042.86 by 30 June 2024.

If you are off track to receive the full Government contribution there is still time to make up the shortfall. If you are a Milford client, you can either set up a direct debit or make a payment through your Milford Client Portal. Simply log in, go to “Payments & Transactions” and follow the instructions. If you are not a Milford client, please contact your KiwiSaver provider for instructions.

If you have any questions for Milford, please reach out to the team on 0800 662 346 and we’d be happy to help.

1 There are exceptions for government employees who are serving outside New Zealand or persons working overseas as volunteers.

2 If you joined KiwiSaver before 1 July 2019 and were aged between 60 and 64 (inclusive) and haven’t yet made a retirement withdrawal, you will also be eligible. If you are unsure, please contact us on [email protected] or 0800 662 346.

3 https://www.ird.govt.nz/about-us/tax-statistics/kiwisaver/contributions/scheme-providers-payments

Past performance is not a reliable indicator of future performance. Milford Funds Limited is the issuer of the Milford KiwiSaver Plan. Please read the Milford KiwiSaver Plan Product Disclosure Statement at milfordasset.com. The disclosure statements of all Milford Financial Advisers contain more information and are available for free on request. Visit milfordasset.com/getting-advice to view Milford Private Wealth Limited’s Financial Advice Provider Disclosure Statement.