Investors have been reminded over recent weeks that financial markets can go down rapidly, as we have seen with the reaction to the spread of coronavirus around the world. Investor confidence has not been helped by a steady stream of bad news, and in some cases sensationalist headlines. However, reacting to these headlines is not a good investment strategy, as experienced investors will attest to.

It’s human nature to be concerned by bad news. But it’s how we react to that news that matters the most when it comes to your investments.

In it for the long term

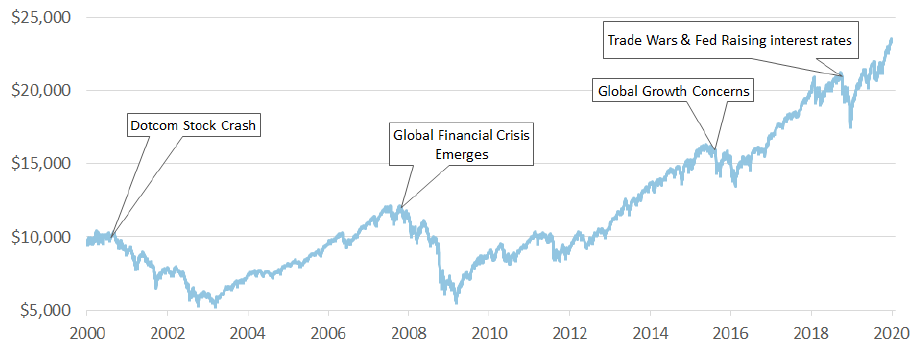

KiwiSaver is a long-term investment. Most KiwiSaver members won’t be touching their KiwiSaver funds until they reach age 65. Markets are notorious for going up and down in value over the short-term. But over the long term, they tend to go up. History shows that sticking with your plan and staying invested through the ups and downs delivers a better outcome at retirement.

Buy a bargain

Another benefit of KiwiSaver is what’s known as dollar cost averaging. This is where instead of trying to time market highs and lows, you make regular investments no matter what the price is. For KiwiSaver this is your regular contribution out of your wages. When prices drop, as they have recently, you are buying more for your money. Think of it like the Boxing Day sale for your KiwiSaver account. Then, when markets recover, as history suggests they will, you benefit from having bought at a discount.

If you’re losing sleep – it might be time to review

Times of market volatility can also be a good reminder to check your appetite for risk and that you are in an appropriate Fund for the risk you are willing to take and the savings goals you are aiming to achieve. We provide a very helpful tool to help you work this out. Now might be a good time to do a check-up, but remember, don’t let recent headlines cloud your decision making. You may be better to just keep calm and carry on.

Beware the noise – Markets reward long term discipline

Source: Bloomberg, MSCI Data 03/01/2000 – 31/12/2019. Past performance does not guarantee future returns.