Updated 1 April 2025

If you’re investing in KiwiSaver or PIE Investment Funds it’s important to check annually that you’re on the correct tax rate, in order to avoid a future tax bill or overpaying tax.

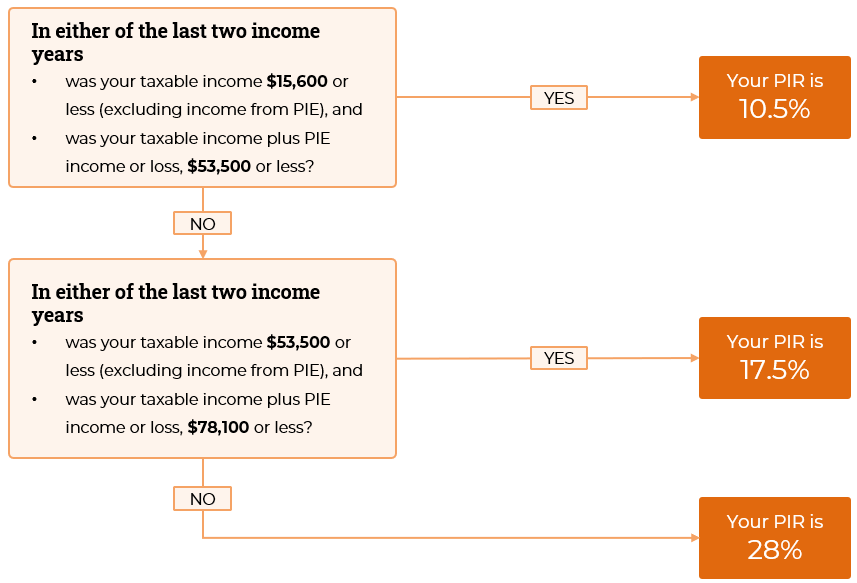

Your tax rate is known as your Prescribed Investor Rate or ‘PIR’ and the below flow chart can help you determine your correct rate.

The PIR for individuals who are New Zealand residents is based on their income from the last two years (to 31 March) and will be either 10.5%, 17.5% or 28% (the highest). Your provider will use this rate to pay tax on your behalf.

What is my PIR rate?

How do I change my PIR?

If you’re a Milford client, you can check and update your PIR by logging into your Client Portal or mobile app. Simply click on the “Profile settings” icon.

![]()

The above information is a general guide, for full information about PIRs, please see the Inland Revenue website.