If there was ever a time when strong financial metrics were the single trademark of a good company, that time has long passed. As responsible, fundamental investors at Milford, there is much we need to know beyond the profit a company will generate this year or next.

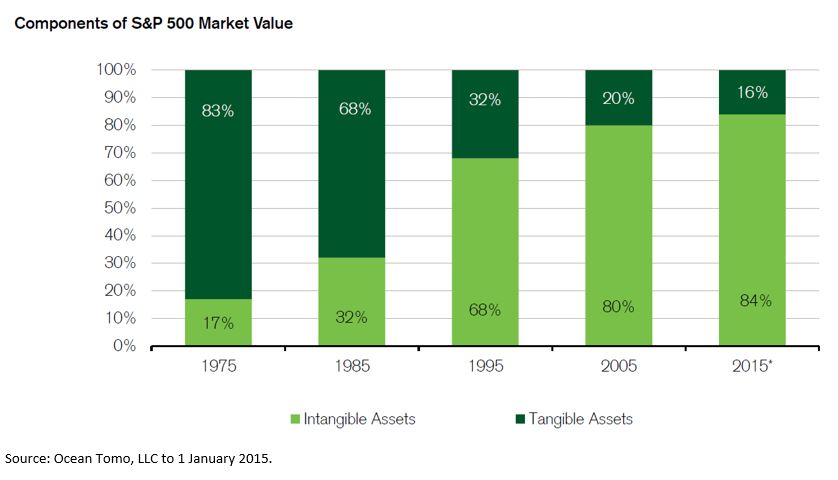

The value of intangibles assets such as brands, licences and goodwill account for more than three-quarters of US corporate balance sheets. It follows that the companies with clear strategies focused on protecting and growing the value of their intangible assets are the ones we want to own. Milford employ two key strategies to identify companies that do this well.

Firstly, we subscribe to the idea that “what gets measured, gets managed”. The clearest signpost for this is remuneration structures that incentivize management to focus on long-term, sustainable earnings.

The CEO of a heavy materials company whose critical compensation hurdle is maximizing this year’s reported profit, may well choose to delay the implementation of costly environmental controls and avoid detracting from current year earnings. Short-term, if everything goes right, the CEO receives a substantial bonus and is rewarded by a spike in the share price, as analysts upgrade their profit forecasts for the current year.

However, the CEO’s short-sightedness virtually guarantees shareholders will eventually pay more to remediate the site. The fact this may not be reflected in the company’s financial accounts right away validates our conclusion that financial metrics tell only part of the story.

As company outsiders, we might never know about the postponed expenditure on risk controls. But the poorly aligned remuneration structure is clearly visible to us as a bright, red flag. We know management decisions weighted too heavily towards short-term profits can significantly increase a company’s risk profile.

Taking our hypothetical example further, a serious contamination incident has become far more likely. If it occurs, it leads immediately to an expensive clean-up operation, unplanned shut-down and months of lost productivity. Customers are forced to source product from competing suppliers. Safety concerns voiced by the local community result in negative publicity and unquantifiable brand damage. Regulators, with the support of reactive politicians, implement punitive, over-arching control measures and announce a review of the operator’s licence conditions. By this point, the share price has fallen significantly and aggrieved shareholders demand the resignation of the CEO and Chair. A class action follows.

We have a second key strategy to avoid these kind of outcomes – we try to ask the right questions in the first place. As active managers, we engage extensively with management to understand a company’s exposure to exactly these kinds of risks and opportunities, and how they are being addressed. We are acutely aware of our capacity to drive positive change, both by partnering with management and through our proxy voting.

At Milford, we consider ourselves owners of much more than a company’s financial statements. We are investors in the management, the buildings, the employees, the culture and the brand. To make the right investment decision, we must consider the whole.